1. Certified Public Accountant (CPA)

The Certified Public Accountant credential is the oldest and most well known accounting designation in the profession. You can think of the CPA as the gold standard since everyone knows what it is and it earns great respect. This is due to the designations unique capabilities.

No other certifications have the ability to write audit reports or give opinions on publicly traded company financials. Only CPAs are licensed by state governments to perform these duties. CPAs also sign tax returns as paid preparers and represent clients in front of the IRS.

CPAs can really do it all and the title is considered one of the more general certifications in the field. CPAs can do all of the same tasks and jobs that other certifications can do, but CPAs don’t go as specific as the other certifications.

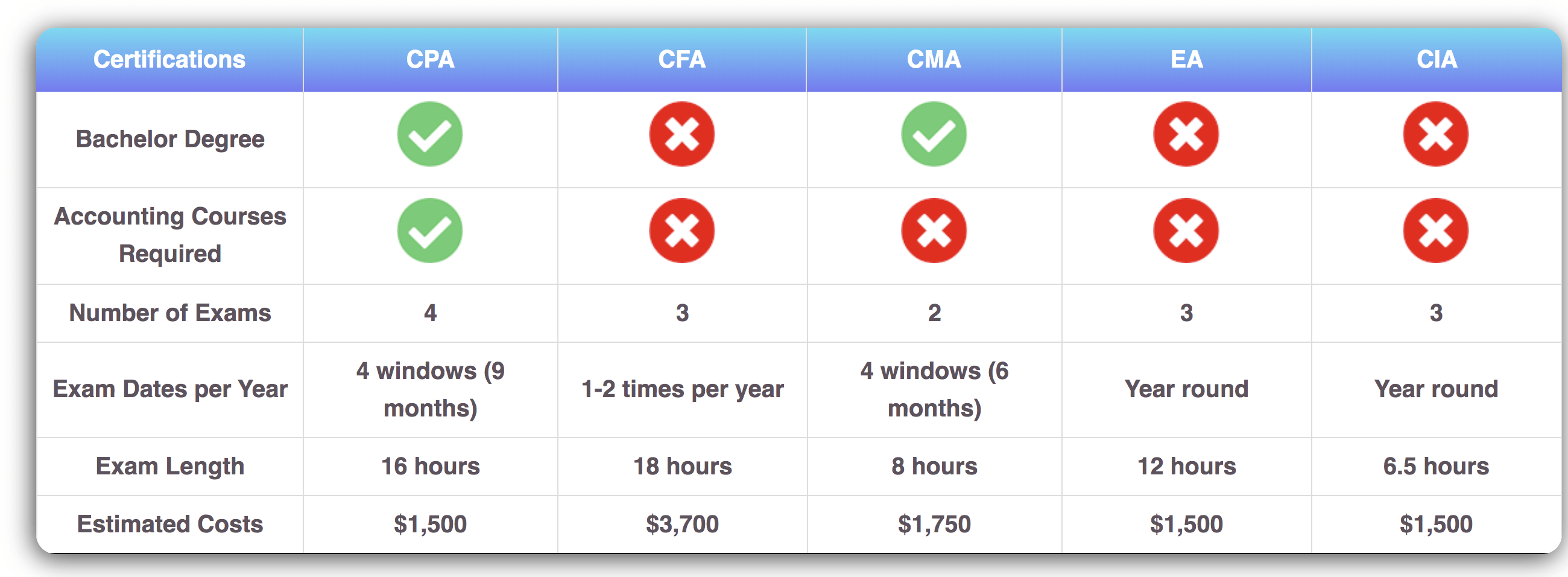

In order to become a CPA, you must take and pass all four parts of the infamous AICPA uniform CPA exam. You will also need to meet the education and work experience requirements of your state. You could get a headstart by reviewing the CPA exam study materials, which can provide the structure and support needed to succeed. For candidates who are feeling stressed about the exam, a review course can be an invaluable resource.

2. Chartered Financial Analyst (CFA)

This designation is intended for those that want a career in the finance and investment world. Most CFAs are finance professionals working on Wall Street or for a hedge fund/investment fund, but the certification has responsibilities beyond company management.

Although the CFA is not as popular as the CPA in the United States, it is one of the most internationally known accounting designations. In Europe and China this designation is much more popular. It helps train people to think analytically about finance, investing, and how businesses operate. This makes CFAs great controllers and CFOs.

To become a CFA, you must pass the CFA exam that is administered by the CFA Institute. The exam process is much longer than the CPA exam because it is only tested one to two times each year depending on the level you are sitting for. The total exam time is also longer and costs more than the CPA exam.

If you are looking to get into the world of finance and investing, this is a good certification for you. If you want to do tax preparation or auditing, you’d be better off with a CPA.

3. Certified Management Accountant (CMA)

Specializing in company accounting management, the CMA designations is a unique title that does not really overlap with the CPA. CMA candidates are great for internal management and executive level roles in companies, like COO or CFO.

Although this certification is not great for public accounting, it is ideal for management. It doesn’t train or certify you to perform audit procedures, write reports, or do any type of tax work. It’s strictly focused on management. For example, if you wanted to become an executive level officer in a Fortune 500 company, the CMA certification would be the one for you to get.

The exam you are required to pass to become a CMA is about half the size of the CPA exam and is administered by the Institute of Management Accountants (IMA). There are also specific and strict requirements to sit for the exam. This includes a bachelor’s degree with proper amounts of educational credits in specific subjects. You will also need to meet the two years of work experience requirement in order to be certified.

4. Enrolled Agent (EA)

Created by the IRS, the enrolled agent certification is used to demonstrate one’s knowledge of the US tax code and the ability to apply its concepts. Since the EA designation is specifically focused on US taxation of all entity types (both individuals and corporations), this designation does not educate you on any finance, auditing, management, or other business topics. It’s strictly a tax certification. If you have this, you know taxes.

If your career goal is in either tax preparation or internal tax work for a company, this would be a good credential to go after. One thing to know is that all public accounting firms will want you to have your CPA over your EA, so if that’s your goal you should start with the CPA.

Enrolled agents do have several responsibilities that CPAs can do as well, such as signing tax returns as paid preparers and representing clients in front of the IRS. This makes the EA designation somewhat useful in public accounting, but most states have additional laws for public firms that restrict ownership and authority to CPAs.

If you want to be a tax professional who doesn’t want to deal with all the education and experience requirements for the CPA exam, the EA designation is meant for you. It allows them to have many of the same rights as CPAs without the certification. To become an EA, you will have to take the enrolled agent exam administered by the IRS. The exam consists of three parts and is 12 hours long.

5. Certified Internal Auditor (CIA)

This designation is strictly for compliance officers and auditors. A CIA typically works for a larger company performing audit procedures and helping independent auditors. On order to gain this certification, you must complete the three sections of the CIA exam totaling 6.5 hours of testing. If you are looking for a career in auditing, the CIA certification is for you.

Which Accounting Certification is the Easiest to Get?

All of these certifications are difficult to obtain, because they all of them have lengthy exams and qualifications that must be met in order to become certified.

The certification with the shortest exam and least amount of requirements is the CIA designation. Keep in mind though, this is also the most limited accounting credential.

Which Accounting Certification is the Hardest to Get?

There is no easy answer to this questions because there is still a great debate over which accounting certification is the most difficult. I think it is tied between the CPA and CFA because both have strict requirements to sit of the exam. Not to mention that both exams are extremely difficult with low average passing rates.

But, since these certifications are known to be difficult to get, they are the most respected and most useful credentials on the list.

Should I Get Two Accounting Certifications?

Many accounting professionals ask themselves this questions, and the answer honestly depends on your career path and your specialization. For example, if you have your CPA license and you want to get into finance and investing more, a CFA designation is a logical choice. You don’t need it, but it will help your career.

I would suggest just getting your CPA license license if you are not looking to specialize in any particular area. This is the most recognized and useful accounting certification.

Should I Get an MBA and an Accounting Certification?

Again, adding an MBA to your credentials depends on your career path and where you want to be in the future. An MBA will help you attain higher management roles in corporate America, but it will also cost you a lot of money. Most states require at least 150 credit hours to obtain your CPA license, so it does make sense get an MBA to fulfill those extra hours. If you are lucky and your employer will help pay for your graduate tuition, you should definitely get your MBA. The CPA-MBA combo is pretty much an unstoppable combination.

Which Certification is Best for Accountants?

You’ve probably figured out the answer to this for yourself, but there isn’t a overall best accounting certification. They are all good for different things and you should go for the certification that is most in line with your career goals.

If you are unsure of your exact career goals within accounting, the CPA credential is by far the most respected and most widely used certification. So if you care going to go for just one, I would recommend getting your CPA license.

Leave your comments

Post comment as a guest