Comments

- No comments found

One of the ongoing public narratives, beginning with the start of President Trump’s imposition of tariffs on trade with China and others and continuing up through the pandemic, has been whether a previous pattern of off-shoring–that is, importing goods and inputs from abroad–would emerge. More generally, the question has been whether the US economy would become less attached to Chinese imports.

The Kearney consulting company provides some information on the actual data in its Reshoring Index. The most recent version came out in May, and a summary appears under the title “Global pandemic roils 2020 Reshoring Index, shifting focus from reshoring to right-shoring “

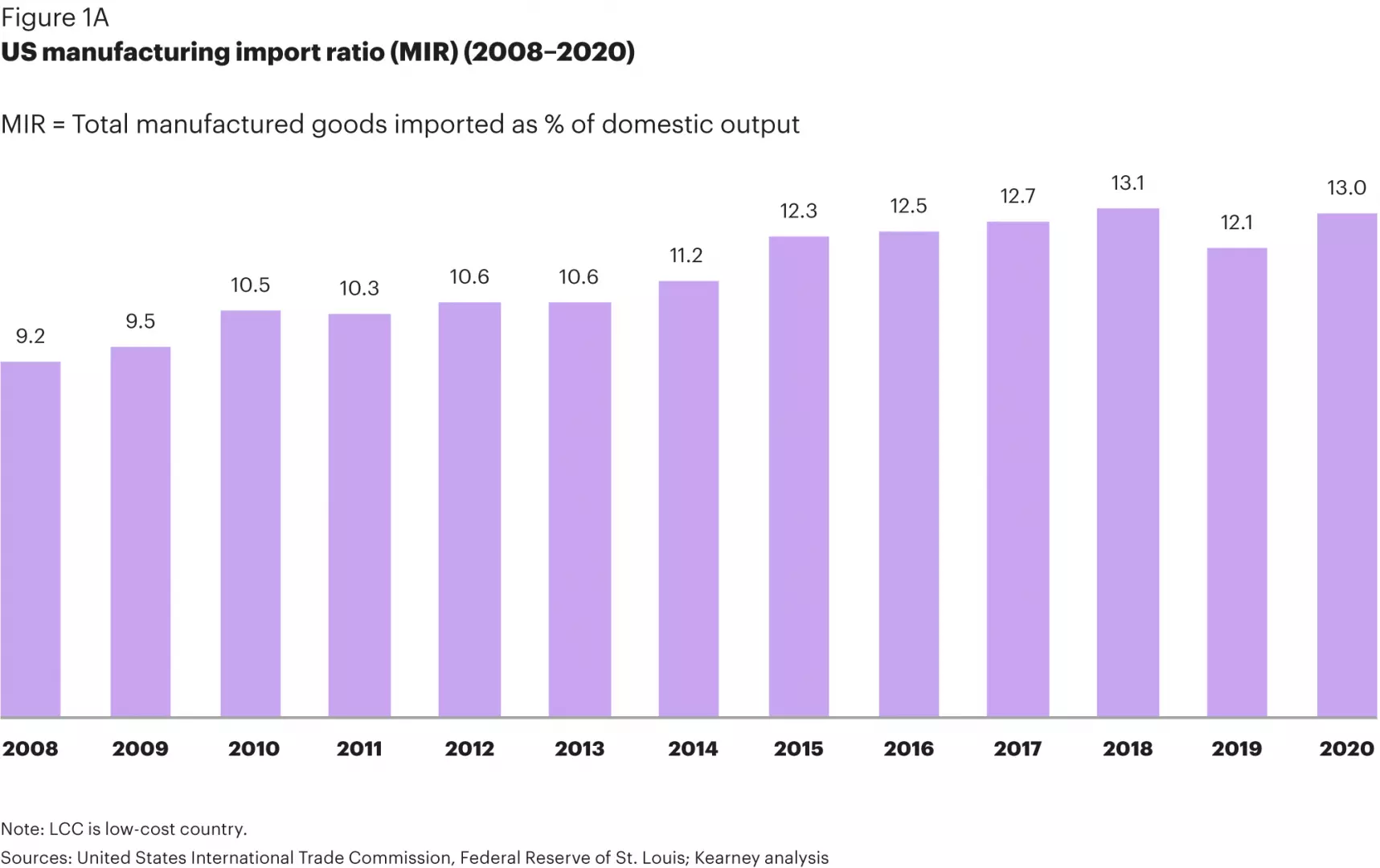

Here’s one basic pattern: total US imports of manufactured goods as a share of US domestic production of manufactured goods. You can see the general rise since 2008, albeit with a small dip in 2019. US imports of manufactured goods are about one-eighth of domestic output of manufactured goods. In my experience, this proportion is considerably lower than a lot of people expect to hear. To put it another way, the potential gains for US manufacturing from being able to export into growing foreign markets around the world are much, much bigger than the potential gains from displacing imports of manufactured goods.

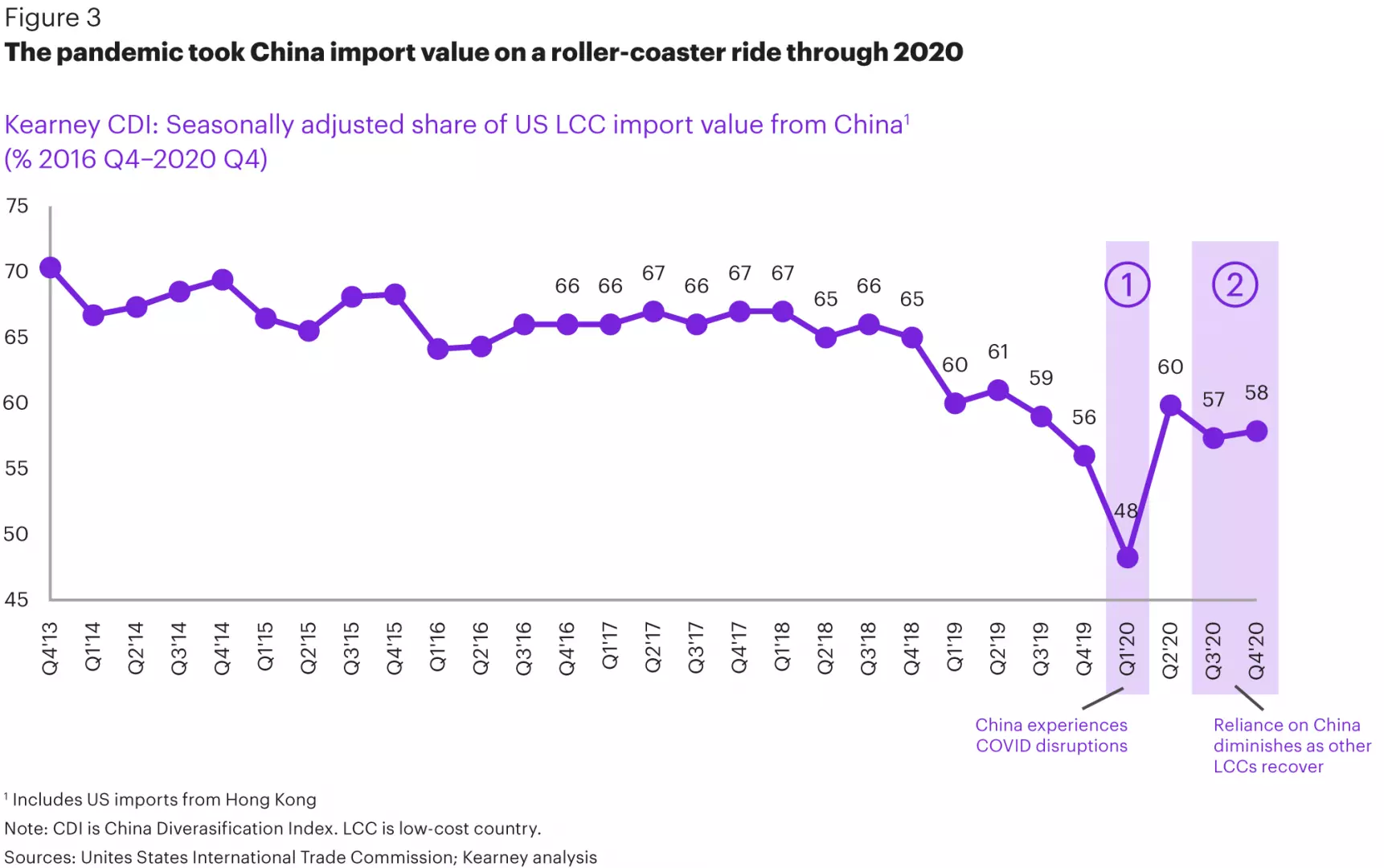

What about China in particular? The report looks at imports from China as a share of total US imports from 14 low-cost Asian countries, what the report calls the LCC. The share of these imports from China does start falling in 2018, and in particular it plummets during the production and trade disruptions at the start of the pandemic in the first quarter of 2020.

The drop in China’s share of LCC exports to the US has largely been matched by a rise in Vietnam’s exports to the US. As the Kearney report notes:

US companies have long viewed Vietnam as a viable sourcing option. Since China’s labor costs began to rise in 2007, Vietnam—where labor costs now fall almost 50 percent below those in China—has successfully used its cost advantage to attract global manufacturing business. A few examples include:

Nike and Adidas reallocated a vast majority of their manufacturing and footwear base from China to Vietnam.

In 2019, Hasbro announced it hoped to have only 50 percent of its production coming from China by the end of 2020, shifting to new plants in Vietnam and India. Hasbro is continuing to advance its transition to Vietnam and India.

In 2019 Samsung ended mobile telephone production in China due to rising labor costs and economic slowdowns, shifting production to India and Vietnam.

In addition, Vietnam is actively participating in free trade agreements to reduce trade barriers, improve market access for its goods, simplify customs procedures, and offer an increasingly attractive business environment. Vietnam has already invested heavily in improving its highways and ports, spending the most on infrastructure among Southeast Asia countries as a percentage of GDP (5.7 percent)

Even if relatively little reshoring of imported manufacturing goods has happened so far, what about the future? The Kearney report offers some data from a survey of US manufacturing executives. A general theme seemed to be that less reliance on imports from China and from the low-cost Asian countries in general was likely. However, a common response was not an expansion of US manufacturing capacity, but instead to emphasize the possibilities of “nearshoring” by relocating many of these supply chains to Mexico or Canada.

In addition, a number of the US manufacturing executives in the survey mentioned the uncertain state of the US workforce during and after the pandemic. Lots of service-oriented jobs can be done virtually, but working at an actual manufacturing job is likely to mean being physically present. One more complication is that 25% of the US manufacturing workforce is 55 or older. Thus, the future of US manufacturing will to some extent be linked to a skilled and willing labor force needed to make it happen.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest