Comments

- No comments found

There has been a controversy in recent decades about the independence of central banks from the rest of the government.

The ongoing concern–especially the high inflation rates that rocked the US and other countries around the world in the 1970s and 1980s–was that governments have a bias toward inflation. Politicians want the central bank to help finance their spending; conversely, politicians will often oppose anything that might slow the economy, like higher interest rates. However, if the central bank can be given a clear goal, like a low rate of inflation, then it can push back against the inflationary biases of the rest of the government.

Thus, many central banks around the world, like the European Central Bank, have a clear-cut target for low inflation as their only policy goal. The US Federal Reserve has a “dual mandate,” to keep inflation low but also to fight recession. But central banks are often expected to deal with other tasks as well, like dealing with financial crashes and participating in bank and financial regulation.

Here, I won’t try to resolve these disputes, but instead will simply point out the long-term pattern: the arguments for greater central bank independence seem to be prevailing. David Romelli discusses “Trends in central bank independence: a de-jure perspective” (BAFFI CAREFIN Centre Research Paper N. 217, February 2024; for a readable short overview, https://cepr.org/voxeu/columns/recent-trends-central-bank-independence).

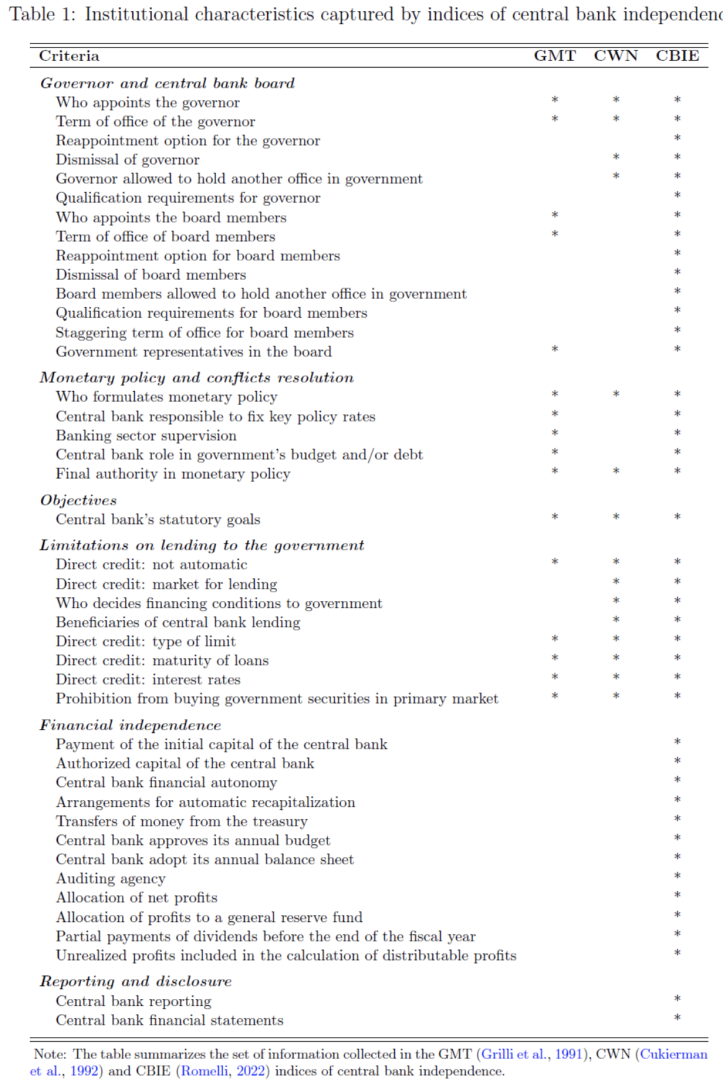

Basically, Romelli collects records of legal changes across 42 categories that reflect more or less central bank independence. I’ll provide the full list of categories below, but they can be grouped into categories like how the governor and board of the central bank are chosen and the rules of governance; how monetary policy is set; whether the central bank has specific statutory goals; limitations on the central bank loaning directly to the government; whether the central bank is financially independent; and rules governing reporting and disclosure for the central bank.

