Comments

- No comments found

Stijn Van Nieuwerburgh delivered the 2023 Presidential Address to the American Real Estate and Urban Economics Association on the subject of “The remote work revolution: Impact on real estate values and the urban environment” (Real Estate Economics, January2023, pp. 7-48, subscription or library access required).

He writes:

I want to focus on the longer-term implications of the pandemic for residential and commercial real estate markets, looking out beyond the current cycle. Its most long-lasting implication in my opinion is the dramatic increase in remote work. Born out of necessity, remote work now appears to have taken hold as a permanent feature of modern labor markets. It is a benefit that employees enjoy and are willing to pay for. Their tolerance for commuting appears to be permanently reduced. Having experienced the flexibility that comes with working from home (WFH), the genie is out of the bottle. Firm managers too have come around to see its virtues, often in the form of higher productivity and profits, and have adjusted their own expectations about the number of days they expect employees to be in the office. Several firms have gone fully remote, while most others have moved to a hybrid work schedule of 2–3 days in the office. Various indicators of office demand appear to have stabilized at levels far below their pre-pandemic high-water marks.

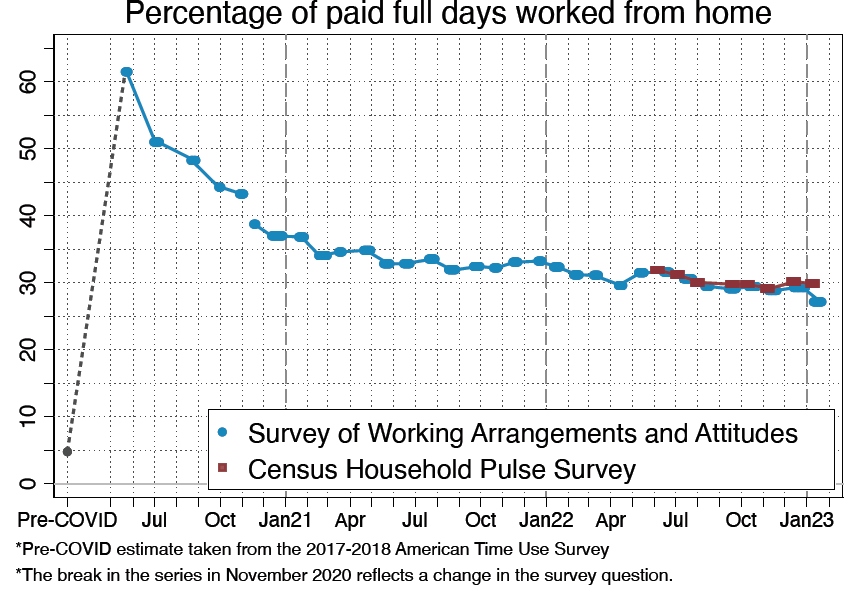

How have patterns of working from home changed? A source cited by many people, including Van Nieuwerburgh, is the Survey of Working Arrangements and Attitudes (SWAA) carried out during the last few years by Jose Maria Barrero, Nicholas Bloom, Shelby Buckman, and Steven J. Davis. Here’s one main pattern from their most recent release in February 2023.

Using data from the American Time Use Survey carried out by the US Bureau of Labor Statistics, they estimate that about 5% of paid full days were worked from home before the pandemic hit. Early in the pandemic, this share spiked above 60% of all paid work days. Now it has dropped to less than 30% of all paid work days. The red line shows data from the Household Pulse Survey being run by the US Census Bureau, which has been finding very similar results.

Of course, this percentage is an overall average between those who are always at the workplace, those always working from home, and hybrid arrangements in-between. Before the pandemic, jobs tended to be either all at a workplace or all at home. The widespread use of hybrid arrangements is new.

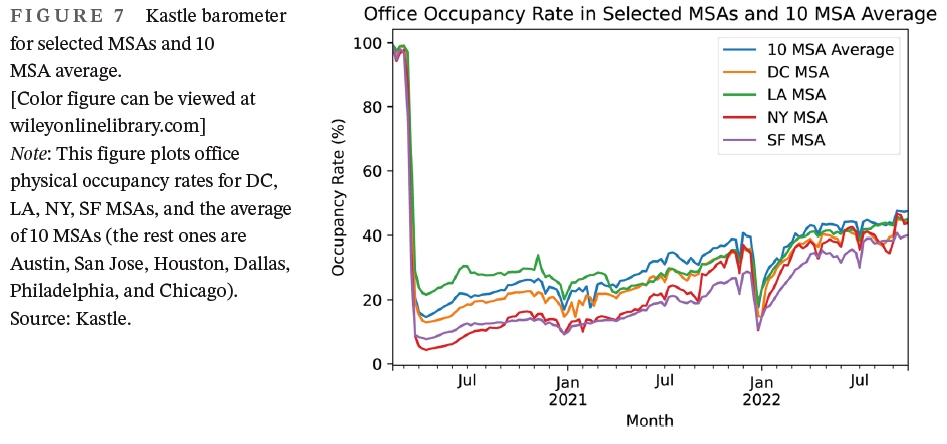

How has this shift affected real estate? Van Nieuwerburgh offers many measures, and I’ll just pass along a few of them here. In terms of office space, the Kastle company gathers “turnstyle” data from the entrance area of office buildings. (It should be noted that there are questions about whether this measure or these buildings are representative of all office space use, but again, there are a number of measures from varying sources on this point with the same general pattern.) If the office occupancy rate was 100 before the pandemic, it’s still only around 40 now. The highly teched-up San Francisco metro area has the lowest office occupancy rate.

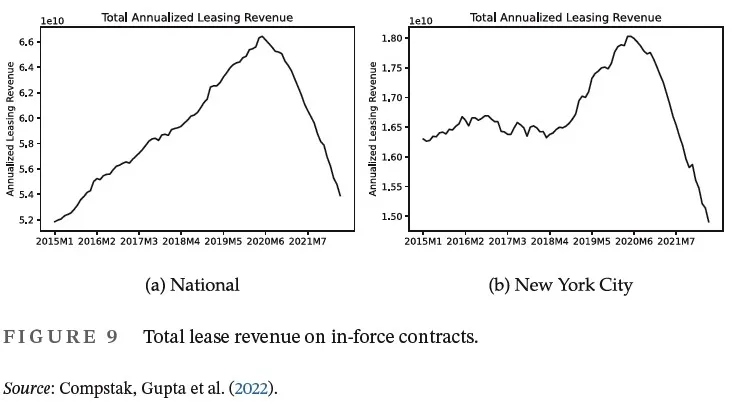

Another measure is to look at revenue from leased paid office space. It’s worth remembering that commercial leases often last 5-10 years, so a number of leases have not yet come up for renegotiation since the pandemic hit. Thus, the drop-off in leasing revenue shown here is likely to persist in the future.

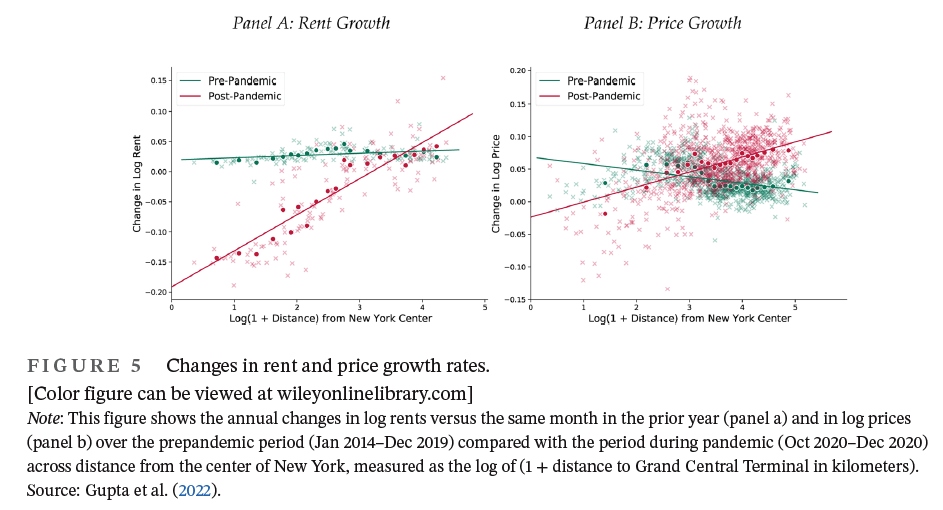

Finally, here’s a pattern on home sales and rental prices, using data from New York City. The horizontal axis shows how close the residence is to the center of New York City. The vertical axis shows the rise in rents or home prices. In the left-hand panel, the green line shows that over the six years or so before the pandemic, rents rose about the same (that is, the green line is pretty flat) whether you were closer to or farther from the center of the city. The red line shows that after the pandemic hit, rents closer to the center of the city dropped, while rents farther from the city center rose. The right hand panel shows that price growth for homes was higher for locations near the center of the city before the pandemic (green line), but price growth for homes near the city center was lower–in fact, was negative–after the pandemic (red line).

The pandemic knocked loose a number of old working arrangements. Let’s assume, as seems plausible, that a large share of previous commuters make a permanent switch to working from home at least a day or two a week–or perhaps more. What are some of the possible implications for real estate, for cities, and for productivity? The research here is of course quite preliminary, but here are some issues.

Lots of people really hate commuting. Having had a chance to do less of it, they really don’t want to go back full-time. On the other side, not everyone wants to work at their kitchen table or on their living room sofa, either. Thus, one possibility is that we will see a rise of satellite offices located in suburbs, or “co-working” offices in the suburbs where you can show up for the day. Such locations can offer some logistical support, like a printer that works or rooms for virtual meetings, and employers would often prefer to know that their employees have a lead gotten out of the house.

If many workers are going to be on a hybrid schedule, maybe working from home a couple of days each week, various coordination problems arise. How many days at home? If one goal is for people to be in the office together, then there must be agreement on what days people will be in the office. Employers may have concerns about having Monday and Friday be work-from-home days, for example, out of a fear that they are implicitly agreeing to a three-day workweek. Employers might want a situation where departments come to the office all together: perhaps marketing is there on Mondays and Tuesdays, and human resources i9s there on Thursdays and Fridays–and the two departments now share the same space. Personal spaces at the office may be reduced: after all, if you’re only going to be there 2-3 days a week, do you really need your own office or cubicle? Maybe you can do just fine with a rolling cart that has your stuff piled on it, and you just roll it over to an open space and grab a chair when you are in the office. Downtown employers might want more spaces for in-person and virtual meetings, or more flexible space where partitions can be rolled out and back, depending on who is in the office and what is needed that day.

With so many fewer workers downtown, and with the ongoing rise of online shopping, urban retail has suffered a huge decline (which of course is another group of people not working downtown, as well). In theory, workers on a hybrid schedule could do their downtown shopping on days that they are commuting to the office, but that doesn’t seem to be happening. Thus, work-from-home is likely to stagger the downtown retail sector as well.

The economic base of urban centers will shift. With less office work and less retail, they will become more reliant on restaurants and entertainment. They might also become more reliant on buying power of people who actually live there.

Lots of cities have a house shortage, in the sense that demand has been driving prices ever-higher in the face of limited supply. But what if some of that less-used office and retail space could be converted to residential space? There are a bunch of tough issues here. In a pure structural sense, lots of office space is not laid-out like residential space: as a basic example, the plumbing and hallways aren’t the same. One can imagine a large square office building divided into long narrow apartments with a window at the far end–but it’s not necessarily an attractive vision and it may run afoul of various residential building codes. The construction costs of such conversions are high, and you can bet that city councils are already salivating at the chance to dictate what kinds of conversions would be allowed and at the idea of setting prices and retail rates. It feels to me as if there is a huge opportunity here to bring housing to cities, and as if the political and economic constraints are likely to strangle that opportunity.

In the long-run, will the work-from-home pattern add to productivity? The evidence on this point is mixed. Early in the pandemic, several studies found that productivity remained pretty high with work-from-home. But during that time, workers at a lot of firms were also making special efforts to help out and get by. Over time, it became apparent that some jobs are more suited for remote work than others. Some workers who were scrupulous about giving a full time effort from home when the pandemic first hit began to ease off over time. Firms began to worry that some activities of business–like certain kinds of brainstorming and strategizing, or certain kinds of information-sharing–worked better when people saw each other every day and could gather in groups. In a work-from-home world, it isn’t clear how on-the-job training works for new hires, or how new hires get informal face-time with other workers. It’s not clear that employee training works as well, either. If you work from home for one company, but could switch to working from home for another company, how loyal are you to either employer?

When it comes to the effects of work-from-home, we are all learning on the fly. There are also likely to be conflicts. At present, it seems to me that lots of employees are willing to go to the office some of the time, and lots of employers are willing to have work-from-home some of the time–but who decides is very much in flux.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest