Comments

- No comments found

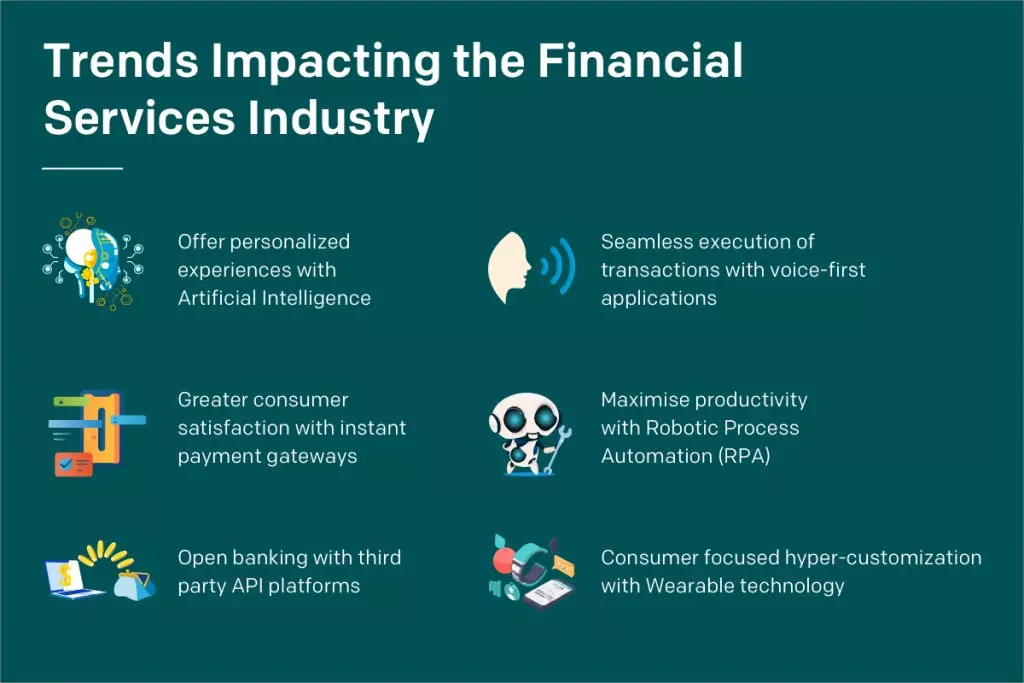

Blockchain, artificial intelligence (AI), and the internet of things (IoT) are set to have a major impact on the banking sector.

Money matters, and therefore does the banking industry too. It is flourishing, focusing on technological advancements. The trends in the banking industry change year after year with better innovations, increasing number of startups, mergers and acquisitions and customer expectations.

The adoption of online-only banks globally increased considerably between 2019 and 2022. As of 2022, over one-quarter of British adults opened an account with a bank that provided only online services. These figures clearly describe the importance that technology has generated in the eyes of banks.

Banks are focused on tailoring their products and services according to the requirements of individuals and, as a result, providing them with highly personalized experiences. This practice helps them to engage and retain customers. They are also trying to enhance their current processes to increase banking productivity and customer satisfaction. Some examples of banks implementing latest technologies are as follows:

It is being used by banks in order to safeguard vital information and even tailoring digital signage. This technology recognizes customers immediately when they try to connect with the bank’s mainframe through a connected device, and retrieves customer information for branch staff and other assisted or self-service services to deliver personalized service.

Artificial Intelligence (AI) enables banks to manage record-level high-speed data to receive valuable insights. AI is the future of banking as it brings the power of advanced data analytics to combat fraudulent transactions and improve compliance. AI algorithm accomplishes anti-money laundering activities in few seconds, which otherwise take hours and days.

It was announced by Barclays to verify users based on their speech patterns. The system stores a recording of the customer’s voiceprint. After an initial recording, the customer will be able to talk to a customer service agent, and during this time their voice is verified against the stored voiceprints. This biometrics solution cuts down the time it takes for customers to verify their identity.

It is one of the most talked about thing in the technology space in recent times. The vast amount of data that is up for grabs is a puzzle that has the capability to unlock major secrets of consumer behavior. It will give the banks an ability to customize their services on one to one basis.

As we know, the key to the success of a banking service lies in its ability to form a relationship with the clients. Transactions are becoming more and more intelligent (capturing data through cards), giving banks an opportunity to grab more data about their clients. The challenge now for banks is to capture relevant information out of this data.

The concept of Zero Trust is to always treat your infrastructure as if it's breached. It assumes that no user, workload, device or network can be inherently trusted. Every access request should be validated on all available data points, including user identity, device, location and other variables.

ATMs have been one of the top IoT devices that make banks far more efficient by allowing real-time transactions, rather than waiting to see a teller at a brick-and-mortar bank. ATMs have been one of the top IoT devices that make banks more efficient.

Blockchain technology, both public and private, can be implemented across a variety of use cases in the financial world, opening up new sectors of banking services that benefit both banks and customers by allowing faster, cheaper, more secure and more inclusive transactions. An example is the emergence of digital asset banks like Protego Trust Bank, providing regulated infrastructure, advanced technology and safeguards that allow clients to securely participate in cryptocurrencies and digital assets.

With the rapid development in technology, businesses all over the world are getting disrupted. Banks realized a long time ago that they need to continuously invest in technology to remain relevant in this age. There are many more innovations taking place in banking technology and the ones mentioned here are just the general trends that most of the banks are employing, in order to have the most effect on banking revenues in the coming decade.

Naveen is the Founder and CEO of Allerin, a software solutions provider that delivers innovative and agile solutions that enable to automate, inspire and impress. He is a seasoned professional with more than 20 years of experience, with extensive experience in customizing open source products for cost optimizations of large scale IT deployment. He is currently working on Internet of Things solutions with Big Data Analytics. Naveen completed his programming qualifications in various Indian institutes.

Leave your comments

Post comment as a guest