Comments

- No comments found

The issue of budget deficits and their impact on the economy is a topic of ongoing debate among economists and policymakers.

The standard economic advice about big budget deficits is that they can make sense when an economy is experiencing a recession and high unemployment rates, to jump-start the economy. However, when an economy is not in recession and unemployment rates are low, then big budget deficits tend to fuel inflation in the present and an unpleasant burden of payments in the future. The Congressional Budget Office regularly publishes updates on the US budget situation. Here are some graphics from its May 2023 report (“An Update to the Budget Outlook: 2023 to 2033”).

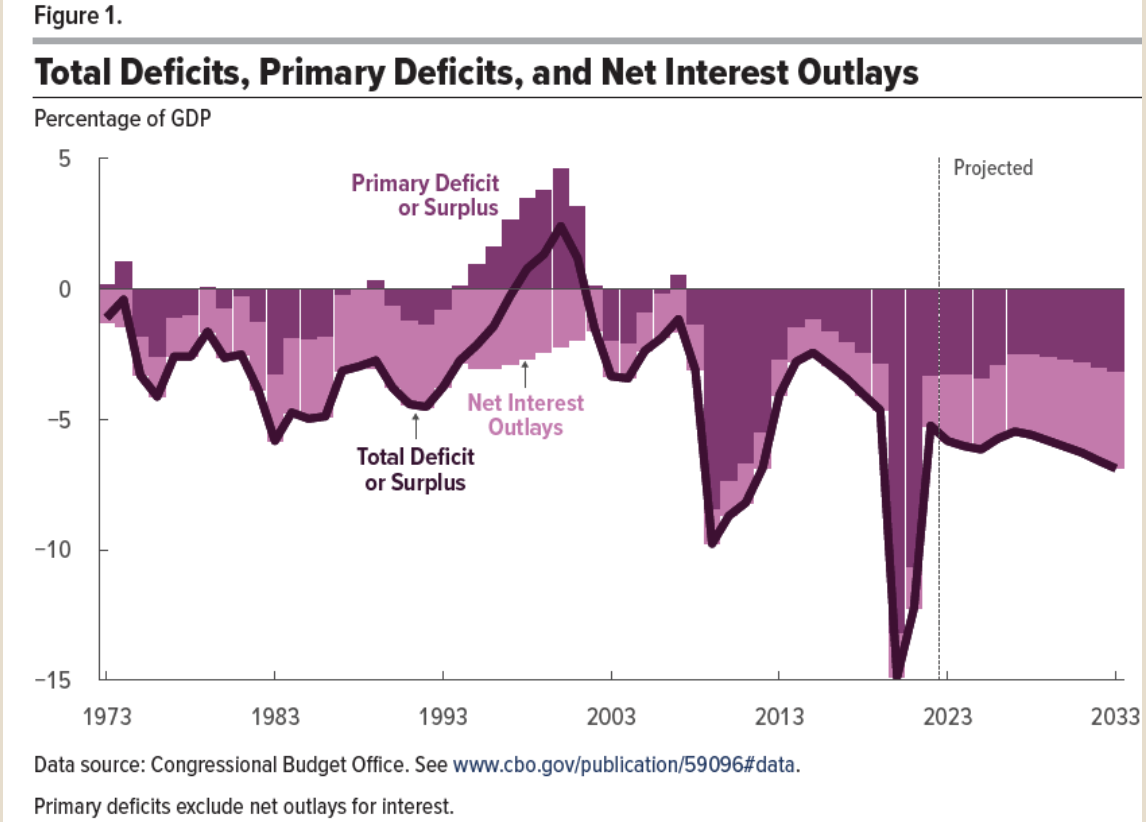

Here’s the pattern of budget deficits in the last 50 years. The black line shows the deficit. It’s notable that the deficits accompanying the Great Recession from 2008-2009 were by far the largest over this period, until being outstripped by the deficits accompanying the COVID pandemic. In the graph, the light purple areas show net interest outlays of the government: thus, you can see that interest payments were quite high (as a share of GDP) in the 1980s and 1990s, much lower in the early 2000s, but are now projected to rise again in the next few years. The dark purple area is the “primary” budget deficit, which is based on spending and taxes after stripping out the interest payments on past borrowing.

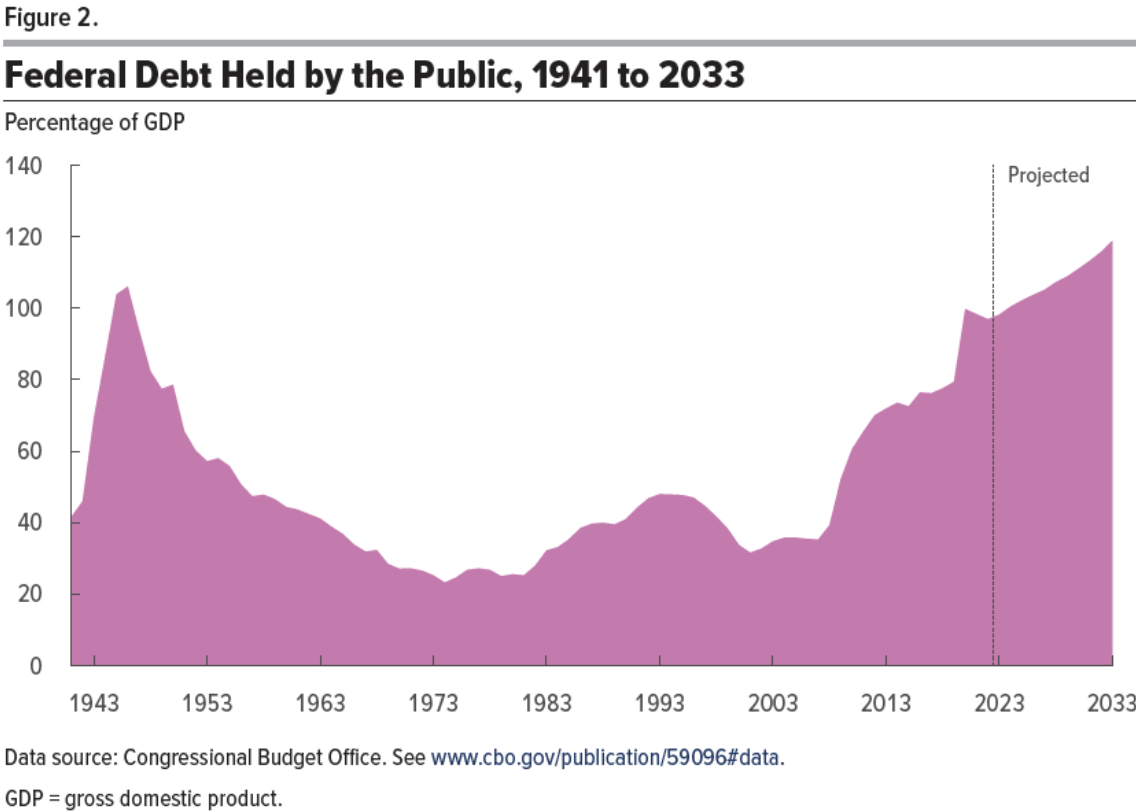

This pattern of much substantially higher annual budget deficits will drive up the total federal debt. As the figure shows, the federal debt/GDP ratio is on its way to rising past the heights only previously scaled by the debt financing to fight World War II. But unlike the end of World War II, there is no dramatic fall in federal debt on the horizon.

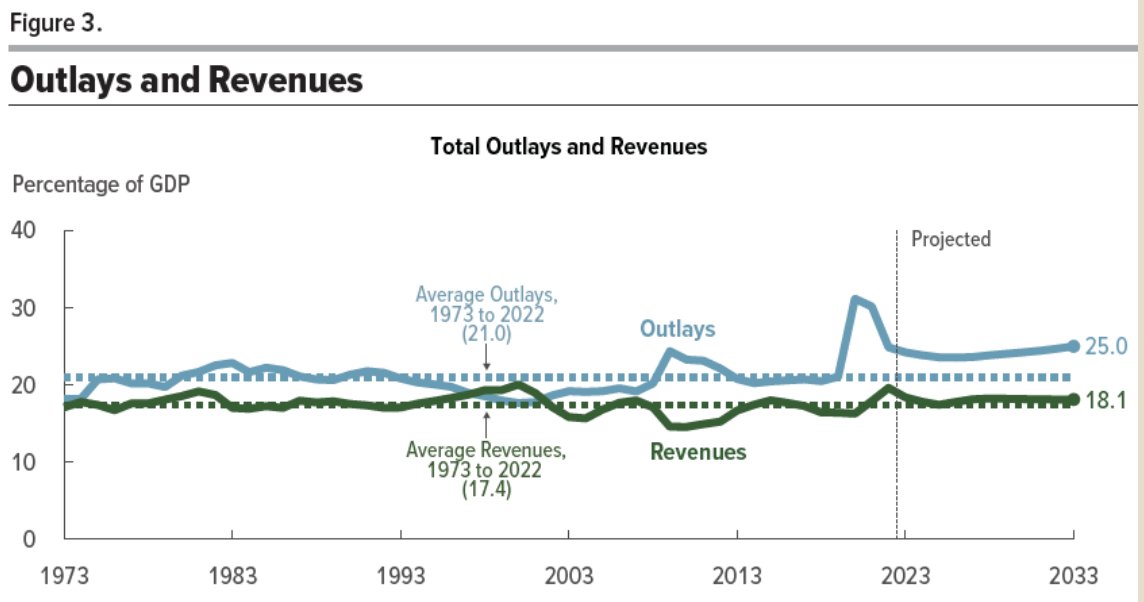

An obvious question is the extent to which these deficits reflect either higher spending or lower taxes. As the figure shows, federal taxes are slightly above their 50-year average, while federal spending–after spiking in response to the pandemic–is projected to remain substantially above its 50-year average.

I’d emphasize two lessons here:

1) The federal government spending reaction to the COVID pandemic turned out to be excessive. It’s hard to put one’s mind back in the mindset of March 2020. The sense was that something needed to be one, and it was nearly impossible (and heartless) to do too little. Some economists were re-fighting battles of 2008, when they felt that fiscal stimulus was too low, and were determined not to make that mistake again. But as it turned out, the actual recession as a result of the pandemic was only two months long. In comparison, the recession from December 2007 to June 2009 was 18 months long. The result was three major stimulus programs: expanded unemployment insurance, direct household payments, and the “Paycheck Protection Program” aimed at supporting businesses. The emphasis in spring 2020 was on getting money out the door quickly, not on targeting the aid to those in need. Thus, it’s perhaps not a shock that the Associated Press is now reporting that $400 billion or more was stolen, wasted, or misspent. Adding these funds to the US economy, especially at a time when the ability of the economy to supply goods and services was still constrained by the pandemic, played a big role in setting off the inflation that started in 2021. It would be nice to think that lessons have been learned about how to react more effectively in the future.

2) The higher spending in the pandemic seems to have reset US federal spending to a higher level. Of course, the historical averages for federal spending and taxes shown above are not a natural law, like the boiling point of water. One can certainly make a case that as America’s elderly population rises, spending on programs like Social Security and Medicare will necessarily rise as well–and it may not be good policy to try to trim other federal spending in response to an aging US population. But that said, substantially higher spending and much-the-same level of taxes is not a recommended formula for a time when there isn’t a recession, unemployment rates are low, and inflation is above desired levels. This isn’t just a US pattern. It’s why publications like the Economist magazine are running headlines like: “Fiscal policy in the rich world is mind-bogglingly reckless: High inflation and low unemployment require tighter budgets not looser ones” (June 14, 2023). But the constituency for lower budget deficits is always a small one, until the harms become undeniably large.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest