Comments

- No comments found

T D S... Do these 3 letters send a shiver down your spine? Do you fail to understand why a client paid you less than what he originally promised?

This article will answer all your TDS-related queries and help you understand how to deal with TDS during income tax return filing.

None of us like to receive a payment which is less than what the client initially promised. Yet, many times, while working with Indian clients, you must have received less payment into your bank account.

When asked WHY, the client may have replied, “Hey, I deducted TDS before paying you.”

TDS? Familiar with these 3 letters but still unable to understand why it reduces your income?

Whether you are a freelancer, a solopreneur, an agency owner, or even a salaried employee, you should know how TDS impacts your earnings.

If you have read 100s of articles and never understood how, why and when it is charged, don't worry. This article will answer all your queries.

In this article, you will learn:

Let’s dive deeper into the world of TDS.

When a person earns income, it is his responsibility to pay income tax on such income. However, to avoid tax evasion, the Income Tax Department requires the payer (person making the payment) to deposit tax on behalf of the person who has earned the income (person to whom payment has been made).

The payer has to deduct this tax while making a payment or crediting the other person’s account, whichever is earlier. Since this tax is deducted at the source, it is called Tax Deducted at Source (TDS).

While paying for professional or technical services, the payer (the person making the payment) has to deduct TDS at the rate of 10 per cent under Section 194J.

However, if the payee (person receiving the payment) doesn’t submit his PAN number, the tax rate will be 20 per cent.

Tax tip: Always submit your PAN number as soon as you start working with a client. It will ensure that the client deducts TDS at 10 per cent instead of 20 per cent.

A client will deduct TDS only when he pays you over ₹ 30,000 in an FY. However, this limit applies to aggregate payment as well. Let’s understand it with a help of a few examples -

Example 1

Reliance Industries Ltd paid Shruti ₹₹ 20,000 for her content writing services. It was a one-off assignment.

NO TDS to be charged in this case since the payment amount is less than ₹ 30,000.

Example 2

Reliance Industries also hired Shreyansh for some graphic designing work and paid him ₹ 50,000. In this case, the company will deduct ₹ 5,000 as TDS and pay ₹ 45,000 to Shreyansh.

Example 3

Reliance Industries hired a third freelancer, Gauri, for their landing page development and paid 4 times in the FY 2020–21:

1st Payment — Rs 20,000

2nd Payment — Rs 5,000

3rd Payment — Rs 10,000

4th Payment — Rs 55,000

The company will charge TDS as follows -

1st Payment: No TDS to be deducted because aggregate/ one-time payment is less than Rs 30,000.

2nd Payment: No TDS to be deducted since aggregate/ one-time payment is less than Rs 30,000.

3rd Payment: TDS to be deducted since the company has paid Gauri Rs 35,000 till now. All the previous payment will be added and TDS will be deducted from the entire amount.

TDS amount to be deducted = 10% of 35,000 i.e. Rs 3,500.

4th Payment: TDS to be deducted since both aggregate and one-time payment are more than Rs 30,000.

TDS amount will be 10% of 55,000 = Rs 5,500.

Because of this provision, sometimes the company may deduct more than 10% TDS while paying you. The company adds all the previous payments made in the same financial year and then deducts TDS.

Individuals don't have to deduct TDS if they are not liable for a tax audit. Usually, if you are working with an individual or a proprietorship firm, they won't deduct TDS even while paying you more than ₹ 30,000 during an FY.

A client can show the amount paid to you for any services as an expense only if they have deducted TDS. If they don't deduct TDS, they can't claim it as an expense in their profit and loss statement. As a result, they will have to pay higher income tax.

So, a client will mandatorily deduct TDS if the one-time or total payment in an FY is more than ₹ 30,000.

TDS provisions are applicable only to Indian companies and firms. A foreign client won't deduct TDS before making a payment.

The deductor (person deducting TDS while making the payment) has to deposit the TDS amount with the Government and file TDS returns as well. In the TDS return, the deductor has to mention:

For this purpose, the clients ask you to submit your PAN number during the onboarding process.

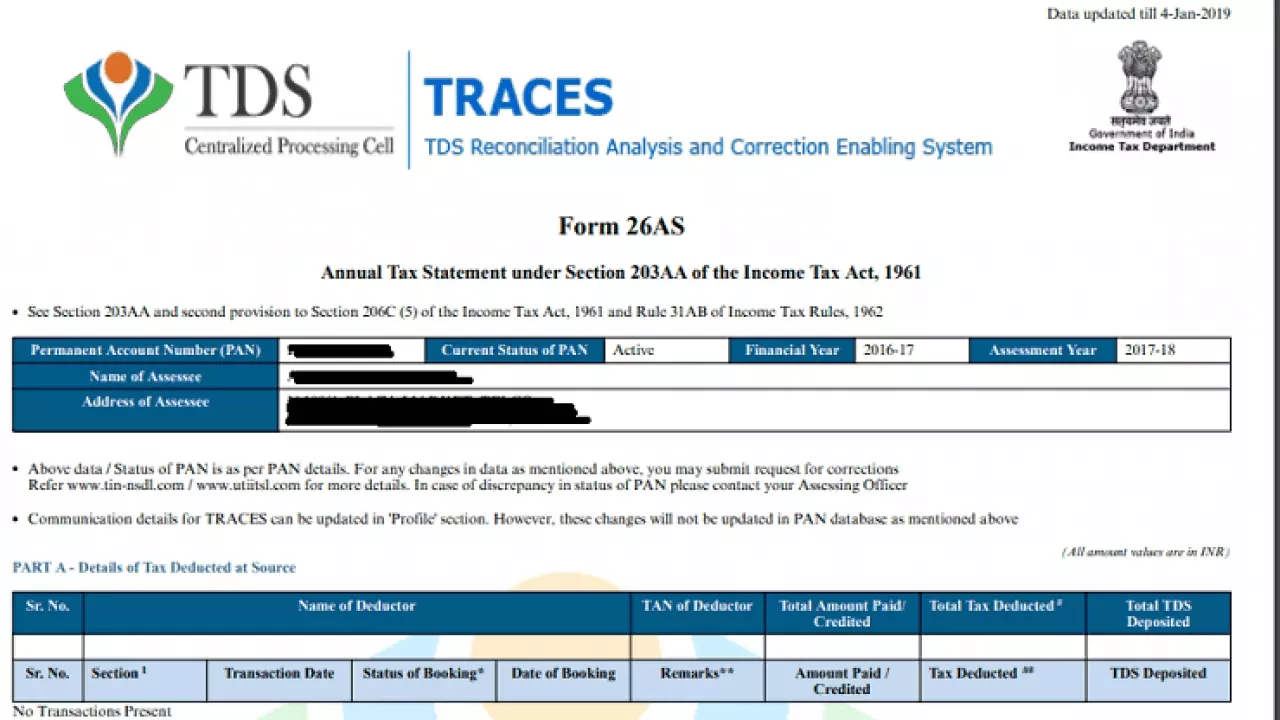

While you can’t cross-verify if the client has filed the TDS return, you can definitely verify and ensure that the TDS amount deducted by the client has been marked against your PAN number.

You can ask your client to send you a TDS certificate (Form-16A). It will contain all the details which have been filled in the TDS return against your PAN number.

Alternatively, you can check the Form 26AS statement as well. It is a tax credit statement that can be downloaded from the Income Tax Website. It shows how much TDS every client has deducted and deposited against your PAN number with the Govt. in an entire Financial year.

Yes, if the client has deducted TDS but your final tax liability (tax on income earned during an FY) is less than the total TDS amount deducted during the year, you can apply for a refund (And the Government will give it happily :p).

But, to get a refund, you have to file your income tax return mandatorily. You can’t claim the refund without filing it.

PS: If your final tax liability is more than the TDS amount, you will have to pay additional income tax while filing your ITR.

No, if your total income for a financial year is above the basic exemption limit (Rs 2,50,000 for FY 2020–21 and 2021–22), you have to file your income tax return compulsorily.

TDS on salary is deducted under section 192, generally, during the last 3 months of an FY. Before deducting TDS, the employer calculates your taxable income (Total salary minus eligible deductions and expenses) and then deduct TDS according to the individual tax slab rate.

Don't get scared of TDS. It's just a method of paying income tax to the Govt. If your final tax liability is less than the total TDS amount deducted and deposited with the Govt, you can easily ask for a refund from the Govt.

Just make sure that you submit your PAN number to the client at the time of onboarding to avoid paying TDS at 20 per cent.

Leave your comments

Post comment as a guest