Comments

- No comments found

Economic productivity is about growing the size of the pie.

I sometimes point out that no matter what your goal–spending increases, tax cuts, greater support for the poor, environmental protection–that goal is easier when the economic pie is growing. When the economic pie isn’t growing, after all, then all priorities have to pit potential winners against potential losers in a zero-sum game.

Thus, a global slowdown in productivity is bad news all around. For context and policy advice, the McKinsey Global Institute has published “Investing in productivity growth” (March 24, 2024, by Jan Mischke, Chris Bradley, Marc Canal, Olivia White, Sven Smit, and Denitsa Georgieva). As they point out: “Advanced-economy productivity growth has slowed by about one percentage point since the global financial crisis (GFC).”

In a given year, 1 percent isn’t much, but remember that it’s a cumulative effect. If productivity growth had been 1% higher since, say, the end of the Great Recession in 2009, then over those 15 years the US economy would already be about 15% larger. In 2024, US GDP is $28 trillion, so 15% larger would have meant an additional $4.2 trillion. As the McKinsey folks note: “Today the world needs productivity growth more than ever. It is the only way to raise living standards amid aging, the energy transition, supply chain reconfiguration, and inflated global balance sheets.”

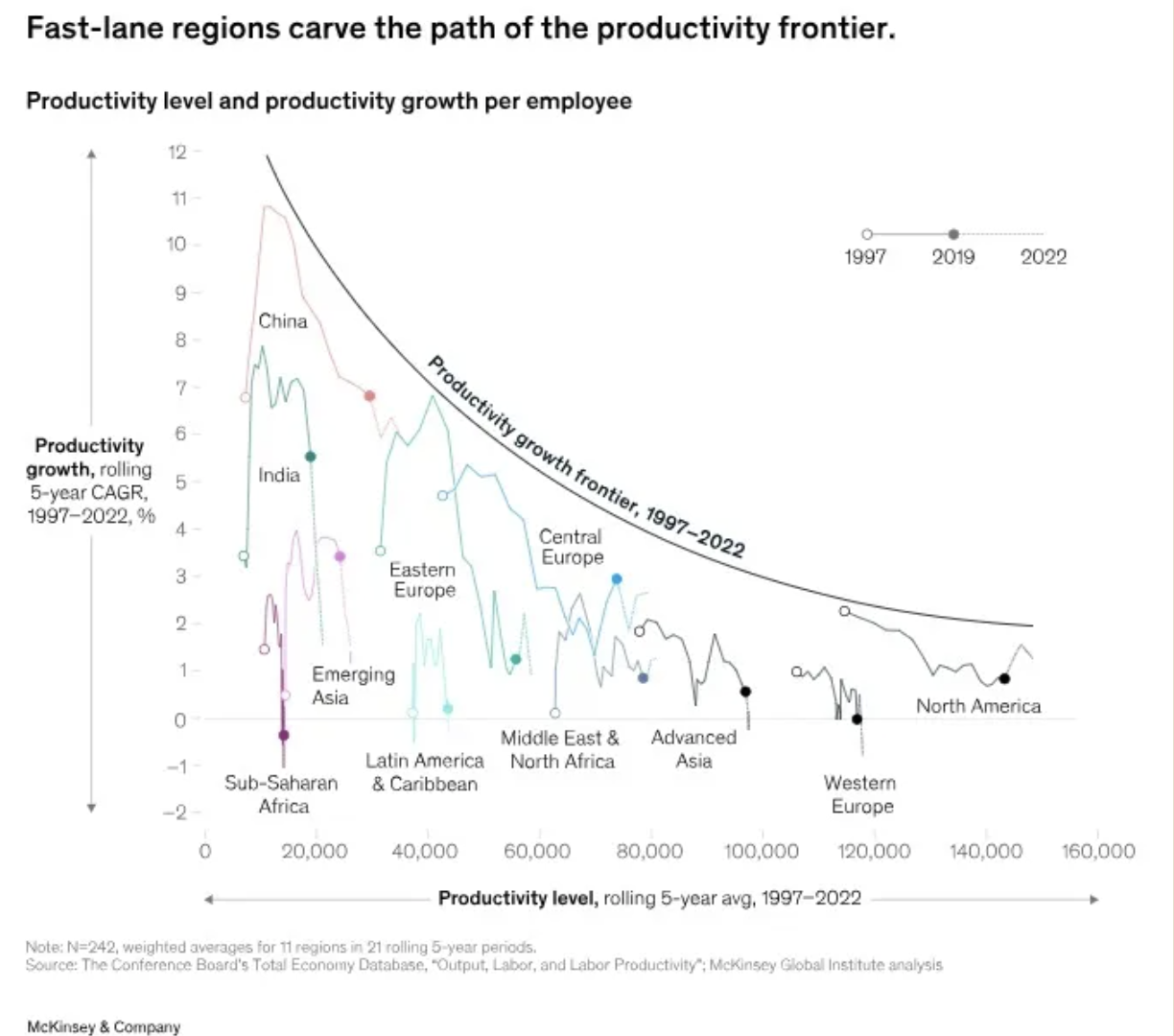

The report offers some interesting context on global productivity. In this figure, the horizontal axis shows the level of productivity for various countries and regions, so that the lower-productivity areas like China and India are on the left, while the high-productivity areas like North America are on the right. As you can see, there’s a general pattern that lower-income places have the potential to grow at faster rates. In part, this is because lower-income places can take advantage of technologies that are already developed and sell to higher-income countries. IN part, it’s essentially a matter of arithmetic: when you start very small, doubling in size is easier than when you start very large. The “productivity frontier” is really a thought experiment, suggesting that certain areas of the world, like sub-Saharan Africa, Latin America, and Western Europe may have potential for substantially more rapid productivity growth.

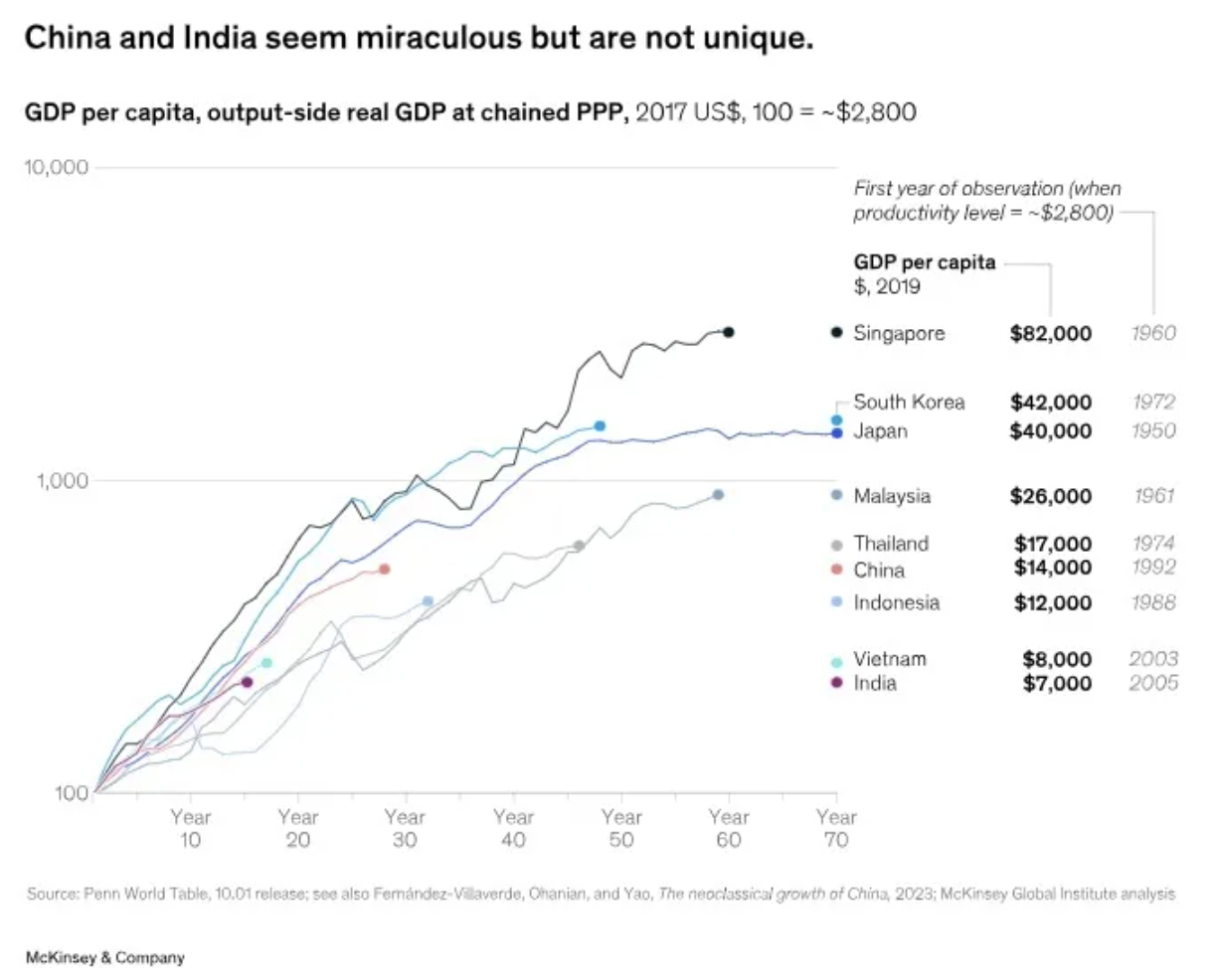

When it comes to China and India, I’m often asked about whether their pattern of growth is about to level off and top out. It might! In China, in particular, the current government seems to have decided that economic growth is less important than other priorities like military power and social control. But there is no law of economics which says that these countries have topped out.

This figure shows some notable historical growth experiences. On the far left, all countries start at a situation where their per capita GDP was roughly $2,800–which the graph sets equal to 100. As you can see, growth in China and India is really just following a path already blazed by South Korea, and before that Japan, as well as Malaysia and Thailand. Given the basic ingredients for productivity growth–the average worker is gaining in education and skills, the average work has more capital equipment to work with, technology is improving, and there are incentives for firms to improve and innovate–growth in India and China could potentially still have decades to run.

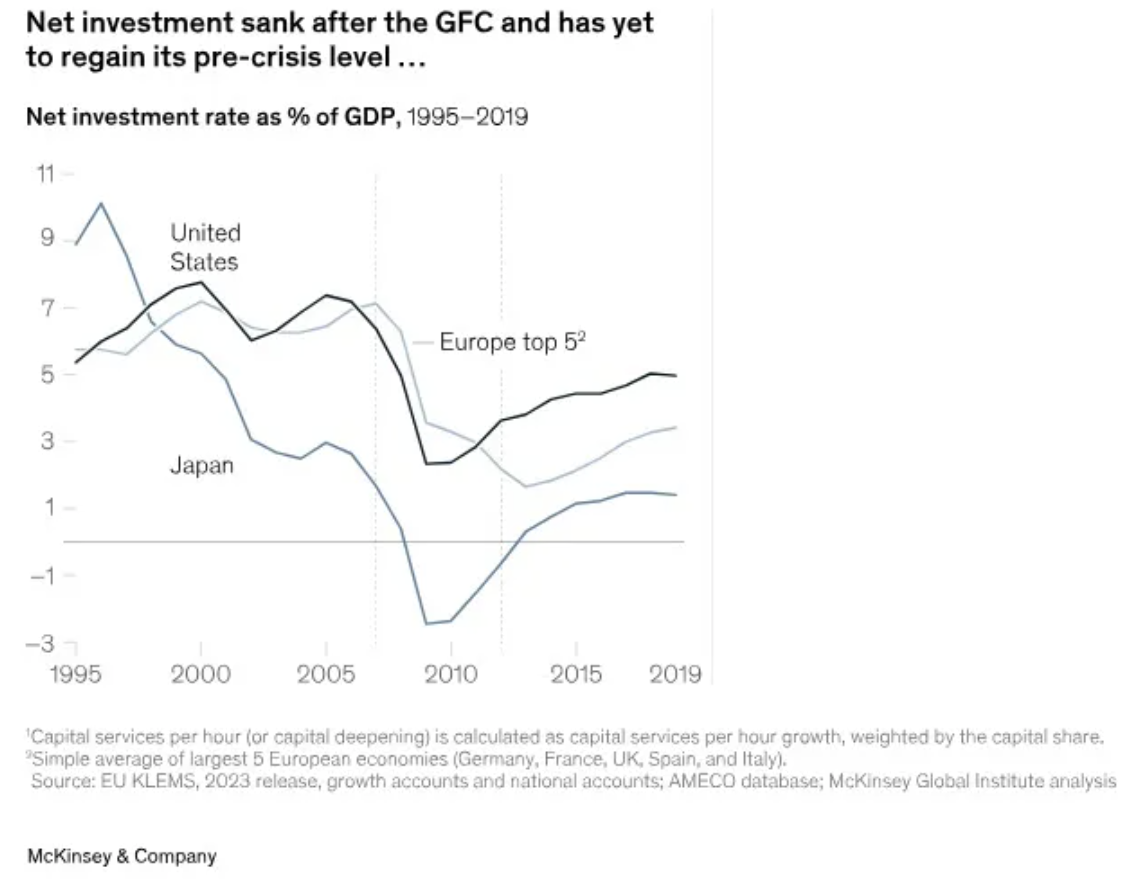

What about productivity in high-income countries, like the United States? The McKinsey report suggest several main reasons why growth has slowed down. Two of the reasons are that factors driving growth in the early 2000s have shifted.

While many drivers affect productivity growth, two stand out for explaining the performance of advanced economies in recent years. First, manufacturing experienced waves of productivity advances fueled by the effects of Moore’s law and a burst of offshoring and restructuring. (Moore’s law, which holds that the number of transistors in a microchip doubles every two years, signals more broadly that computers become more powerful and efficient while coming down in cost.) These waves yielded productivity gains before the GFC [global financial crisis] but petered out over time. The second major factor is a secular decline in investment across multiple sectors … These two trends explain the slump in advanced economies almost entirely. Digitization was much discussed as the main candidate to rev up productivity again, but its impact failed to spread beyond the information and communications technology (ICT) sector.

The main prescription for additional economic growth from the McKinsey analysis is to raise the level of investment: to be clear, this advice is meant to include both investment in actual physical capital as well as investment in “intangible” capital that leads to gains in knowledge, management, and skills. The report notes:

The slump in capital investment slowed productivity growth beyond manufacturing by 0.5 percentage point in the United States, 0.3 point in our Western European sample economies, and 0.2 point in Japan … This decline spanned almost all sectors: in the United States, the only exceptions were mining and agriculture; in Europe, only mining, construction, and finance and insurance generally remained stable, while real estate accelerated.

More specifically, slowing growth in tangible capital (for example, machines, equipment, and buildings) explains almost 90 percent of the drop in the United States and 100 percent in Europe. From 1997 to 2019, gross fixed capital formation in tangibles fell from 22 to 14 percent of gross value added in the United States and from 25 to 17 percent in Europe. Intangible capital growth (for example, R&D and software) was more resilient but could not make up for falling investment in the material world. Gross fixed capital formation in intangibles increased from 12 to 16 percent in the United States and from 10 to 12 percent in Europe. Investment in intangibles is needed to boost corporate performance and labor productivity, but it may face barriers (skills needed to scale up, limited collateralization and recovery value), and the productivity benefits can take longer to materialize.

Economic growth doesn’t happen purely from the invention of technology: instead, it happens when that technology moves into widespread use. There’s a gap between the invention and the application, sometimes called the “valley of death,” because moving from the conceptual idea to the practical application can be so hard. “Investment” is how an economy bridges the gap. The McKinsey writers note: “Post-GFC investment declined sharply and persistently, failing to generate anything to take their place. But today, directed investment in areas such as digitization, automation, and artificial intelligence could fuel new waves of productivity growth.” I’m a little less certain than they are about the directions of future growth: for example, I think genetics and material science may have big roles to play as well. But without a rise in investment, we aren’t even going to know what we’re missing.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest