Comments

- No comments found

Modern economic growth is a mixture of physical objects and the ideas that can be embodied in those objects.

Wheat makes flour which makes a cake. Sand can be used to make concrete or computer chips. The original basic objects of the world economy are called “commodities.” Broadly speaking, they include fossil fuels, agriculture, and minerals. Many of the concerns about economic growth and environmental sustainability are essentially arguments about economic or environmental aspects of future production of commodities. For an overview of the economic isues, John Baffes and Peter Nagle have edited a four-chapter book on Commodity Markets : Evolution, Challenges and Policies” (World Bank, 2022).

Here’s a long-term overview of commodity markets from the first chapter, “The Evolution of Commodity Markets over the Past Century,” by Baffes and Nagle together with Wee Chian Koh.

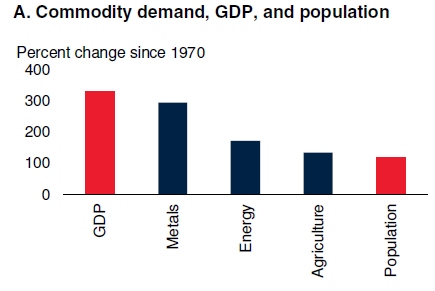

Economic expansion after World War II (WWII), and more recently the emergence of EMDEs [emerging markets and developing economies] as important players in the global economy, has increased commodity demand, especially for energy commodities and metals and minerals. Even though the world’s population rose from 2 billion in 1920 to 8 billion in 2020, the production of commodities to feed, clothe, and support the rising population has more than kept pace. Expanding production was possible because of technological innovations, the discovery

of new reserves of commodities, and more intensive agricultural production.

On the energy front, crude oil became the most important commodity, replacing coal. Known reserves of crude oil and natural gas have increased substantially even as production has risen. For example, the development of shale technology during the early 2000s enabled producers to exploit deposits that had previously been considered unprofitable; as a result, the United States became once again the largest producer of crude oil. Mineral resource development expanded because of advances in technology and new discoveries.

Metal production has become more efficient as innovations and productivity improvements became widespread in mining, smelting, and refining. Improved fabrication and new alloys have allowed less metal to be used without loss of strength. Despite radical changes in supply and consumption, metals prices, in real terms, have seen cycles around a quite flat trend over the past century. …

Food production has increased faster than population, and most of the world’s consumers have better access to adequate food supplies today than they did a century ago. This improvement is due to technological advances in the 1900s, especially the Green Revolution. In large part because of increasing productivity, prices of agricultural commodities have experienced a downward trend over the past 100 years.

The bottom line here is that large increases in population and GDP have been matched by large increases in commodity products including energy, metals, and agriculture.

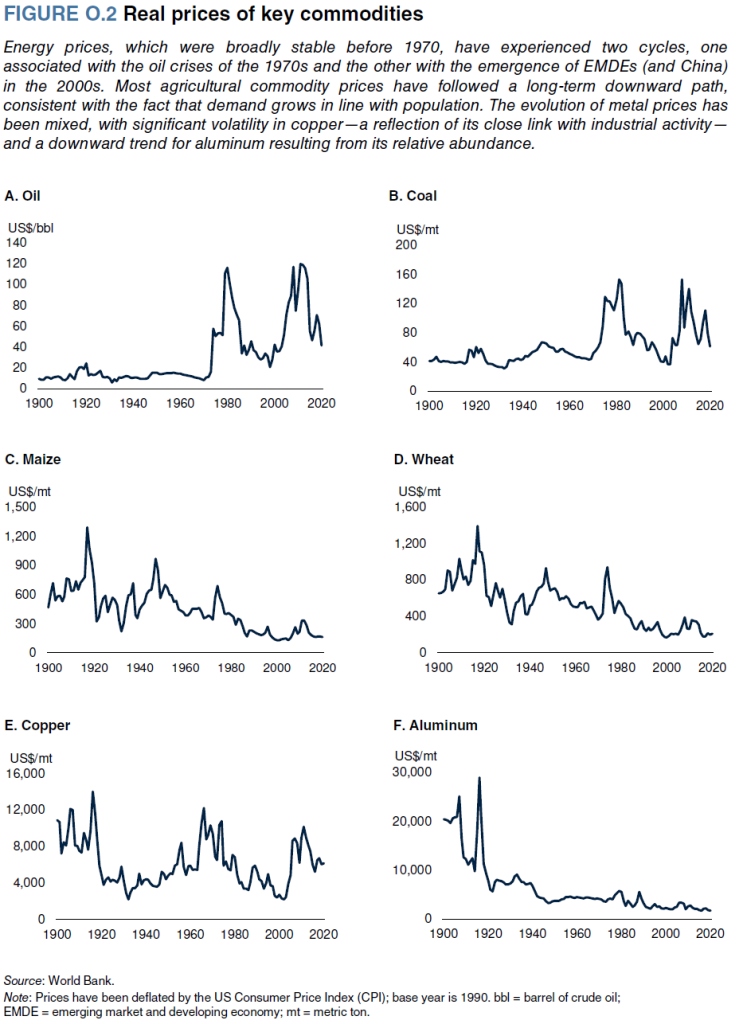

However, while the quantity demanded of commodities has risen dramatically, prices of commodities do not show much upward trend–and some show a downward trend. The figure illustrates with two examples from energy, two from agriculture, and two from metals.

The figures of prices also show some large fluctuations in prices over time, in what are sometimes called “commodity cycles.” For countries where the economy is heavily reliant on production or important of one or a few commodities, the effects of these price fluctuations can be severe–and the volume discusses causes and effects of these commodity cycles at some length. But the overall pattern of higher quantities and flat or falling price levels remains.

Some readers may also be interested in “Commodity Prices and Growth in Africa,” by Angus Deaton (Nobel ’15), in the Summer 1999 Journal of Economic Perspectives.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest