Comments

- No comments found

Hedge funds managers are building the type of tech stacks that marketers, CIOs, and CROs have been using for the better part of a decade, in order to take advantage of operational efficiencies and improved analytics, reporting, prediction, and automation.

But how are they choosing the technologies they use, what are they using software for, and what software are they using?

Hedge funds use software for the elements of the business that are repeatable and rules-based. Everything that isn’t a judgment call can be automated to some extent, and the time and attention of finance professionals are at a premium.

Hedge funds use software for two main areas, planning trades and executing them. But they also use software for modeling and general background research.

Hedge funds use software to model markets and to carry out research. In both cases, the typical method is to use consumer-grade or general business software, coupled with proprietary or professional-grade information sources.

For instance, one of the most common tools for basic modeling in Excel. As Morgan Stanley’s John Hwang explains:

Think about it. There are <10,000 tickers in the U.S. And for any given company, there are maybe 500~ indicators & metrics worth looking at.

So if your job is to create a basic revenue model for a specific industry or a basket, you probably won't be dealing with more than 50,000 rows of data.

Not only that, all the data is clean and structured, so you don't need to do complex data munging.

Thus, you take out the needs for 1) big storage and 2) data munging, and you remove the biggest reasons why anyone should feel compelled to program in Python versus Excel.

But the data that populates the cells can come from reports costing hundreds or thousands of dollars. Basic research is carried out using the same web browsers everyone else uses, but the research sources are often paid sites or premium memberships of specialist financial research and news organizations.

In these instances, the software is non-specialized, it’s just being used for access or management of specialized data. But there are cases where specialist software is used.

Analytics software provides traders with insights into the state of the market and the relative strengths and weaknesses of trades being considered.

They’ll analyze price actions, chart patterns, and other statistics to provide better clarity on which to base decision-making. Often, however, these will be separate analytics platforms for different markets or assets.

Execution software is used to actually make trades; it’s usually shortened to EMS (Execution Management Systems), and enables traders to interact with markets through and sometimes offers some real-time information as well as access to exchanges and other sources of liquidity. They also provide the interface for trading algorithms and pre/post-trade analytics.

Hedge funds have lists of clients, potential clients, financials, and other data common to every business. They’ll need CRM, whether ordinary business CRM or an industry-specific solution like Dynamo, invoicing and financial software, and all the other common tools relied on by businesses in the digital age.

For hedge funds, this includes:

Algorithmic trading:

Algorithmic trading is done using proprietary AI algorithms or commercially available robots.

All-in-one solutions:

These usually bundle analysis and trading, rather than trying to be a full-business platform that also allows customer data management, for instance. They’ve bundled software tools for doing everything that a hedge fund does professionally. Good solutions often offer access via API to allow integration with the back-office stack, however.

It’s common for hedge funds to use Prime Services from firms like JP Morgan and Goldman Sachs. For smaller operations, popular options include Charles Schwab’s StreetSmart Edge, whose Screener Plus uses real-time streaming data to let clients filter stocks and ETFs on a range of fundamentals and technical data.

Fidelity has a downloadable trading interface with a deeper feature set than is available through the website. This includes technical signal alerts for stocks you’re following, alerts on open positions, and 30 rolling days of intraday data.

This depends on where in the organization the software is being used. In many cases, a stack is used, integrated across the organization, which means that any new software is selected both on its own functionality and on its ability to integrate with the stack already in use — just as in most other industries now.

What most hedge funds need is the ability to grant secure access to investors, increasing transparency without being shackled to constant reporting requirements, together with access to sources of liquidity, algorithmic trading robots and source codes, and a large number of technical indicators for multivalent analysis on the same platform.

What are the most popular hedge fund management software solutions?

Bipsynch is designed to bring the hedge fund research process together under one roof, with a centralized, easy-to-use RMS, process management, and data integrations. It’s intended to bring greater efficiency to several roles, offering CTOs greater control, decision-making confidence for CCOs, and insights to guide Portfolio Managers.

Available for:

Features:

Pricing:

Custom, by contacting sales. Free trial available.

The bottom line:

The browser-based implementation can be slow, and Bipsynch really only addresses research and analytics; within that, it’s a solid tool for making compliance, note-taking, and preparation easier and more efficient.

FundCount is an accounting and analu=ytics software solution for tracking, analyzing, and reporting the value of complex investments. It’s used by family offices and private equity firms as well as fund admins and hedge funds. It’s an integrated, multi-currency general ledger, combined with a suite of automated workflow and reporting tools.

Available for:

Features:

Pricing:

Annual subscriptions start at $25,000, including customer support, ongoing maintenance releases, and upgrades. However, FundCount has startup pricing options in which they partner with firms and grow with them.

The bottom line:

FundCount supports a broad range of asset types and portfolio measurement methodologies and is usually relatively easy to use, though there is a learning curve if you’re unfamiliar with software in the space.

It also relies for some functionality on data inputs from firms it doesn’t control, meaning pricing information has to be either paid for separately from firms like Thomson Reuters or entered manually. It’s a good choice if the earning potential from efficiency at scale outweighs the hefty price tag.

Oriented toward individual investors rather than large-scale investment businesses, StockMarketEye lets users track and manage investments, follow markets, and access analytics. Accounts can be imported, and there are historical price charts as well as real-time market and portfolio updates.

Available for:

Features:

Pricing:

StockMarketEye is $79.99 per year, with a 30-day free trial available.

The bottom line:

StockMarketEye is a lightweight solution that doesn’t offer everything a hedge fund might need. In particular, it doesn’t offer much in the way of algorithmic trading functionality, with no way to integrate baskets and code with the data provided by StockMarketEye.

For smaller companies, though, there might be enough here, especially if you’re looking for something to add the missing functionality to a stack you’ve already built at a lower price point.

FinLab’s PackHedge is a comprehensive analysis tool for hedge funds, alternative funds, private equity funds, and other investment instruments. It offers research, risk, exposure, and scenario analysis, resource allocation, portfolio construction, shadow accounting for portfolios, and more. It also comes with CRM, compliance, and KYC bundled.

Available for:

Features:

Pricing:

Pricing starts at $4,500 per year. You can request a demo from FinLab’s sales team.

The bottom line:

With its huge functionality, FinLab’s PackHedge has a learning curve; in particular, there’s a lot of customization potential, meaning this isn’t a plug-and-play option but might end up being more efficient after being configured. PackHedge integrates well with basic tools like Excel too.

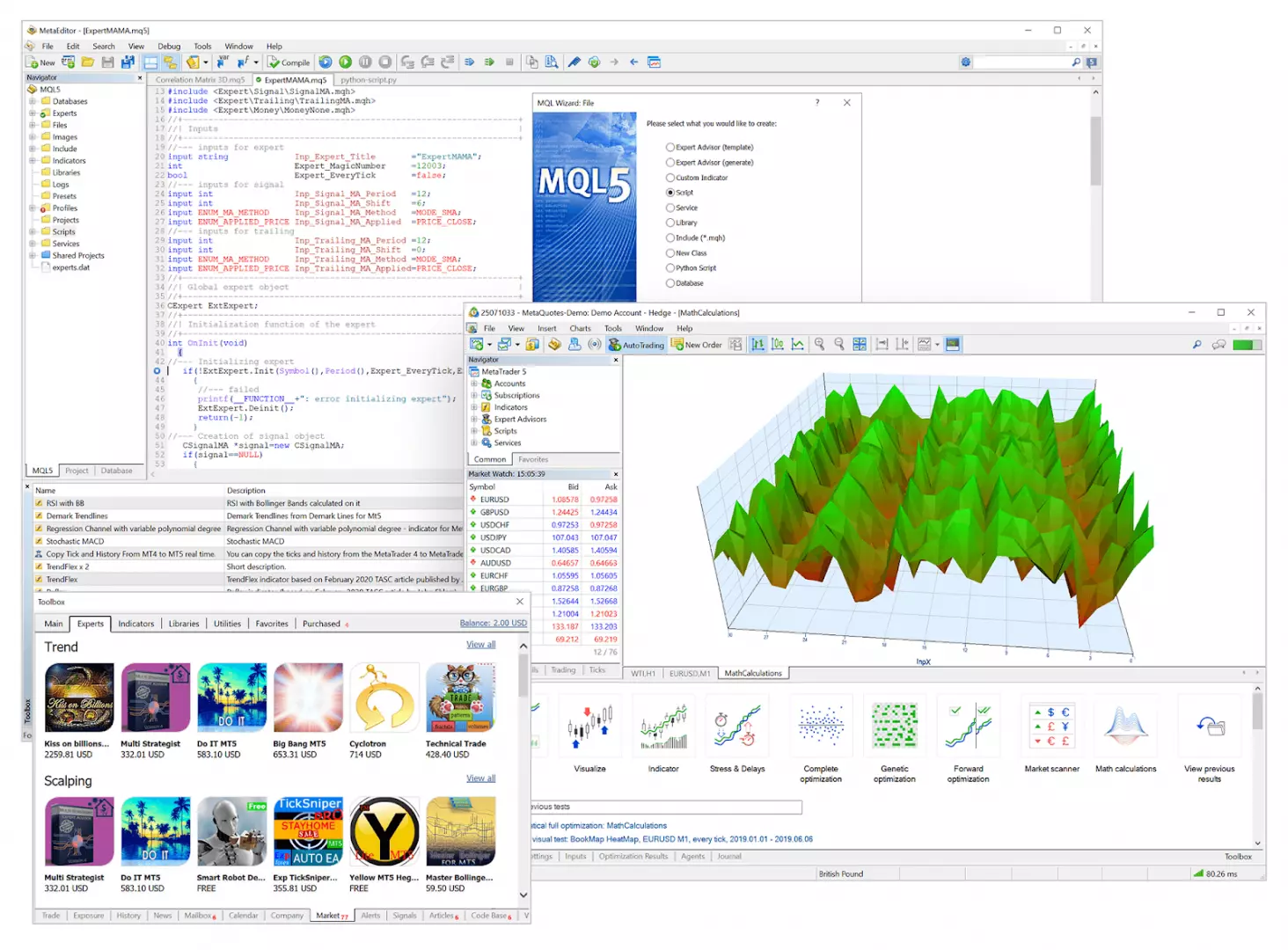

MetaTrader 5 is a customizable, multi-asset infrastructure platform that eliminates the need for standalone analytics. Users can combine different markets, general statistics, and full control over large numbers of funds.

Available for:

Features:

Pricing:

MetaTrader 5 starts at $2,000 per month, with a two-week free trial.

The bottom line:

MetaTrader 5 gives users access to a unique library of algorithmic trading options, as well as automated workflows, reporting, and permission roles. Investors can use it too, creating a unique level of transparency. There’s extensive additional functionality available for MQL5 developers.

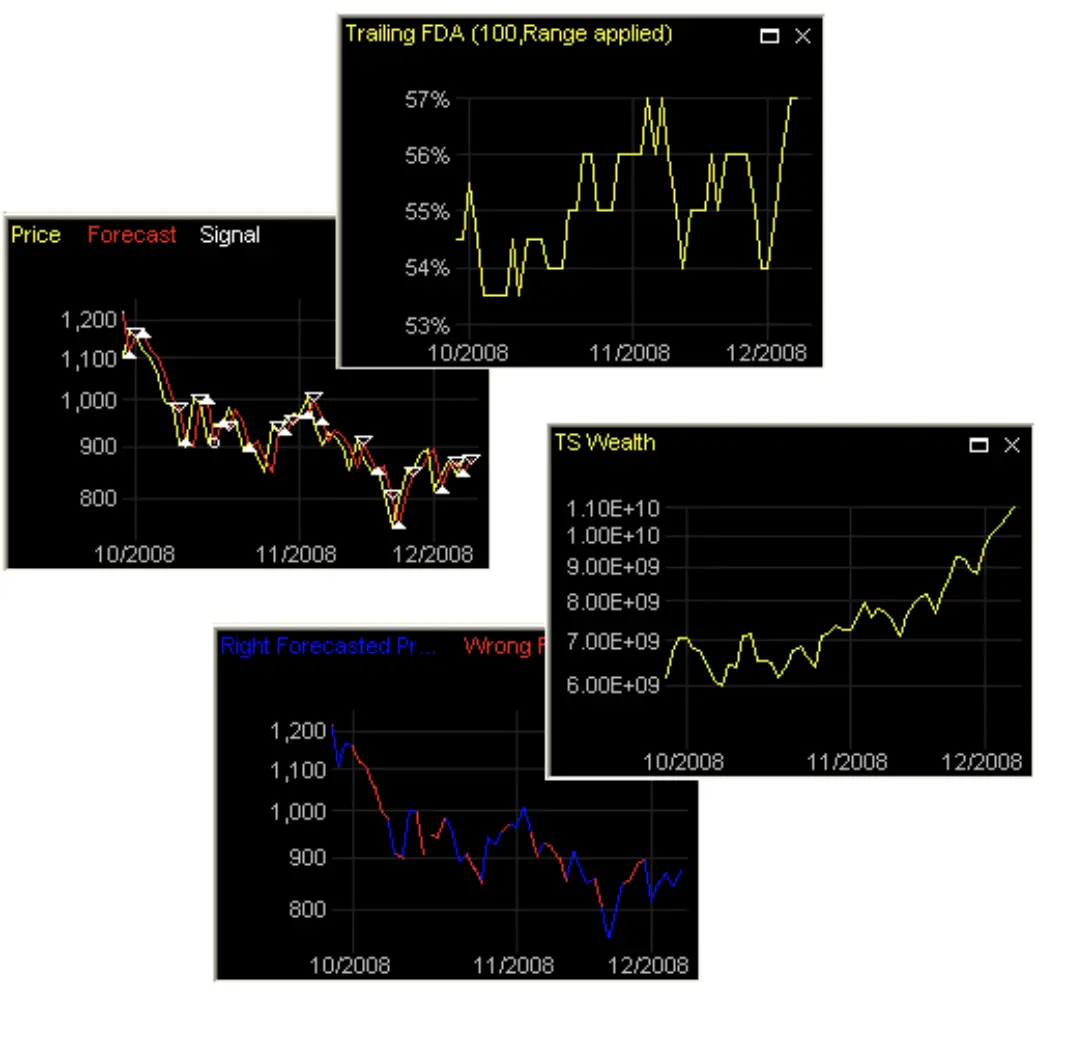

Altreva Adaptive Modeler forecasts stocks, EFTs, Forex currency pairs, commodities, cryptocurrencies, and other markets using market simulations. Users apply virtual trading strategies to real-world market data, letting Altreva aggregate one-step-ahead predictions about real markets out of these virtualizations, and without overfitting to historical data.

Available for:

Features:

Pricing:

Altreva’s Standard Edition is priced at $199 for a 3-year, single-user license including upgrades and support. The Professional Edition is $399 for a 3-year single-user license, also including upgrades and support. Both can be bought and downloaded here.

The bottom line:

Altreva’s Adaptive Modeler allows users to take counterintuitive positions and catch the market as it turns, by giving traders something to consult other than historical data. However, while it earns its place in our list on the strength of its unusual functionality, it also has quite restricted features. If you’re looking for a full-service solution for your fund, this isn’t it.

VestServe integrates front, middle, and back-office operations to cut the total cost of ownership while driving efficiency and performance. It includes portfolio management features like performance measurement, rule-based modeling, breakout allocations, and yield curve analysis.

Available for:

Features:

Pricing:

VestServe pricing starts at $27,500 per year and is features-based. You can book a free demo on their website, but there is no free version or trial.

The bottom line:

VestServe is an enterprise-standard investment management solution, built to fit the needs of investment professionals — which means it’s less innovative than some other tools on this list and more focused on the operational demands of large organizations than on the market analysis or prediction.

Luke Fitzpatrick has been published in Forbes, Yahoo! News and Influencive. He is also a guest lecturer at the University of Sydney, lecturing in Cross-Cultural Management and the Pre-MBA Program. You can connect with him on LinkedIn.

Leave your comments

Post comment as a guest