Comments

- No comments found

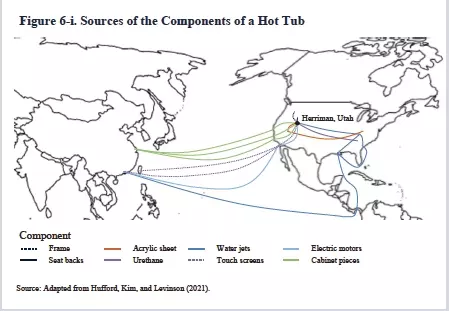

Here’s an example of a global supply chain, which is all the more powerful for its ordinariness.

It’s taken from the most recent Economic Report of the President, produced each year by the White House Council of Economic Advisers. Each year, the report is an overview of the economy from the viewpoint of academic economists who are admittedly and overtly sympathetic to the president in power, but also who feel a professional compulsion to provide facts and figures and tables to back up their beliefs. Chapter 6 of this year’s report is entitled “Building Resilient Supply Chains.” The CEA writes:

The M9 hot tub is made by Bullfrog Spas in Utah, where 500 workers assemble almost 1,850 parts from 7 countries and 14 states (see figure 6-i). The hot tub top shell starts as a flat acrylic sheet from Kentucky, which is then combined with a different type of plastic in Nevada and sprayed with an industrial chemical from Georgia. Parts of the frame shell of the hot tub are driven in by trucks from Idaho several times a week. Many of the electric motors come from China and are assembled into water pumps in Mexico and then driven to Utah. Additional material for exterior cabinets is transported from Shanghai on container ships through the ports of Long Beach or Oakland. Water-spraying jets are made in Guangzhou, China; are sent through the Panama Canal and Eastern ports to the supplier’s warehouse in Cleveland, Tennessee; and then are sent on to Utah. Once fully assembled, the finished hot tubs are placed on trucks or trains and delivered to retailer warehouses. This example illustrates both the extent of outsourcing, which increases the number of individual companies involved in the production of a single good, and the geographic distance traveled by each component, estimated to total nearly 900,000 miles, as well as the dependence on transportation and logistics this entails.

On one side, it seems pretty clear that Bullfrog Spas would not be providing jobs and payroll in Harriman, Utah, without some kind of far-flung supply chain. The great benefit of supply chains is the ability to combine specialized inputs from all over the world. On the other side, any company with far-flung supply chains will be vulnerable to disruptions of those supply chains.

The CEA report emphasized two main reasons for growth of global supply chains in the last three decades or so.

The first change is increased access to foreign suppliers, making offshoring more cost-effective for firms, largely due to advances in information technology (IT) and reductions in trade barriers since the 1990s. Advances in IT allow firms to convey detailed information about product and process specifications across long distances, while improvements in transportation, such as containerization, allow goods to be moved more quickly and consistently … The second key change is the growing role of financial criteria and institutions in corporate decision making. This “financialization” of the economy has encouraged outsourcing and offshoring because of savings in costs that are easily measurable. … Such incentives have encouraged managers to focus more on these financial statement numbers than on less easily measurable metrics, such as resilience. … This financialization of the economy has been an important driver of U.S. lead firms’ supply chain strategies. Outsourcing of production and other capital-intensive activities is prescribed by consulting firms promoting an “asset-light” strategy. These firms note that, all else held equal, a lower amount of capital makes a given amount of revenue yield a higher measured return on assets …

As global supply chains have wobbled in the COVID pandemic, the potential tradeoffs have become more clear. The most obvious tradeoff is the potential for gains from a smoothly functioning supply chain vs. the risks and costs of a disrupted supply chain. But the CEA report mentions a number of more subtle tradeoffs, which often depend on the exact nature of the supply chain.

For example, the cost of building a cutting-edge semiconductor fabrication plant now exceeds $12 billion, and so most users of computer chips buy rather than make their own. But is the best choice to rely on very standardized chips, which can be purchased from several manufacturers, or to work closely with just one or two fabs to design customized chips–and to reserve production space for those chips?

The use of semiconductors in the auto industry illustrates this point. Although semiconductors became key to the operation of modern vehicles more than a decade ago, many automakers did not begin to communicate directly with semiconductor manufacturers until late 2021. Rather, they bought chips indirectly, through distributors or first-tier suppliers, and did not commit to purchases more than a few weeks out. Thus, although their product plans included more intensive use of semiconductors in future vehicles, automakers had not been credibly signaling this intention to manufacturers. Without this commitment, semiconductor manufacturers were unwilling to build new fabs for automotive-grade chips, since fabs must maintain very high capacity utilization to be profitable. Further, they did not devote resources to innovating on the dimensions important to automakers, such as reduced cost and increased reliability. In contrast, Apple has long paid to reserve capacity in advance at fabs, and has worked with semiconductor manufacturers and design firms to innovate on the dimensions important to them—speed and power …

Another tradeoff related to innovation is that getting chips from a long distance away gives a user access to cutting-edge technologies. However, there is also a belief that when engineers from chip-makers and chip-users are geographically closer, both sides may benefit:

However, there is evidence suggesting that geographically separating production and innovation impedes innovation. Engineers overseeing production are exposed to the capabilities and problems of existing technology, helping them to generate new ideas both for improving processes and for applying a given technology to new markets. Losing this exposure reduces the opportunity to generate such innovative ideas. For example, when production of consumer electronics migrated to Asia in the 1980s, the United States lost the potential to later compete in the burgeoning market for follow-on products like flat-panel displays, LED lighting, and advanced batteries ..

Yet another tradeoff of supply chains is that a lead firm, purchasing inputs from others, may buy from a supplier firm that offers considerably lower wages and benefits, or perhaps also worse working conditions. Especially if the supplier is another US firm, this ability to contract out jobs to a separate workforce under a different employer seems like a mixed blessing for the US workforce viewed as a whole.

There are of course ways to reduce vulnerability to short-term supply chain disruptions: holding larger inventories, making sure you have a geographically distributed range of suppliers for key inputs, planning ahead for shifting to other inputs if needed, and so on. The problem is that these solutions have costs of their own–and at some point, the costs of avoiding vulnerability to a disruption mean that the extended supply chain isn’t worth it in the first place. But many firms that rely on long supply chains had, frankly, not given a lot of thought to their vulnerability before the pandemic.

Governments can sometimes play a role, too. One vicious circle in supply chain disruptions is that all the buyers are trying to build up their own inventories–which of course makes the shortage worse. In some cases, the government can help alleviate this hoarding by providing shared information about the market.

For instance, the U.S. Department of Health and Human Services has taken on an important role in providing an accurate demand signal for PPE. The department’s Supply Chain Control Tower receives near-daily data from distributors that represent more than 80 percent of the volume for the commodities it is tracking, along with supply status from 5,000 hospitals. This dashboard alleviates hospitals’ fear of shortages, so they do not need to incur extra costs of holding inventory. The dashboard also allows distributors to receive a truer demand signal by reducing excessive ordering that exacerbates supply constraints (U.S. Department of Health and Human Services 2022, 13). In cases such as these, the public sector is well positioned to collect, aggregate, and disseminate this information.

Another role for the government is in setting the conditions for investment in infrastructure–for example, to reduce the risk that US ports become clogged. In a different chapter, the CEA notes:

There is much evidence that the United States lags far behind its competitors in supplying the essential inputs to economic capacity. U.S. infrastructure provides several examples. The World Economic Forum’s Global Competitiveness Report found in 2019 that, out of 141 countries, the United States ranked 13th in quality of overall infrastructure, 17th in quality of road infrastructure, 23rd in electricity supply quality, and 30th in reliability of water supply (Schwab 2019). A separate ranking of global ports by the World Bank and IHS Markit found that no U.S. port made it into the top 50 globally, and just 4 are in the top 100. By comparison, of the top 10 ports, several are in China. The Federal Communications Commission (FCC 2018) has also ranked the United States 10th among developed countries for broadband speed and connectivity. In transporting goods and services, in connecting workers around the country and globe, in transforming technological progress into productivity gains, the United States is not at the frontier.

Supply chains offer enormous economic benefits. But one hopes that a lasting economic lesson from the pandemic, for both private firms and government actors, is to think more seriously about the risks and vulnerabilities of supply chains.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest