Comments

- No comments found

The US produces almost no coffee, other than small quantities from Hawaii.

However, the US market imports about 15% of global coffee production each year, and thus is fully exposed to global coffee prices–which have been on the rise. Angela Cantor describes the recent supply and demand patterns in “Historic coffee prices percolated after a bitter global supply crisis” (Bureau of Labor Statistics: Beyond the Numbers, September 2023). I pass them along here because, as Cantor reports, Americans drink more coffee than any other beverage, including tap water. Also, it’s a relatable supply and demand story for students.

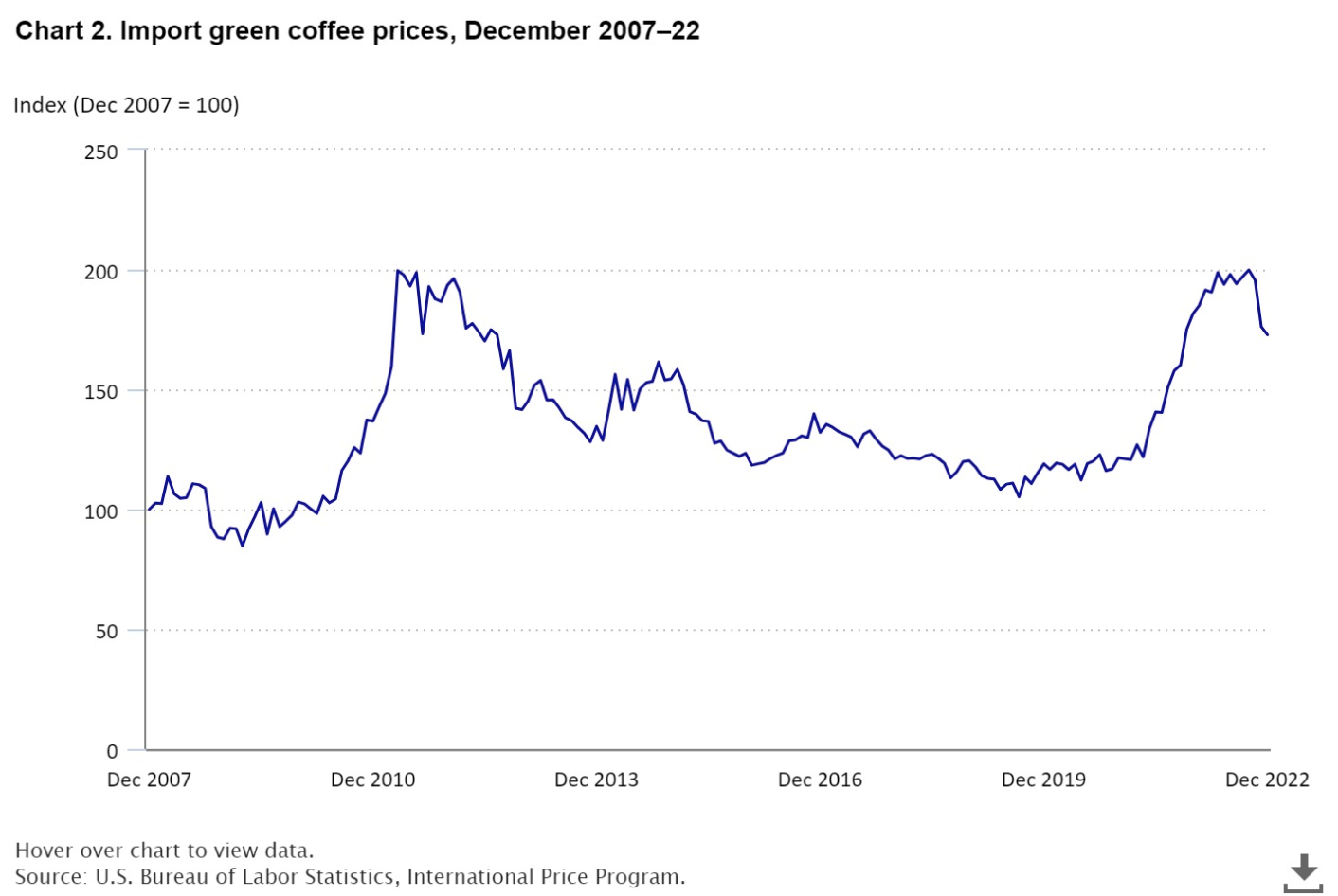

Here are prices of coffee imports on the world market since 2007. The current spike is clearly not without precedent, but it’s still pretty abrupt.

A sharply higher price can be the result of either a rapid increase in quantity demanded or a rapid decrease in quantity supplied, and in this case the latter factor is dominant. The supply shock has two causes: weather disruptions that reduced coffee harvests in key producer countries and pandemic-related difficulties in shipping coffee to the US market.

Brazil is the “coffee pot of the world,” by far the world’s producer of coffee. It produces about twice as much as second-place Vietnam, which in turn produced as much as the combination of Columbia and Indonesia, the two countries tied for third.

But the Brazil coffee harvest in 2021 was the lowest in four years, due to a variety of factors like “the tropical storm La Niña and greater variability in temperatures, along with deforestation of the Amazon.” Pandemic-related travel restrictions in Vietnam meant that many workers chose not to travel to the coffee harvest, because they feared being locked-down and unable to return to their permanent homes. Colombia experienced a national strike against a COVID-19 pandemic reform plan proposed by the president, which dramatically hindered coffee production and shipping: for example, the main Columbian port out of which coffee is usually shipped closed for 48 days. Indonesia already had a scarcity of ports and international cargo facilities, which only got worse when containers for shipping became scarce during the pandemic.

Canton concludes:

By the end of 2022, coffee traders were optimistic about seeing some stabilization in the market as they placed their bets on the expectation of the 2022–23 season being an on-year in the coffee production cycle, and the rise of breakbulk shipping as a solution for the lack of containers. At the time, rapidly decreasing prices seemed to confirm that expectation. However, at the start of 2023, prices made an unexpected turnaround to the high levels that were last seen in the fall of 2022. Throughout 2023, high U.S import coffee prices persisted, hovering just below 2022’s high price record, as Brazil continues to deal with the aftermath of the impact of severe frosts, high temperatures, and the below-average-rainfall that occurred in 2021, and as Colombian coffee yields remain low because of growers’ decision to limit fertilizer use due to its price spike. Further, there is now a shortage of coffee laborers in Central America as many have abandoned the region in search of better opportunities.

For a discussion of another part of the coffee supply chain–namely, how coffee that sells for a few dollars a pound ends up retailing in a coffee shop for a few dollars a cup, see “Coffee-nomics: A Supply Chain Story” (January 25, 2020). Those with historical interests may prefer “When Coffee was the Newly Introduced Good Under Attack” (December 24, 2019) when tells the stories of when the governor of Mecca sought to ban coffee in 1511, when a group of priests appealed to Pope Clement VIII to ban coffee later in the 1500s, and when the physicians of Marseilles attempted to discredit coffee drinking in 1679.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest