Comments

- No comments found

Starting in the Great Recession of 2007-9, the Federal Reserves started a policy of “quantitative easing,” in which the Fed held substantial quantities of financial assets like US Treasury bonds and federally guaranteed mortgage-based debt. The problem at the time was that the Fed had reduced its policy interest rate to near-zero. The idea was that if the Fed held such assets, then interest rates could be somewhat lower, compared to a situation where these assets were being sold in financial markets.

An obvious question raised at the time was whether the Fed was, in effect, just printing money to cover government borrowing. “Monetizing” the debt this way is typically thought to be a lousy idea, because it leads to inflationary pressures, and even to doubts about the true value of the debt on financial markets. But Fed economists at the time drew a clear distinction between quantitative easing and monetizing the debt. Here are David Andolfatto and Li Li of the St. Louis Fed on the subject (“Is the Fed Monetizing Government Debt?: February 1, 2013).

What is usually meant by “monetizing the debt,” however, is the use of money creation as a permanent source of financing for government spending. Thus, to ascertain whether the Fed has in fact monetized its purchases of $1.2 trillion in government bonds since 2008, we have to know what the Fed intends to do with its portfolio of assets over time.

If the recent rapid accumulation of Treasury debt on the Fed’s balance sheet constitutes a permanent acquisition, then the corresponding supply of new money would be expected to remain in the economy (as either cash in circulation or bank reserves) permanently as well. As the interest earned on securities held by the Fed is remitted to the Treasury, the government essentially can borrow and spend this money for free. If, on the other hand, the recent increase in Fed Treasury debt holdings is only temporary (an unusually large acquisition in response to an unusually large recession), then the public must expect that the monetary base at some point will return to a more normal level (through sales of securities or by letting the securities mature without replacing them). Under this latter scenario, the Fed is not monetizing government debt—it is simply managing the supply of the monetary base in accordance with the goals set by its dual mandate. Some means other than money creation will be needed to finance the Treasury debt returned to the public through open market sales.

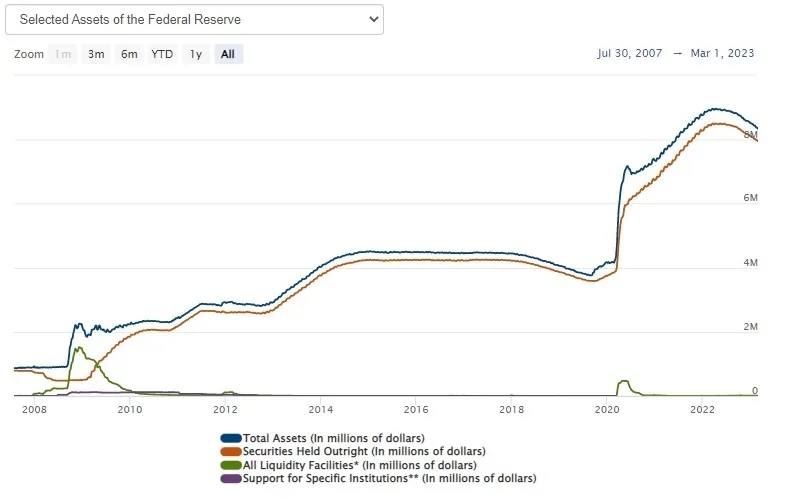

Here’s a figure from the Fed showing the evolution of its asset holdings over time. You can see the build-up in assets after the Great Recession–those first waves of quantitative easing. You can then see a modest decline in Fed asset-holding, as Aldolfatto and Li described above. The idea during this time was that the Fed would simply hold the debt it had purchased until that debt expired, and thus gradually and slowly let its asset holdings phase down. A phrase commonly used was that the process would be about as exciting as watching paint dry.

But then the pandemic recession hits, the US government runs extraordinarily large deficits to fund its pandemic relief programs, and given the uncertainties in global financial markets, the Fed holdings of assets take another dramatic leap. For reference, the numbers are in millions of dollars, so the “8M” on the right-hand axis refers to eight million million–that is, $8 trillion.

So even if the Fed was not monetizing federal debt back in 2013 or so, is it doing so now? What’s the current plan for phasing down the now much-larger Fed holdings of government debt? Huberto M. Ennis and Tre’ McMillan of the Federal Reserve Bank of Richmond lay out part of the plan in “Fed Balance Sheet Normalization and the Minimum Level of Ample Reserves” (Economic Brief No. 23-07, February 2023).

Ennis and McMillan write:

From the beginning of the pandemic through the spring of 2022, the Fed’s balance sheet increased significantly due to the Fed’s efforts to aid market functioning and support the flow of credit to households and businesses. Reserves in the banking system increased to record highs, well beyond levels desired by the Fed in the long run. With financial and economic conditions improving, the Fed started the process of balance sheet normalization in March 2022, whereby it intends to significantly reduce the amount of Treasuries and mortgage-backed securities (MBS) that it holds in its System Open Market Account (SOMA) portfolio.

So what is going to happen, and how far and how fast? Here, the desired reduction in Fed assets over time–basically, the Fed holding less in Treasury bonds and in federally guaranteed mortgage-backed securities–intersects with the imperatives of conducting everyday monetary policy. The main tool that the Fed uses for conducting monetary policy is to change the interest rate it pays on reserves that banks hold at the Fed, and in this way to affect its key policy interest rate, called the federal funds rate. A Fed website explains: ,

The FOMC [Federal Open Market Committee] has the ability to influence the federal funds rate–and thus the cost of short-term interbank credit–by changing the rate of interest the Fed pays on reserve balances that banks hold at the Fed. A bank is unlikely to lend to another bank (or to any of its customers) at an interest rate lower than the rate that the bank can earn on reserve balances held at the Fed. And because overall reserve balances are currently abundant, if a bank wants to borrow reserve balances, it likely will be able to do so without having to pay a rate much above the rate of interest paid by the Fed. Typically, changes in the FOMC’s target for the federal funds rate are accompanied by commensurate changes in the rate of interest paid by the Fed on banks’ reserve balances, thus providing incentives for the federal funds rate to adjust to a level consistent with the FOMC’s target.

Thus, as a first step, when the Fed wants to raise interest rates, it raises the interest rate it pays on bank reserves. For this policy to work, there need to be “ample” bank reserves. As Ennis and McMillan write:

The idea is for the Fed to maintain a balance sheet large enough to accommodate growth in currency in circulation plus an ample quantity of bank reserves. “Ample” means that reserves are plentiful enough to not carry any significant convenience yield. In other words, banks should value the marginal unit of reserves for the interest on reserves that they earn, but not because that marginal unit facilitates the daily operations of the bank holding it in any meaningful way.

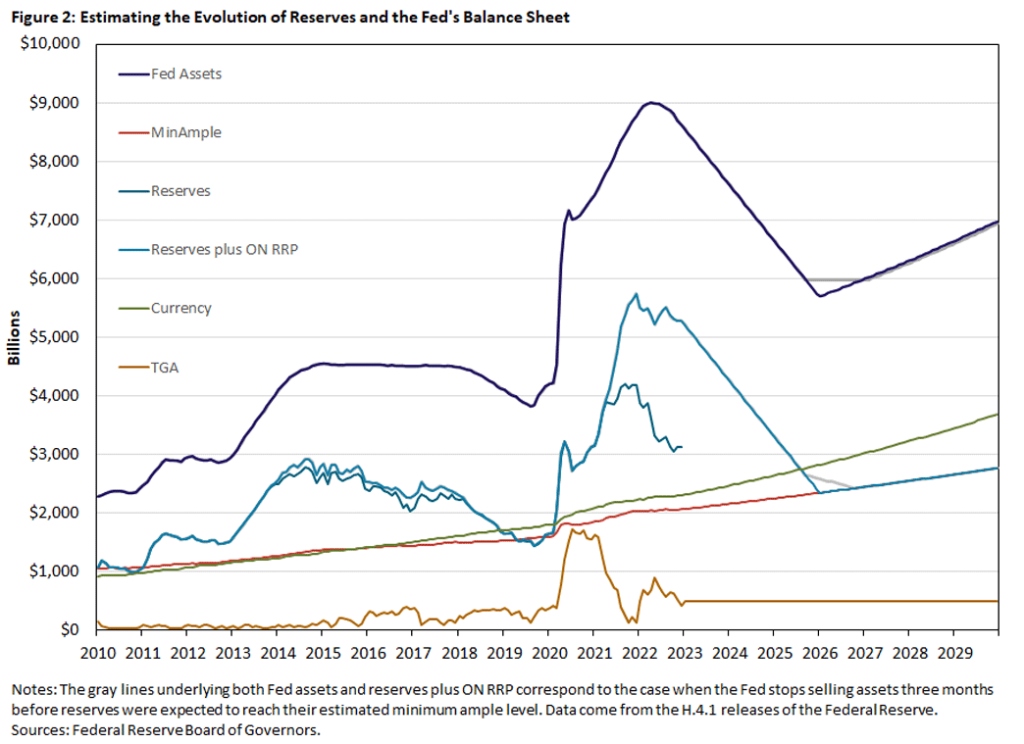

What does that “enough but not too much” language mean in practical terms? They suggest that the goal should be to get bank reserves back to their level in about 2019, before the run-up of Fed assets during the pandemic. (This seems to be a commonly held view at the Fed: for example, scroll down and see similar comments from Christopher Waller.) Here’s an illustrative figure with their calculations out to 2029.

For our purposes, here are the important lines. The top line shows the total holdings of Fed assets, as shown above. The light blue line shows bank reserves actually held; the red line shows their calculation of “minimum ample reserves.” You can see their projection that bank reserves will decline in the next year or two until they reach the “minimum ample” level. The bottom orange TGA line shows the “Treasury General Account” at the Fed: you can see how it bounced up at the start of the pandemic, when the Treasury wanted to have cash on hand to make payments as legislation and emergencies dictated, but then dropped again.

All of this raises two questions. The first question is practical: How does the Fed plan to make this happen? The answer is that as the Fed receives interest payments on the Treasury debt and the mortgage-backed securities that it is holding, it will not reinvest that money in new debt. Thus, the value of the debt it is holding will diminish over time. Ennis and McMillan estimate that this process will reduce Fed holdings of debt by about $80 billion per month. Thus, the “ample” level of bank reserves would be reached by about 2026.

The second question is harder: Is this goal for reducing Fed assets the right one? Here, it’s worth pointing out that the policy goalposts have been shifted. Back in 2013, you’ll remember, Aldolfatto and Li argued that the first wave of quantitative easing was not “monetizing the debt,” because it wasn’t a permanent step, and debt held by the Fed was being phased down. Now here we are in 2023, and even if the Fed manages to stick to its plan of phasing down its Treasury debt holding in the next three years, total Fed assets would still be about $7 trillion by 2029. What looked like a slow phase-down of Fed assets back in 2013 will be starting to look like a permanent and generally rising pattern of Fed assets by 2029–which was the working definition of monetizing the debt.

I don’t see any easy choices for the Fed here. The optics of having a central bank decide to do a large-scale sell-off of the debt of its own country would not be a good look in financial markets. But the approach of reducing the debt that the Fed is holding by not reinvesting interest payments on the debt that the Fed holds is slow. As I see it, the Fed seems to be hoping that after having experienced two once-in-century events in the last 15 years–the Great Recession of 2007-9 and then the pandemic recession–it just won’t feel a need to do quantitative easing (or “monetizing the debt?”) again in the next decade or so.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest