Comments

- No comments found

Economic statistics are all useful, and all imperfect. They must be consumed with care.

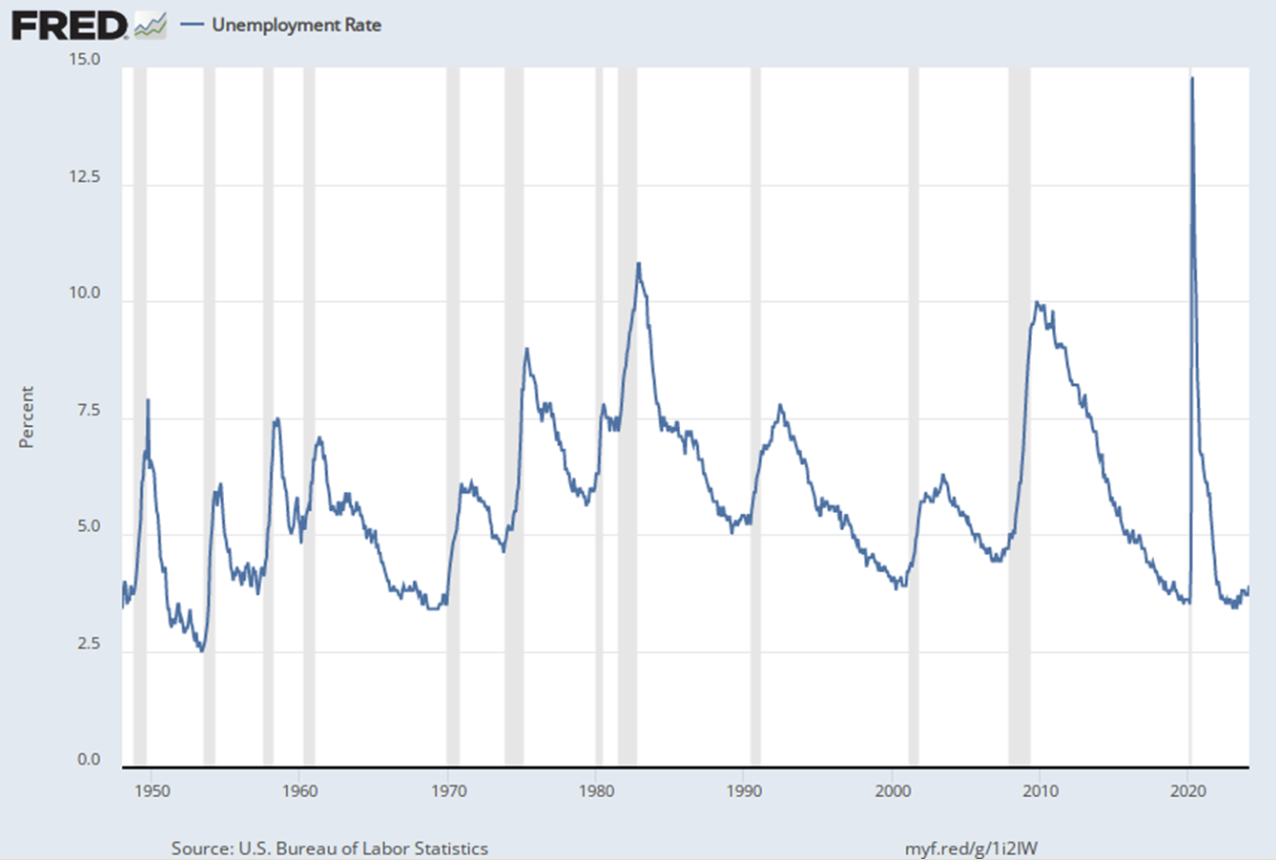

Consider the unemployment rate, a headline indicator of the US labor market. The US unemployment rate has been below 4% since December 2021. As you can see from the graph, which shows the unemployment rate going back to 1948, there was a sustained period back in the early 1950s, and then another in the late 1960s, when the unemployment rate was this low for this long. But for the half-century from 1970 up through 2020, the US economy could only dream of an unemployment rate below 4% for 15 consecutive months.

Does it make sense to interpret this unemployment rate as a sign of a historically wonderful US labor market? Or does it make more sense to think about whether, for one reason or another, the unemployment rate at present isn’t capturing the essence of what’s happening in the US labor market?

In January 2024, the Hutchins Center on Fiscal and Monetary Policy at Brookings brought together 40 labor market economists talk about this issue and others. Louise Sheiner, David Wessel, Elijah Asdourian wrote an overview paper describing the discussion in “The U.S. Labor Market Post-Covid: What’s Changed, and What Hasn’t?” The first question they tackle is “What is the best measure of labor market slack?”

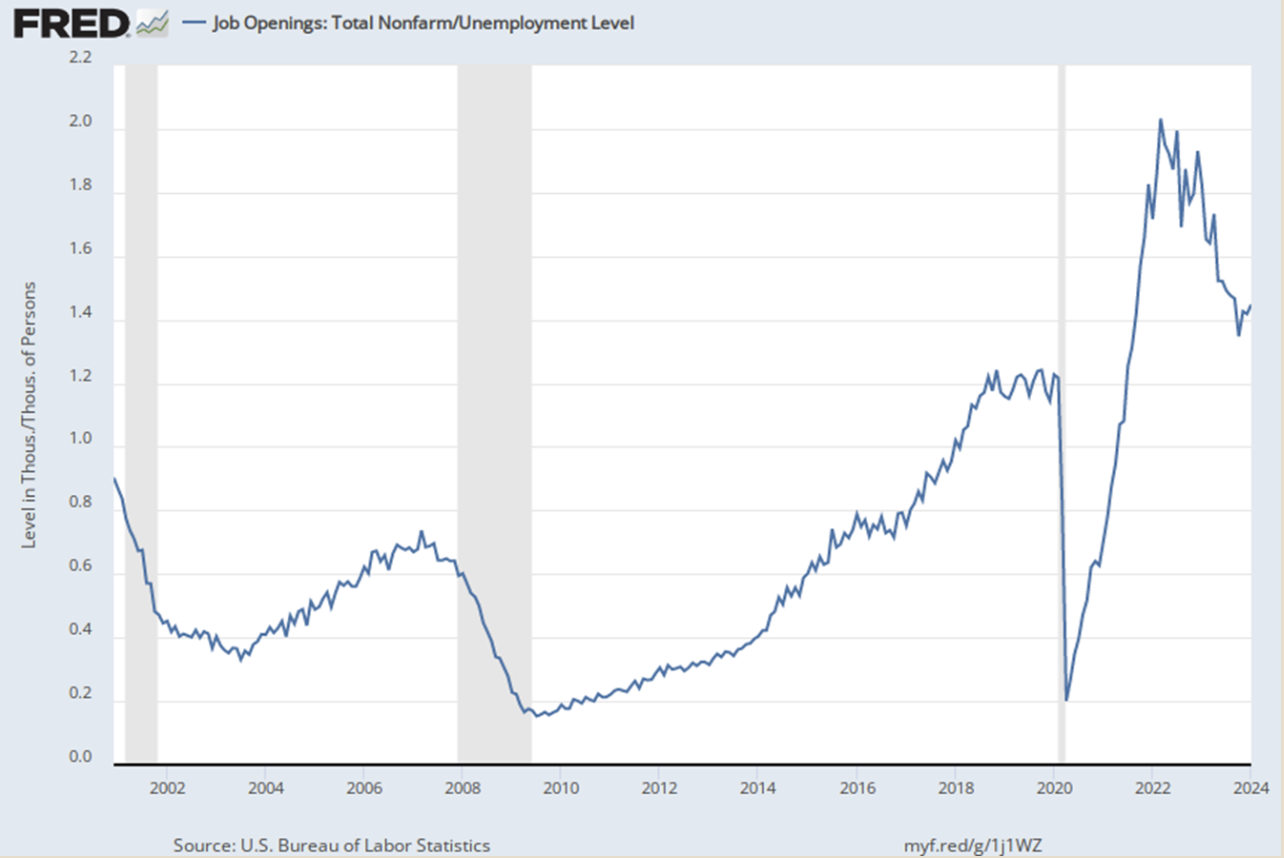

As Sheiner, Wessel and Asdourian write: “Many economists are no longer confident about the adequacy of the unemployment rate as the only important measure. Although unemployment in 2023 was at about the same level as it was in 2019, other measures of slack suggested that the labor market was much tighter.” Specifically, one of these “other measures” is the number of job vacancies (also called the number of job openings) divided by the number of unemployed–sometimes abbreviated at V/U.

As you can see, at the worst of the Great Recession back in 2009, as well as in the pandemic recession, there were about 0.2 job vacancies for each unemployed person. Just before the pandemic recession, there were about 1.2 job vacancies for every unemployed person. Just after the pandemic recession, the number of job vacancies per person spiked as high as 2.0, before dropping back to 1.4.

This figure helps explain why a sub-4% unemployment rate before the pandemic isn’t the same as a sub-4% unemployment rate after the pandemic–that is, there are notably more job vacancies per unemployed person after the pandemic. The spike in the V/U ratio in early March may also help to explain why inflation started rising at about that time, just as the drop in V/U may help to explain the easing of inflationary pressures in the last year or so.

But there are also doubts about just what is being captured by the “job vacancy” measure. This is based on data about job openings posted by employers. But in the age of the internet job search, as it has become cheaper for firms to post job openings, perhaps firms have become more likely to post openings. The pandemic-related shifts in employment, especially for firms now willing to hire remote workers, may have changed the underlying meaning of “job vacancy” statistics as well. The total job openings seems to be trending up.

The discussion of labor economists made similar points:

Other participants argued against relying on V/U, largely because of skepticism about the reliability of the vacancy measure. Julia Coronado of MacroPolicy Perspectives and others pointed out that the recent rise in V/U is hard to separate from the upward trend in vacancies that began around 2008. Erica Groshen, former commissioner of the Bureau of Labor Statistics, said that vacancies are increasing across the board because digital technology makes vacancies much easier to post. “When I applied to colleges, my high school told us, ‘You can apply to five colleges,’” she remarked. “…My kids were told 12 colleges, because it was electronic, and I think the next generation is being told something like 20.” Without accounting for the long-term increase in vacancies, V/U’s detractors argued that the data as is could not inform the ongoing conversation about labor market tightness.

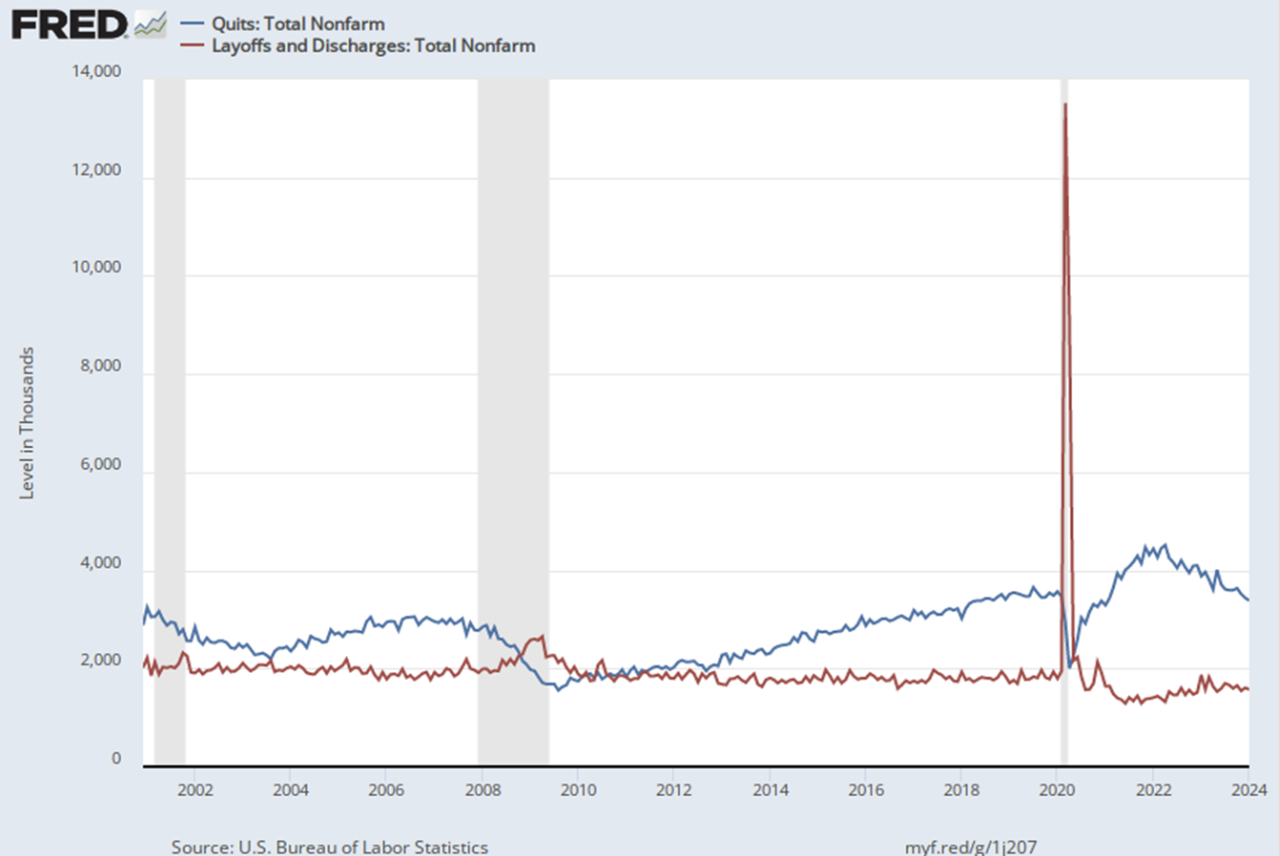

Yet another way to look at the labor market is based on how people leave their jobs. Basically, there are two broad reasons for leaving a job: a voluntary separation called a “quit” (blue line) or an involuntary separation called a “layoff/discharge” (red line). As the figure shows, layoffs rise during recessions, and spiked in the pandemic. However, the number of quits was rising before the pandemic, and after the pandemic spiked to new highs. This is sometimes called the “Great Resignation”–that is, people choosing to quit jobs.

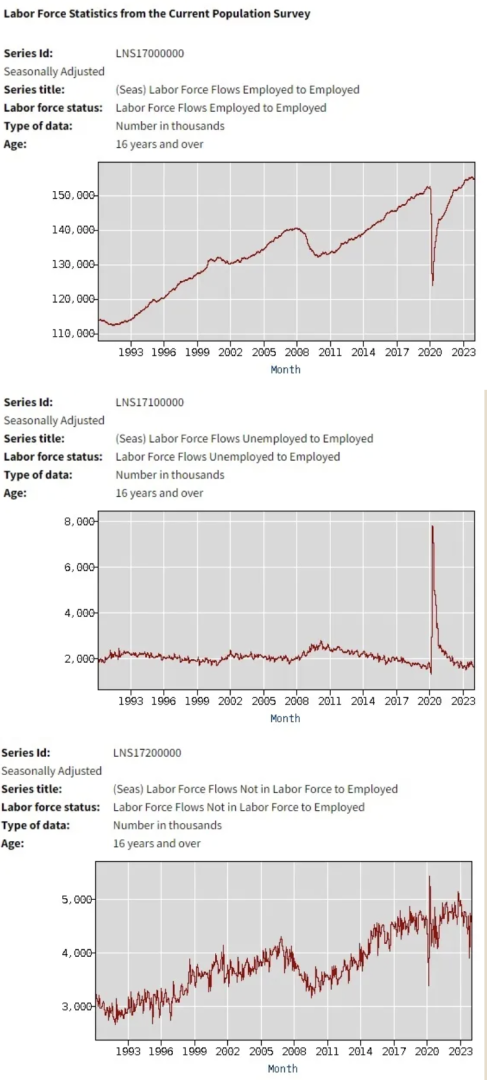

The higher number of quits suggests another pattern for the modern US labor market. Many of us are used to a mental model where workers move to being unemployed, and then back to being employed. But what about people who quit for a new job, and thus don’t go through a spell of unemployment? Or people who leave the labor market for a time and then re-enter, but are not counted as “unemployed” in the meantime? Statistics from the Current Population Survey let you look at flows into jobs, and the statistics suggest: 1) the number of people who move from being employed at one place to employed somewhere else is on the rise (top figure); 2) the number moving from unemployed to employed is about the same (second figure); and 3) the number moving from out-of-the-labor-force to employed has risen a bit.

Some of these patterns blend together. The US economy seems to be exhibiting more people who already have jobs shifting to jobs with other employers. Faced with that situation, a rational response for employers is to post more job openings. In some cases, the firm may not feel it is necessary to hire in the near-term, but they want to have an available pool of applicants if they lose workers, and if the right candidate comes along, they are willing to hire.

Taken together, these statistics suggest that the US economy is indeed performing well in terms of availability of jobs. But it also suggests that a lot of workers are looking for something different, or better, or higher-paying in a way that will help to offset the accumulated inflation of the last few years and the higher interest rates that they are facing for consumer and home loans.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest