Insurtech has recently emerged in the insurance space growing by leaps and bounds, helping organizations protect their business and execute transactions remotely during the pandemic era.

Insurance companies are leveraging the benefits of the fintech revolution in insurance to address pain points in providing better, secured, and personalized customer services.

Ever since the insurance sector has come into existence, people are insuring everything from gadgets to their health and lives. The increase in the range of products and services to insure has increased the market size of the insurance industry, which has reached a whopping $4,023.62 billion in 2018. But, the growth of the industry has increased the responsibilities of the insurers to provide better risk management from financial losses. A glimpse into the insurance industry market size gives one an idea of the trust that people have on the industry. To maintain the trust and to provide the best risk management solutions, insurers are implementing the use of technology in their daily practices. There are a lot of insurance companies who have started investing in fintech, and several others are on their way. The fintech revolution in insurance is helping insurers to take a customer-centric approach among many other benefits.

The Fintech Revolution in Insurance During the Pandemic Era

The insurance industry is facing intense competition as other industries have started providing alternative financial solutions to insurance. For instance, banks are proviing loans to aid immediate financial losses, and industries like healthcare are providing medical membership as an alternative to insurance. There is a need for insurance companies to stand out from the competition, and they can achieve it with the help of fintech. Here are some of the services that insurance companies can provide to get an edge over the competition:

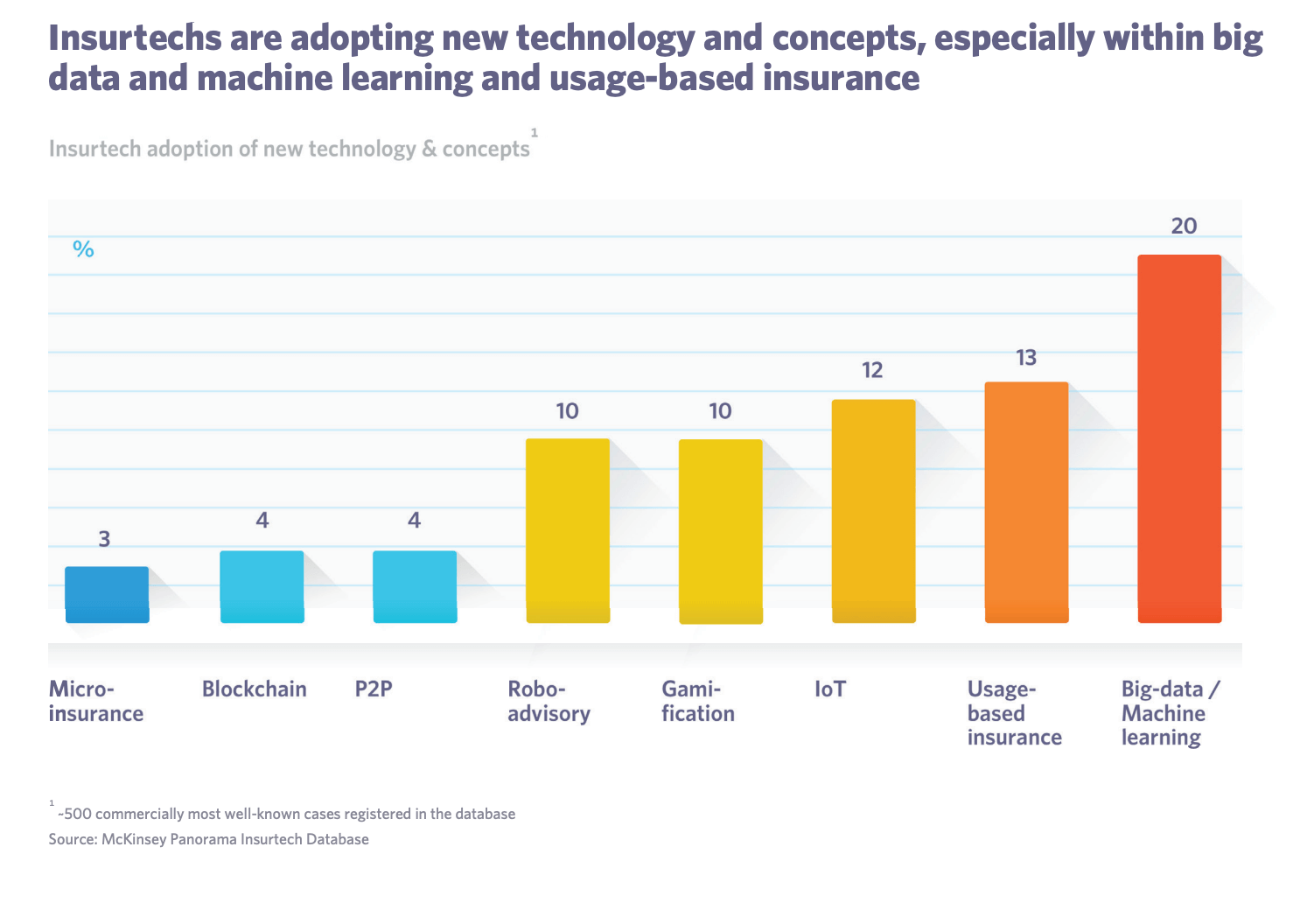

IoT, Big Data & Machine Learning Are Taking Personalized Insurance To Another Level

Source: Mckinsey

With the use of internet of things (IoT) devices, big data and machine learning, insurance companies can collect data that can be helpful to provide personalized insurance packages to customers. For instance, health insurers can make use of patient data to get an insight into the medical condition and behavior of a person. And they can offer personalized premium medical insurance that covers normal or life-threatening medical conditions that the person might suffer based on his or her behavior. Another application of IoT is that vehicle insurers can monitor the driving habits of the insured. Insurers can then provide personalized insurance based on the driving habits of the insured.

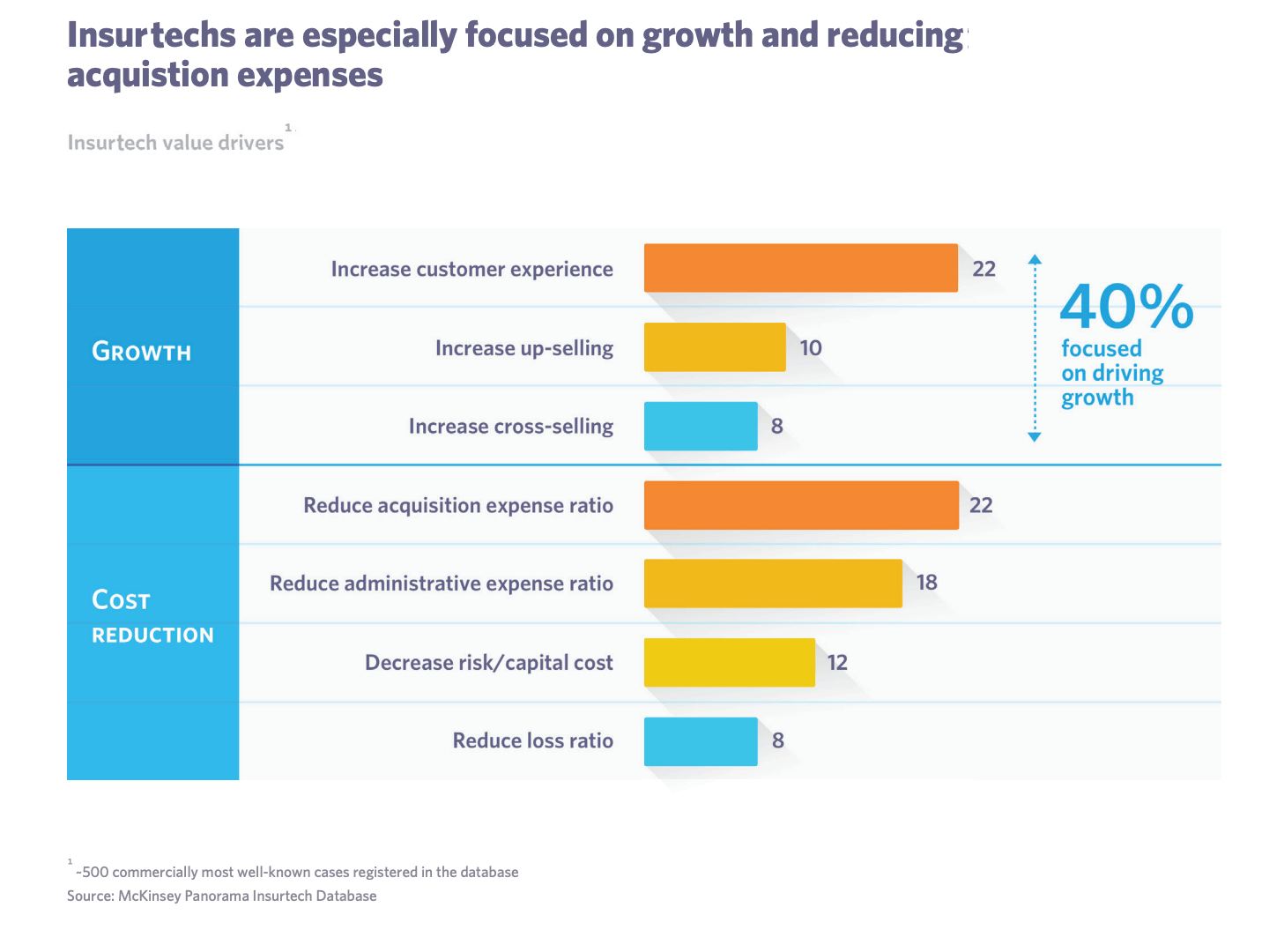

Insurtech is Bringing Improved Security & Less Acquisition Expenses

Source: Mckinsey

Using advanced technologies like blockchain and artificial intelligence (AI) can impact the insurance industry in many different ways. For instance, the use of blockchain’s decentralized ledger will help insurers to keep their customer’s data more secure. The consumers can also use blockchain technology to keep control over their data and only allow the insurers to access it on an as-needed basis. Blockchain technology will also help insurers to detect fraud. Insurers can share transaction data on the blockchain and collaborate to find out any suspicious activities across the industry.

Conclusion

The global fintech market size is expected to reach $190.80 Billion in 2028 and register a CAGR of 8.5% over the forecast period, according to the latest report by Reports and Data. Technological developments and increasing customer expectations are driving innovation in the insurance industry. And, the innovations are being developed with partnerships of the insurance companies and tech firms. It is time for every small and large insurance business to leverage the benefits of fintech and be a part of the upcoming technological revolution.

Leave your comments

Post comment as a guest