Comments

- No comments found

One of the frustrations of the modern US economy is that it costs money to make payments. Credit cards have fees.

Banks have fees. Electronic payment systems have fees. Paying by cash doesn’t have an explicit fee, but it does have the implicit costs and risks of walking around carrying cash–and a growing number of merchants don’t take cash. One estimate is that US consumers pay 2.3% of GDP just for payment services, and while that is relatively high, payment services are more than 1% of GDP in many countries.

Brazil decided on an alternative approach. The basic idea is that the Brazil Central Bank (BCB) has set up a platform for payment service providers. The central bank sets up the “application programming interfaces,” which essentially means that there is a common technology through which payment services providers can access the system. The central bank owns and operates the platform itself, and all large banks and other payment services providers are required to participate. If two parties are using different service providers, they can still readily make a transaction over the shared platform. From the launch of the system in November 2020, it went from zero to 67% of Brazil’s adult population in its first year. Angelo Duarte, Jon Frost, Leonardo Gambacorta, Priscilla Koo Wilkens and Hyun Song Shin tell the story in “Central banks, the monetary system and public payment infrastructures: lessons from Brazil’s Pix” (Bank of International Settlements, BIS Bulletin #52, March 23, 2022). Here’s a description:

The BCB [Brazil Central Bank] decided in 2018 to launch an instant payment scheme developed, managed, operated and owned by the central bank. Pix was launched in November 2020. The goals are to enhance efficiency and competition, encourage the digitalisation of the payment market, promote financial inclusion and fill gaps in currently available payment instruments. The BCB plays two roles in Pix: it operates the system and it sets the overall rulebook. As a system operator, the BCB fully developed the infrastructure and operates the platform as a public good. As rulebook owner, the BCB sets the rules and technical specifications (eg APIs) in line with its legal mandate for retail payments. This promotes a standardised, competitive, inclusive, safe and open environment, improving the overall payment experience for end-users.

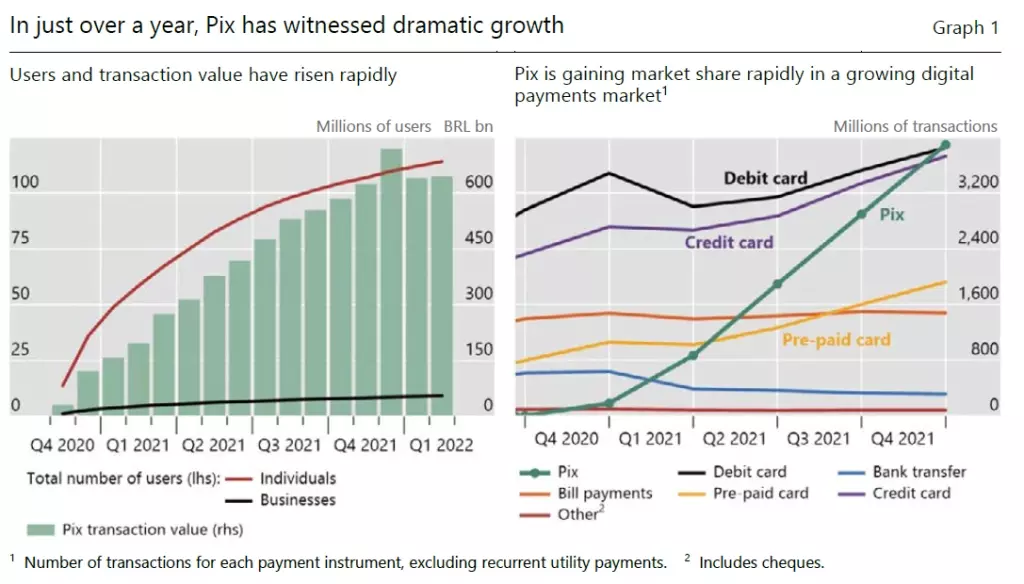

Since its launch, Pix has seen remarkable growth. By end-February 2022 (15 months after launch), 114 million individuals, or 67% of the Brazilian adult population, had either made or received a Pix transaction. Moreover, 9.1 million companies have signed up – fully 60% of firms with a relationship in the national financial system. Over 12.4 billion transactions were settled, for a total value of BRL [Brazilian reais] 6.7 trillion (USD 1.2 trillion) (Graph 1, left-hand panel). Pix transactions have surpassed many instruments previously available – eg pre-paid cards – and have reached the level of credit and debit cards (Graph 1, right-hand side). Pix partly substituted for other digital payment instruments, such as bank transfers. Yet notably, the total level of digital transactions rose substantially. Using accounts from banks and non-bank fintech providers, more individuals entered the digital payment system. Indeed, Pix transfers were made by 50 million individuals (30% of the adult population) who had not made any account-to-account transfers in the 12 months prior to the launch of Pix. Thus, Pix helped to expand the universe of digital payment users.

Credit transfers between individuals have been the main use case for Pix since its launch. Indeed, adoption by individuals is very straightforward. Individuals can obtain a Pix key and quick response (QR) code to initiate transfers to friends and family, or for small daily transactions. In line with its strategic agenda for financial inclusion, the BCB decided to make Pix transfers free of charge for individuals. PSPs pay a low fee (BRL 0.01 per 10 transactions) to the BCB so that the BCB can recover the cost of running the system.

To ensure access and integrity, PSPs must digitally verify the identity of users. With the existing interface and know-your-customer (KYC) processes provided by their bank or non-bank PSP, users can have an “alias” – such as a phone number, email address or other key – which forms the basis of digital identification. The most common such aliases are randomly generated keys (e.g. QR codes), but phone numbers, email addresses and tax IDs are also used … The ease of use for individuals and the multiplicity of use cases may be one reason why actual use has increased quite rapidly …

Brazil’s Pix system is still quite new, and one suspects there will be growing pains: security breaches, fraud, efforts by private actors to use the system to reduce competition, and so on. But the experiment itself may teach lessons about how a country can simultaneously expand access to electronic transactions while dramatically reducing the fees imposed by current payment systems, and thus is deeply interesting.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest