Comments

- No comments found

Digital trust has increasingly been described as the core currency of our time, a critical business and social enabler that can foster long lasting loyalty and shared value impact, making it a highly appropriate focus for brand new research by the Swiss Re Institute entitled "Decoding Digital Trust".

In 2021, the number of people making purchases online jumped from 1.66 billion 5 years ago to 2.14 billion – and these are purchasing decisions that are both increasingly and directly correlated to digital trust, with additional benefits across lifetime customer value, brand love and broader economic growth.

Set in this context, the recent prediction by IDC Research that more than a third of organizations will have replaced Net Promoter Scores (and aligned measurements) with digital trust indices by 2025 seems both timely and fitting. To move towards a future where there is greater unification around trust across privacy, compliance, security and customer experience considerations, it becomes imperative to understand what really constitutes trust and contributes to its genesis. Because although trust appears ubiquitous, its’ understanding, fostering and retention has also become a key challenge for many organizations today.

So what does trust actually mean? It is not an easily isolated identity, amorphous in nature and has multiple definitions – but these do all broadly coalesce around the ‘willingness to be vulnerable to the actions of others’ with dimensions spanning commitment, reputation, probability and trusted opinion. Within academic literature whilst trust and vulnerability are both intertwined and interpersonal, trust is typically distinguished from reliance - moving beyond a belief in competence, to a belief in positive intent. So whilst an artefact may fail it would not ‘let you down’ in the same way as a person or even brand relationship not delivering on an expressed or perceived intent. This is reflected within the Edelman Trust Barometer which has provided benchmarking for 20 years and where we find that people grant trust based on two specific and distinct attributes, ethical behaviour (doing the right thing, improving society) and competence (delivering on promises).

When we consider the ‘state of trust’ in the world today, research findings also vary in respect to who are held as the bastions of trust and the levels of trust held by consumers towards different types of organization. In particular, the World Economic Forum has observed an erosion citing that ‘declining trust, prompted by unease at the way some organizations are using digital technology, could undermine the societal benefits of digitalization’ thereby creating notable challenges to the growth of the global digital economy.

Looking again into the Edelman findings, another duality emerges, that of trust inequity with the ‘informed public’ far more trusting of every institution than the mass population where perceptions of inequity, unfairness and fear are key negative drivers. New dialogue, approaches, tools and techniques are therefore needed to help increase consumers' confidence in the digital ecosystems which support their lives across all contexts to help bridge the present digital trust gap between some consumers and types of organizations.

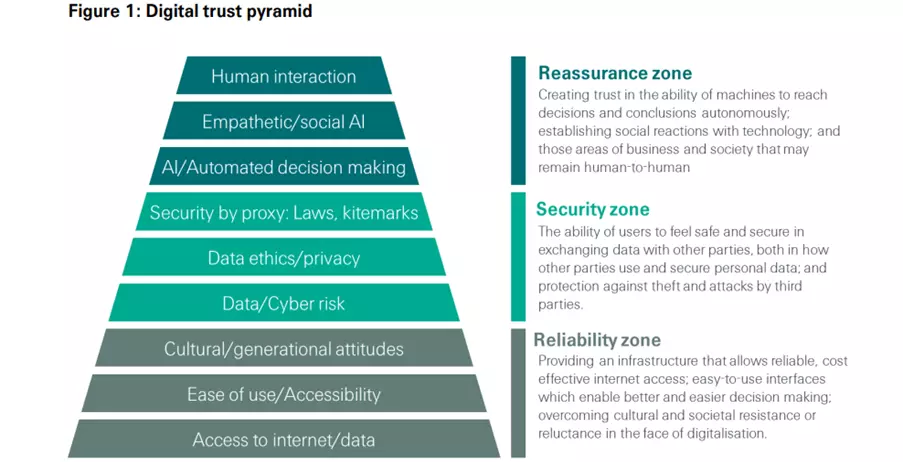

So how can this progress best be actualized? I believe the Swiss Re "Decoding Digital Trust" research heralds an important milestone in this trajectory, notably the establishment of the Digital Trust Pyramid (Figure 1), a nine-step methodology that provides a lens through which to approach and better evaluate digital trust. Akin to Maslow’s Hierarchy of Needs approach, these steps map onto different levels of higher order advancement, in this case three zones:

Reliability – reflects the baseline physical and mental trust foundations or constraints and includes access to data / internet, ease of use, cultural and generational attitudes

Security – critical to maintaining trust as the relationship develops and includes data / cyber risk, data ethics and privacy and trust by proxy: laws, self-policing

Re-Assurance – the dynamic of human and technology partnership in trust evolution and includes AI / automated decision making, empathetic / social AI and Human-to-human interactions

Copyright @Swiss Re Institute Research

The research findings herald an array of insights, from unpacking some of the societal characteristics that help cultivate more suitable environments for creating digital trust, for example countries with higher innovation, governance and income levels typically correlate with higher levels – to revealing some data surprises, for example the ‘it’s complicated’ relationship between regulation and digital trust! This is elucidated further by Pravina Ladva, Group Chief Digital and Technology Officer at Swiss Re in her insightful new blog available here. Clearly, the relationship between guidelines, principles, pledges, legislation and trust is a non linear one:

‘Some common ideas about what increases trust can turn out undermining it… although a basic level of regulation increases trust, the authors found that, highly dependent on local conditions, digital trust will, past a certain point, not necessarily increase by adding further levels of rule-based protocol. Therefore, more regulation is not necessarily the be-all-and-end-all of creating digital trust’

Reflecting on the insurance industry in particular, the new Swiss Re research also shines a light on its critical role in supporting the growth of digital trust in others, catalyzed by the sectors’ existent embedding within critical trust journeys’ – from supporting us as individuals and organizations alike, from situations that can range from health crisis or road traffic accident, right through to natural catastrophes, cyber-attack and supply chain management.

In particular, with cybersecurity risks escalating in scope, scale and sophistication - and impacting individuals, families, SMBs and Enterprises alike – cyber becomes the most obvious point in the value chain where insurers can seek to create trust. Cyber-insurance increases security by encouraging or ‘incentivizing’ the use of third-party security organizations for support and overarching all, via the adoption of best practices. Putting this into context 98% of cyber threats can be negated with the application of basic cyber hygiene such as Two-Factor Authentication. With a strong positive correlation identified in the research between cyber preparedness and digital trust, the broader ecosystem impact becomes clear too.

Finally, improving digital trust in the insurance industry itself is also imperative. Technologies such as blockchain can help embed transparency, traceability and trust by design and there are multiple touchpoints in the insurance lifecycle journey where trust is impacted, right across the stages of product conception and design, sales and distribution, underwriting, pricing and risk assessment, and where consumers are most impacted - claims.

In Pravina Ladva’s new blog, available here [link to add] there are some insightful takeaways around digital design, and how when led by behavioural science, this can better engender trust and ‘nudge’ users to make more informed choices. Another area that significantly impacts both insurers and consumers is the affects of mental health, with previous research by the Swiss Re Institute estimating that circa 45 million people are suffering with mental conditions in six key insurance markets.

Responding to this, and a really tangible example of providing support and building trust in the process, it is excellent to see the collaboration between Swiss Re and leading AI powered mental health platform Wysa to create an insurance-specific app. This will enable improved monitoring and mental health tracking curated pathways to signpost consumers to relevant offline support and provide better reporting for insurance clients too. With user input to the fore, it is also a testament to the appropriate way to develop more empathic and social AI with shared value benefits.

Digital trust is one of the most intangible yet acutely valuable assets of our time. Difficult to gain and lost quickly, it is critical to better understand what digital trust really means and the multi-faceted determinants that catalyze its growth and how to sustain and improve it. This new research and the Digital Trust Pyramid is an important step forward to advance dialogue, approaches, tools and techniques, and ultimately shared understanding. Finally, it is also clear that building an effective digital trust strategy requires people and technology in partnership - necessitating understanding of where human trust may be both necessary and complementary.

Dr. Sally Eaves is a highly experienced Chief Technology Officer, Professor in Advanced Technologies and a Global Strategic Advisor on Digital Transformation specialising in the application of emergent technologies, notably AI, FinTech, Blockchain & 5G disciplines, for business transformation and social impact at scale. An international Keynote Speaker and Author, Sally was an inaugural recipient of the Frontier Technology and Social Impact award, presented at the United Nations in 2018 and has been described as the ‘torchbearer for ethical tech’ founding Aspirational Futures to enhance inclusion, diversity and belonging in the technology space and beyond.

Leave your comments

Post comment as a guest