Comments

- No comments found

It’s well-known (although it’s not clear anyone wants to do anything about it) that US budget deficits and government debt took a big jump during the Great Recession from 2007-9, then another big jump during the pandemic recession, and are projected to rise steadily in the middle-term as an aging US population leads to higher government spending on Medicare, Medicaid, and Social Security. But it’s not just the United States. Especially after the pandemic, government debts around the world are high. The question is, based on past experience, what steps have some plausibility for reducing these debts.

The International Monetary Fund takes up this question in Chapter 3 of the World Economic Outlook report that came out in April 2023, titled “Coming Down to Earth: How to Tackle Soaring Public Debt.” At the most recent annual conference held by the Kansas City Fed at Jackson Hole, Serkan Arslanalp and Barry Eichengreen take up the same subject in “Living with High Public Debt.” These reports mostly agree on the problem, but differ on what solutions are plausible, with the IMF report offering mildly greater optimism.

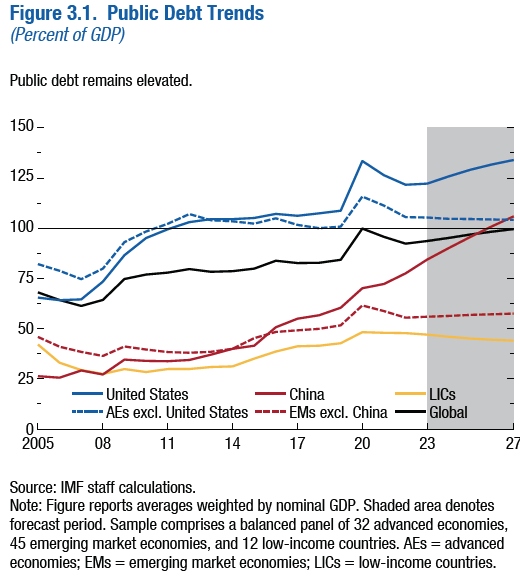

Here’s a figure from the IMF report on trends in public debt as a share of GDP. The black line shows rising global debt; the blue line shows the US; and the red line shows China. Of course, the relatively moderate rise in overall averages shown in the figure represents an average of countries where debt is reasonably under control and countries where it is not.

One can dig down into exactly how public debt is being measured, or shifts in what parties are holding public debt, and those interested in doing so can plow into these reports. Here, I want to focus on the statements about how debt/GDP burdens might be reduced in theory, and the evidence about what has worked in practice.

The first and most obvious approach to reducing public debt, of course, is to stop running budget deficits and start running surpluses. But as Arslanalp and Eichengreen write:

The conventional way of bringing down high public-debt ratios … is by running primary budget surpluses. … There are instances in history where governments have succeeded in doing just this. But while the logic is impeccable in an accounting sense, it may be problematic in a political sense, in that the political conditions allowing heavily-indebted governments to run primary budget surpluses for extended periods are not present today.

They refer to some classic examples in which governments reduced debt by running sustained budget surpluses for long periods of time, but these examples have a 19th century feel, like the US after the Civil War and the UK after the French and Napoleonic Wars. In more recent episodes, as the IMF notes: “[P]artly because fiscal consolidation tends to slow GDP growth, the average fiscal consolidation

has a negligible effect on debt ratios.”

The IMF also digs down into the situations in which this approach has worked. They argue that running long-run budget surpluses does tend to bring down debt burdens in the historical evidence of recent decades when: 1) it happens in a context where the economy is growing steadily; 2) public debt has been “crowding out” private investment, so the reduction in public debt leads to a rise in public investment; and 3) the debt reduction is driven more by spending cuts than by tax increases. Conversely, when a country tries to reduce its budget deficits in a setting of slow growth or recession, at a time when the lower government borrowing doesn’t lead to a rise in private investment, and by raising taxes rather than cutting spending, it is often unsuccessful in reducing the debt/GDP ratio.

For a useful overview of the evidence that a permanent reduction in the expected future path of government spending is more likely to reduce public debt, with fewer tradeoffs, than raising taxes, I recommend the discussion by Alberto Alesina, Carlo Favero, and Francesco Giavazzi in the Spring 2019 issue of the Journal of Economic Perspectives (where I work as Managing Editor), “Effects of Austerity: Expenditure- and Tax-Based Approaches.”

A second approach to reducing government debt is to have higher inflation, which eats away at the value of past debt. In the short-term, a burst of unexpected inflation can have a one-time effect like this. But in the longer-term, persistent inflation leads to correspondingly higher interest rates. Arslanalp and Eichengreen write:

inflation is not a sustainable route to reducing high public debts. Only unanticipated inflation has this effect. Although an anticipated increase in inflation may reduce debt ratios in the short run by raising the denominator of the debt-to-GDP ratio, in the long run it is apt to raise interest rates and shorten maturities. At both horizons, these effects are unlikely to be economically important.

The IMF adds: ” Although high inflation can reduce debt ratios, the chapter’s findings do not suggest that it is a desirable policy tool. High inflation can lead to losses on the balance sheets of sovereign debt holders such as banks and other financial institutions and, more crucially, damage the credibility of institutions such as central banks.”

A third approach to reducing public debt relies on the gap between the interest rates on public debt and the growth rate of the economy. Remember that the goal here is to reduce the ratio of debt/GDP over time. If interest rates are low, that will help to reduce the rise of the debt, and if combined with steady growth in GDP, then the ratio of debt/GDP would decline. Without going into great detail here, we are living in a time when interest rates are rising and policies for how to raise economic growth in a near-term, sustained, and sustainable way are thin on the ground.

A fourth approach to reducing public debt goes under the general heading of “financial repression.” Basically, these are policies in which governments pass regulations or laws that require certain parties like banks or pension funds to hold public debt, or that seek to limit or cap higher interest rates. These steps also often require limits on investments moving across borders. Historically, such steps have been able to assure that governments are able to keep issuing public debt while paying relatively low interest rates. But widespread efforts along these lines seem unlikely. As Arslanalp and Eichengreen write: “[S]tatutory ceilings on interest rates and related measures of financial repression are less feasible than in the past. Investors opposed to the widespread application of repressive policies are a more powerful lobby. Financial liberalization, internal and external, is an economic fact of life. The genie is out of the bottle.”

A final approach to reducing debt is what the IMF calls a “debt restructuring,” but which many of us would just call a partial default. This step can reduce debt, but it’s a last-ditch step for desperate and relatively small economies, not a useful strategy for major advanced economies.

So where does that leave us? Arslanalp and Eichengreen write: “Our thesis in this paper is that high public debts are not going to decline significantly for the foreseeable future. Countries are going to have to live with this new reality as a semipermanent state. These are not normative statements of what is desirable; they are positive statements of what is likely.”

The IMF is not as blunt, but the report notes: “Ultimately, reducing debt ratios in a durable manner depends on strong institutional frameworks, which prevent `below the line’ operations that undermine debt reduction efforts and ensure that countries indeed build buffers and reduce debt during good times.”

In other words, whether the ratio of public debt to GDP has doubled in the last 18 years or so, as it has for the US economy in the figure above, or quadrupled, as it has for China in the figure above, there isn’t an easy fix. Taking on high levels of debt is easy; reducing debt is hard. If you don’t seize the opportunity in good economic times to make a serious effort to reduce debts, then it’s even harder to do so in lukewarm or bad economic times. It would help the long-term debt picture if the US political system could get serious both about finding ways to hold down the projected rise in expenses on the big-ticket programs like Medicare, Medicaid, and Social Security, as well to focus on the many small things that don’t matter all that much individually, but do add up (for suggestions, see this GAO report on reducing duplication and overlap in government programs, or this discussion of underutilized government office space). More broadly, my sense is that too many public actors have fallen into the bad habit of thinking that federal spending is free.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest