Comments

- No comments found

Technology has undergone an extraordinary upheaval in the twenty-first century.

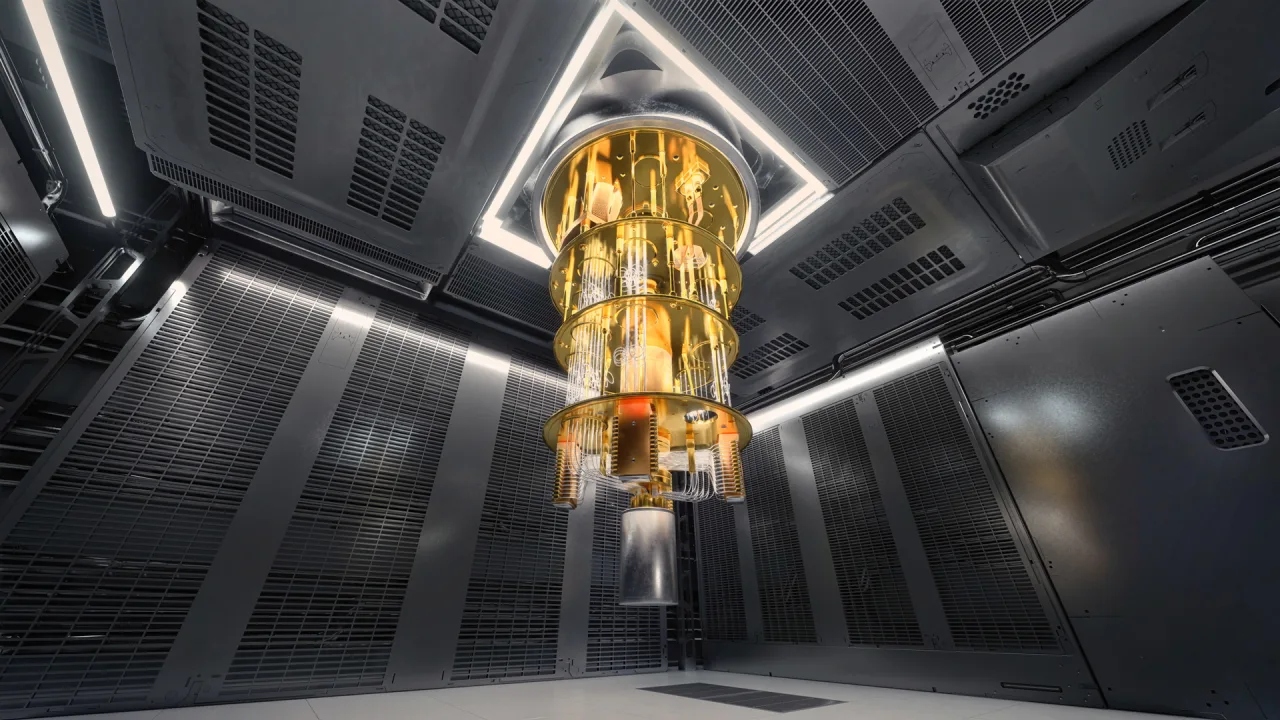

One of the most exciting and revolutionary developments in the financial sector is quantum computing. By solving complicated problems at speeds that were previously unthinkable, quantum computing, which makes use of the bizarre and potent principles of quantum mechanics, has the potential to revolutionize the financial sector. The development of finance in the twenty-first century, the advent of quantum computing, and the numerous quantum computing use cases to alter the financial landscape will all be covered in this article.

Technology breakthroughs have caused substantial changes in finance in the 21st century. People all over the world now have easier access to financial markets because of the development of the Internet and mobile technology. Investors can now make trades at speeds measured in microseconds thanks to electronic trading platforms and algorithmic trading, which are becoming more and more prevalent. Additionally, the rise of data analytics and machine learning in the digital age has made it possible for financial institutions to make data-driven choices and manage risk more successfully.

But as the complexity of the financial markets has increased, so have the difficulties they pose. Traditional computers with classical bits have difficulty handling the complex calculations needed for fraud detection, portfolio optimization, and risk assessment. In this setting, quantum computing shows promise as a game-changing technological advancement for the finance sector.

In addition to being a speedier form of classical computing, quantum computing is a brand-new paradigm that makes use of quantum mechanics. Quantum bits, or qubits, are the basic building blocks of quantum computing. Superposition and entanglement allow qubits to exist in several states at once. Compared to conventional computers, quantum computers can handle enormous volumes of data and carry out complicated calculations at an exponentially faster rate.

A crucial activity in asset management, portfolio optimization, can be greatly improved by quantum computing. Quantum algorithms can assist in determining the most effective asset allocation to maximize returns while avoiding risk by concurrently assessing numerous scenarios and variables. When building durable investment portfolios, this ability is priceless.

The financial sector places a high priority on assessing and managing risk. Real-time analysis of enormous datasets by quantum computers enables financial organizations to model possible risks and gauge market volatility. This makes it possible to manage risks proactively and make better decisions.

Complex mathematical models, such as the Black-Scholes equation, are used in option pricing. These equations can be effectively solved by quantum computers, giving traders and analysts more precise pricing models. This can therefore result in fewer price mistakes and more accurate trading techniques.

Financial institutions constantly struggle with fraudulent transaction categorization in real-time. Fraud prevention efforts can be improved by quantum computing, which can scan huge transaction data streams for suspicious patterns and abnormalities faster and more efficiently than traditional computers.

Financial transactions must be secure at all costs. Due to their potential to defeat current encryption protocols, quantum computers also present a concern. To protect financial data and transactions in the quantum age, quantum-resistant cryptographic algorithms are being created.

Monte Carlo simulations, which are frequently used for risk analysis, derivatives pricing, and other financial modeling activities, can be expedited by quantum computing. This might result in simulations that are more accurate and precise, taking less time to compute and costing less money.

There is no denying that quantum computing has the potential to revolutionize the financial industry, but there are still a number of issues that need to be resolved. With few qubits and significant error rates, quantum computing is still in its infancy. Quantum hardware is expensive to build and operate, and not all financial institutions have access to it yet.

Quantum software and algorithms also need to be improved and developed further for use in financial applications. There is a dearth of qualified quantum programmers in the sector, which necessitates specific knowledge.

Nevertheless, the subject of quantum computing is one that is fast developing, and as technology advances, it is anticipated to become more widely used and less expensive. Financial organizations that make investments in quantum science now could have a competitive advantage later on.

The financial industry has transformed in the twenty-first century, moving from traditional trading floors to digital platforms, and quantum computing is set to be the next step in this process. Quantum computing presents the financial sector with a tremendous tool for portfolio optimization, risk assessment, fraud detection, and more due to its capacity to solve complicated financial issues at previously unfathomable speeds.

The potential of quantum computing in finance is too great to ignore, despite the major obstacles that still need to be addressed. Financial institutions that use quantum computing will be better able to negotiate the complexity of the current financial landscape and maintain competitiveness in the twenty-first century as quantum technology develops and becomes more widely available.

Luke Fitzpatrick has been published in Forbes, Yahoo! News and Influencive. He is also a guest lecturer at the University of Sydney, lecturing in Cross-Cultural Management and the Pre-MBA Program. You can connect with him on LinkedIn.

Leave your comments

Post comment as a guest