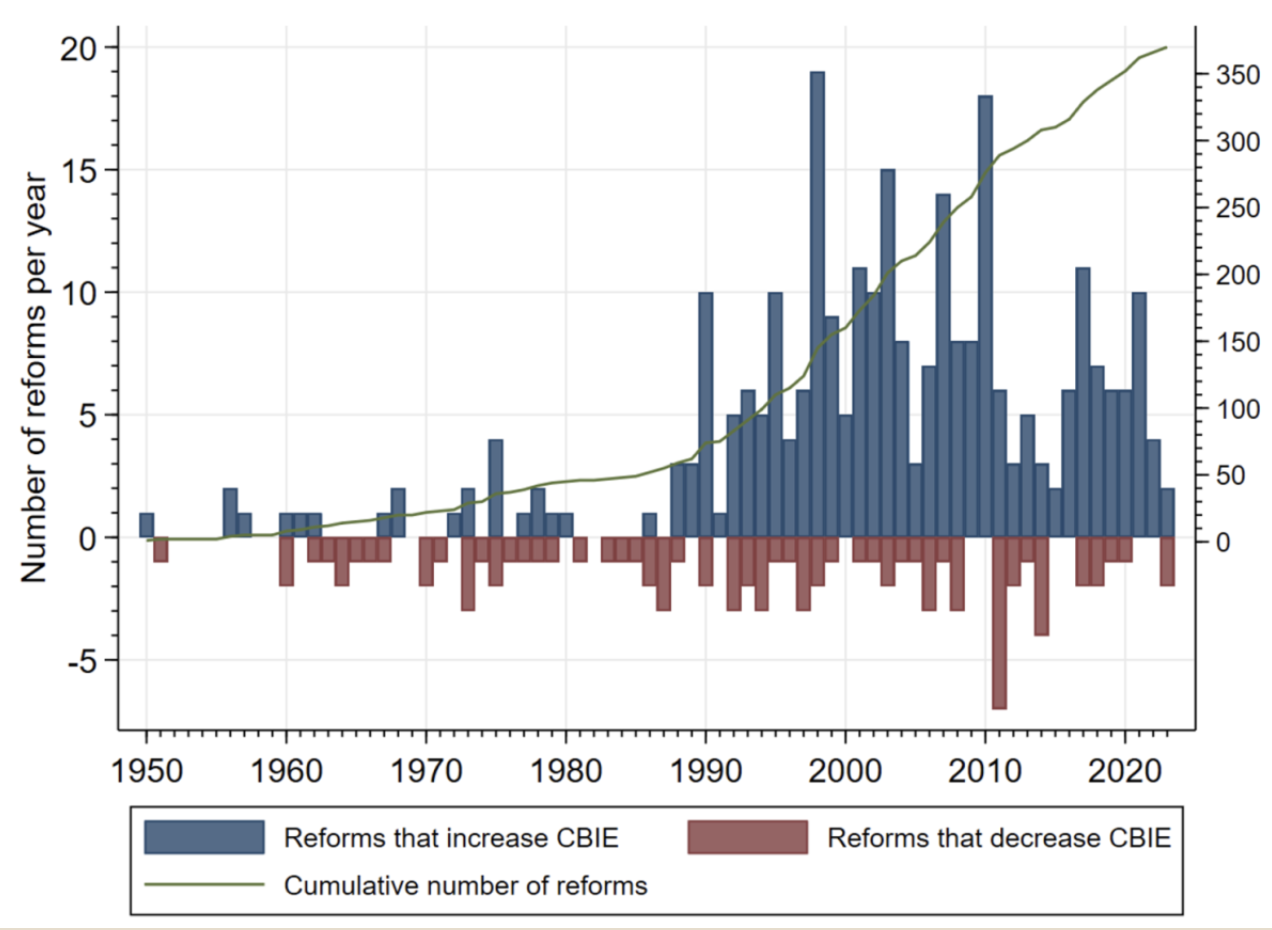

Taking these together, the basic theme is that central bank independence doesn’t change much up until about 1990, when there is a dramatic shift upward. The shift occurs across countries at all levels of economic development: high-income, middle-income, low-income. The momentum toward greater central bank independence stalls for a few years after the 2007-09 global financial crisis, when legislators and central banks were understandably focused on other topics, but has resumed since then.

Romelli writes:

This paper presents an extensive update to the Central Bank Independence – Extended (CBIE) index, originally developed in Romelli (2022), extending its coverage for 155 countries from 1923 to 2023. The update reveals a continued global trend towards enhancing central bank independence, which holds across countries’ income levels and indices of central bank independence. Despite the challenges which followed the 2008 Global financial crisis and the recent re-emergence of political scrutiny on central banks following the COVID-19 pandemic, this paper finds no halt in the momentum of central bank reforms. I document a total of 370 reforms in central bank design from 1923 to 2023 and provide evidence of a resurgence in the commitment to central bank independence since 2016. These findings suggest that the slowdown in reforms witnessed post-2008 was a temporary phase, and that, despite increasing political pressures on central banks, central bank independence is still considered a cornerstone for effective economic policy-making.

Here’s the list of 42 characteristics affecting central bank independence in Romelli’s index:

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest