Comments

- No comments found

When the Federal Reserve raises interest rates to fight inflation, a “hard landing” refers to the possibility is that inflation is reduced at the cost of a significant recession, while a “soft landing” refers to the possibility that inflation is reduced with only a minor recession–or perhaps even no recession at all.

Perhaps the canonical example of a hard landing happened in the late 1970s and early 1980s, when the Fed under chair Paul Volcker broke the back of the inflation of the 1970s by raising interest rates, but at the cost of back-to-back recessions in 1980-81 and 1982.

What is the historical record of the Federal Reserve in raising interest rates and managing a soft landing? Alan S. Blinder tackles that question in the just-published Winter 2023 issue of the Journal of Economic Perspectives in “Landings, Soft and Hard: The Federal Reserve, 1965–2022.” (Full disclosure: I’ve been the Managing Editor of JEP for 36 years, so I am perhaps predisposed to find the articles of interest.)

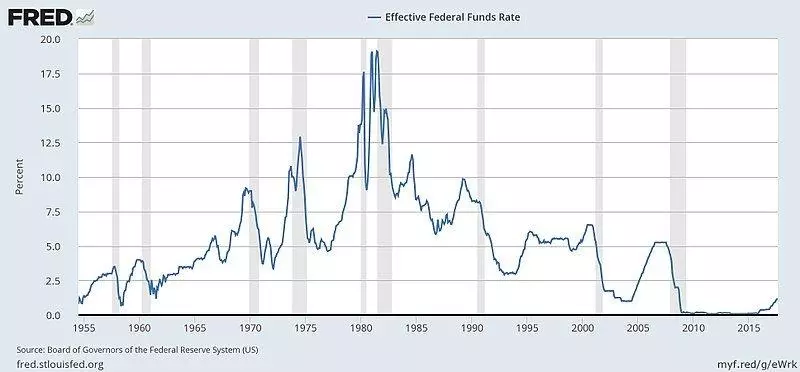

From Blinder’s paper, here’s a figure showing the federal fund interest rate over time. There are some challenges in interpreting the figure when there are jagged jumps up and down in a short time, but Blinder argues that it is fair to read the historical record as involving 11 episodes where the Fed raised interest rates substantially since 1965.

What jumps out from the figure is that there are a number of times where the Fed raised interest rates and either it was not followed by a recession (1, 6, and 8), or the recession was very short (9), or the recession that followed was not caused by the higher interest rates (10 and 11). The Fed raising interest rates to nip inflation in the bud in 1994 (episode 8) is perhaps the best-known example of a landing so soft that a recession didn’t even occur. As another example, the Fed was gradually raising interest rates in the lead-up to the pandemic (episode 11), but the pandemic recession was clearly not caused by higher interest rates!

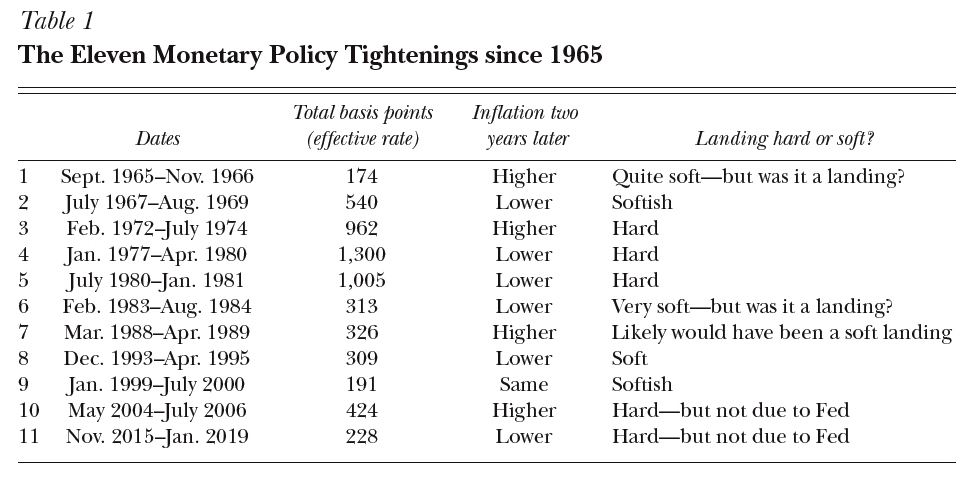

Here’s a table showing Blinder’s evaluation of the type of landing that followed each of the 11 episodes of monetary tightening. When he asks “was it a landing?”, he is raising the possibility that the higher interest rates didn’t actually bring inflation down at that time. For “would have been soft” (episode 7), Blinder argues that the Fed might have pulled off a soft landing with its interest rate increase in 1988-89, except for Iraq’s invasion of Kuwait in 1991.

The Fed has raised its key policy interest rate (the “federal funds rate”) from near-zero in March 2022 to about 4.6%–with talk of additional increases to come. Based on the historical record, what insights are possible about the whether a hard or soft landing is likely?

There are clearly examples where higher interest rates from the Fed, in the service of fighting inflation, were followed by recessions.

The Fed has faced two main challenges in the last few years: the pandemic recession, where the policy response led to a huge burst of disposable income along with supply chains problem, and then the Russian invasion of Ukraine in early 2022, which caused a new burst of higher prices for energy and food along with additional supply chain disruptions. History doesn’t offer do-overs. But it’s at least possible that the inflation which started in 2021 might have faded on its own if it had not been reinforced by the Russian inflation.

One can argue that the last three recessions were not caused by higher Fed interest rates, but instead by the pandemic (2020), the implosion of financial instruments related to the housing price bubble (2007-2009), and the end of the dot-com boom in stock prices and investment levels (2001). Thus, perhaps the key question about the risks of a recession in 2023 may be less about interest rate policy and more about whether the US or world economy experiences a severe negative shock this year.

Several of the Fed’s interest rate increases over time can be thought of as readjusting back to a more reasonable long-run level. For example, the rising Fed interest rates pre-pandemic were in some ways just based on a belief that the rate shouldn’t and couldn’t stay near zero percent forever. Or going back to Blinder’s episode 6, this was a time of chaotic shifts after a severe recession, with a plummeting price of oil and falling inflation, and the at that time seemed to believe that it had gone a little too far in cutting interest rates, so it adjusted back. Part of the Fed increasing interest rates in the last year or so is surely a belief that although it made sense to take the policy interest rate down to zero percent in the pandemic recession, again, it shouldn’t and couldn’t stay there forever.

Macroeconomics is hard because the key factors driving the economy shift over time. It’s not obvious, for example, that the same lessons which applied to the stagflationary period of the 1970s should apply equally well and in the same ways to the dot-com boom-and-bust of the 1990s, or the housing price bubble of the early 2000s, and also to a short-and-sharp recession caused by a pandemic.

Some of the arguments about inflation are really about momentum. When inflation rises, does it have a tendency to fade out? Or does it have a tendency to maintain the higher rate of inflation? Or does it have a tendency to build momentum, like a rock rolling downhill? Which scenario prevails probably depends to on how the causes of the inflation are perceived; the recent historical record and the credibility of the central bank in fighting inflation; and what expectations firms, workers, and consumers have about future inflation.

My own sense, for what it’s worth, is that the US economy is unlikely to escape this episode of higher Federal Reserve interest rates without experiencing a recession, by which I mean a period of higher unemployment and lower production. It seems to me that the pressures and tensions unleashed by the higher interest rates are working their way into reduced borrowing and credit, as well as tensions in bond markets. The Fed seems to be taking a middle road here, with a belief that part of the 6.5% inflation rate from December 2021 to December 2022 was temporary–in the sense that pandemic-related spending will fall, supply chains issues will resolve, and tensions from the Russian invasion of Ukraine will be manageable. Thus, the Fed is trying to raise interest rates only by as much as necessary to be clear that inflation will not gain a permanent foothold, while minimizing the risk of a hard landing.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest