Comments

- No comments found

A Japanese firm has recently announced that it was buying U.S. Steel for $14.9 billion.

The news was unsettling to politicians of both parties, who have often argued over the years that steel is a vital domestic industry, along with being an important source of jobs.

For me, the real shock was the announced purchase price of $14.9 billion. When US Steel was formed back in 1901 by merging together a number of smaller competitors, it was the largest firm in the world. By 1960, it was still in the top 10 US firms in the Fortune 500 listings. By 1991, US Steel was no longer included in the 30 large firms that make up the Dow Jones Industrial Index. In 2014, US Steel fell out of Standard & Poor’s index of the top 500 US firms. Indeed, US Steel is no longer even the largest US steel firm–that would be Nucor. US Steel now makes about 12% of American steel.

The purchase of US Steel would not be the biggest deal of 2023. For example, Kroger’s bought Albertson’s last year, in a merger of grocery store chains, for $24.6 billion. The biotech firm Amgen paid $26 billion for Horizon Therapeutics. Prologis, a firm that owns and manages industrial space, paid $23 billion for Duke Realty. Broadcom, which designs and makes a range of software infrastructure and semiconductor products, bought VMWare, which makes software that allows you to “run any app on any cloud on any device” for $61 billion–call it four times the value of US Steel.

Indeed, there are now several US professional sports teams valued at $7 billion or more, including the (football) Dallas Cowboys, the (baseball) New York Yankees, and the (basketball) Golden State Warriors. Once-mighty US Steel is now worth about two professional sports franchises.

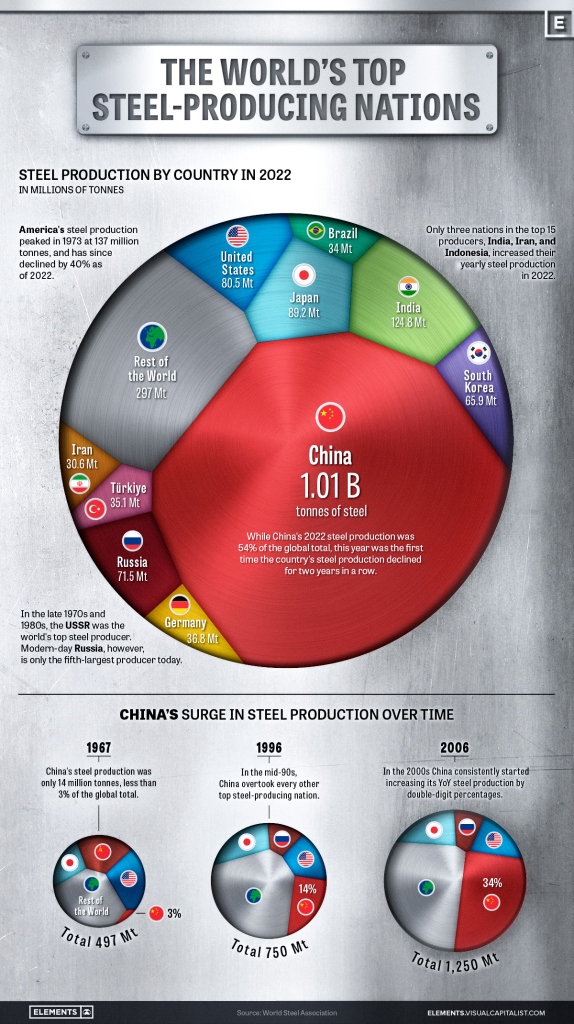

The diminishing importance of US Steels is part of an overall shift of the global steel industry. For a sense of the global steel market, and the place of US steel-makers in that market, consider this figure by Nicolo Conte at the Elements website. On the bottom left of the figure, you can see that back in 1967, China had 3% of the global steel market, but now it has 57%. Japan and the US together make less than one-fifth as much steel as China–and both the US and Japan lag behind India as a steel producer.

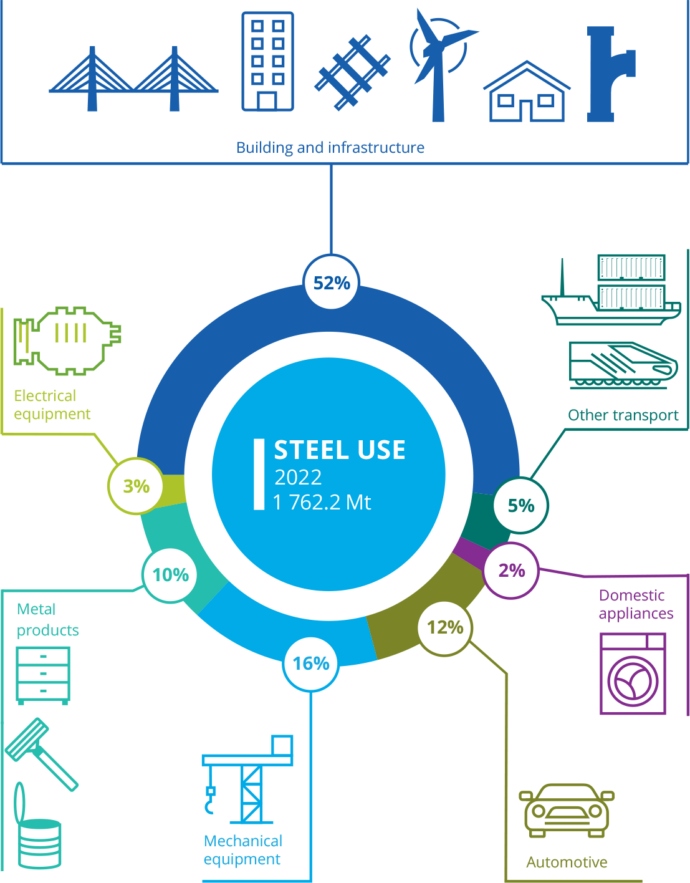

One part of the rise of steel production in China and India is the dramatic expansion of their economies. The World Steel Association reports the main uses of steel from a global perspective in this way:

Of course, the production of buildings, transportation equipment, and machinery in China has skyrocketed in the last 40 years or so. Thus, the local market for steel producers in China has skyrocketed, too.

But the other issue is that the US steel industry in general–and US Steel in particular–has historically been well behind the cutting edge of advances in steel technology. As Brian Potter points out in “No inventions; no innovations,” a History of US Steel” (Construction Physics, December 29, 2023), US Steel was considerably behind the technology curve in the post-World War II era, including: the shift from open hearth furnaces to the Basic Oxygen Furnace; the pursuit of economies of scale through very large furnaces; the rise of the “mini-mill” that steel by melting scrap steel, rather than processing iron ore; and others.

The US steel industry overall and US Steel in particular have been forced to trim down considerably in the last few decades, but the US economy still makes most of its own steel. According to the US Geological Survey annual volume on Mineral Commodity Summaries 2023, 14% of US finished steel consumption was imported in 2022. The main sources of these imports were Canada at 21%, Brazil at 15% and Mexico at 14%.

However, the US has a long history of blocking imported steel from other countries; for example, when President Trump decided to ramp up trade protectionism in 2018, steel was one of the first industries to gain additional tariff protection. As a result, steel-using US industries like construction, cars and transportation equipment, and machinery pay more than steel-users in other countries. The SteelBenchmarker website reports that at present, US steel-users pay $1,142 per metric tonne of hot-rolled band steel: for comparison, the comparable price in western Europe is $790; the price in world export markets is $606; and the price in mainland China is $484. Thus, every US industry relying on US steel production is at a competitive disadvantage in global markets compared to firms elsewhere.

At about this point in the argument, it’s usual for someone to say, accusingly, “So, you just don’t care about the jobs of steelworkers and you just don’t care if the US steel industry vanishes.” Actually, I do care. But the historical pattern over the last half-century is that the US government keeps protecting the US steel industry from international competition, and the US steel industry has not used that protection to catch up technologically.

Looking ahead, the US and Japan combined are only a small slice of global steel markets. The steel industry in both countries needs greater scale and continuous technological improvement. In comparison to those problems, the question of whether a certain Japanese steelmaker should be allowed to pay $14.6 billion for the #2 US steelmaker is a diversion from the real issues.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest