Comments

- No comments found

The number of US patents granted has been rising rapidly. However, US productivity has not been rising. Why aren’t more patents leading to more productivity?

Aakash Kalyani of the St. Louis Federal Reserve discusses research that suggests an intriguing possibility in “The Innovation Puzzle: Patents and Productivity Growth” (Economic Syn0pses: Federal Reserve Bank of St. Louis, March 29, 2024). The underlying research paper, “The Creativity Decline: Evidence from US Patents,” is available here.

There’s a new wave of research in economics that finds ways to use text as data, and Kalyani’s research offers an interesting example. The idea that some patents are more creative, while other patents have more of a me-too flavor. Kalyani suggests that one way to distinguish them is that more creative patents will be more likely to use new terms. As the research paper described it:

A patent describes in detail the working or features of an invention, and to do so uses a range of technical terminology. To construct my measure, I decompose the text of each patent (beginning in 1930) into one-word (unigrams), two-word (bigrams) and three-word (trigrams) combinations, and subsequently remove those that are commonly-used in everyday English language to obtain a list of technical terms. I then classify these technical terms into ones that were previously unused in the five years before the patent was filed. This process yields the share of new technical terms in a patent that is my measure of patent creativity. For the baseline version, I consider the measure with bigrams, and I show that my empirical results are unchanged for a measure that uses all three–unigrams, bigrams and trigrams.

An intuitive example is that “cloud computing” is first used in a patent application in 2007. Thus, patents using the term “cloud computing” in 2007 would be counted as “creative,” but patents after 2007 would not be counted as creative because they used “cloud computing”–they would only be counted as creative if they used some new term.

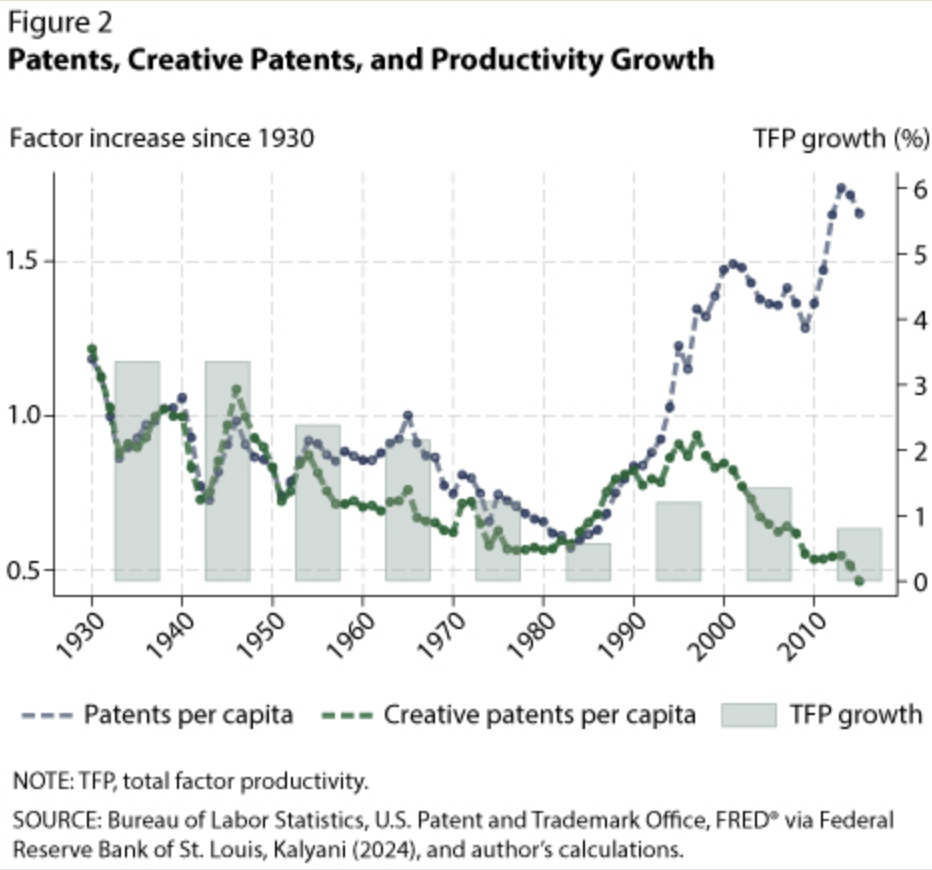

Of course, one can think of various things that might be right or wrong with defining “creative” patents in this way, but if we just go with the distinction, what patterns to we see? Here’s a figure from Kalyani. Three points seem worth emphasizing here: 1) The total number of patents per per capita gradually declines from the 1930s up through the 1980s, and productivity generally declines at the same time. 2) The number of patents starts rising quickly in the 1980s, but productivity does not rise at the same rate. 3) Up to the 1990s, the number of “creative” patents shown by the green dashed line follows a general trend similar to total patents; starting around 2000, creative patents drop off sharply.

One issue with text-based evidence is that one can imagine reasons why the use of language might change: for example, perhaps the US Patent Office became more likely to grant patents if the applications avoided new terms and used pre-existing language. But one would of course have to back up that alternative hypothesis! Kalyani looks at other patterns as well and finds that “creative patents” seem to matter. He writes:

Through examination of top scoring creative patents, I observe that creative terminology in these patents captures the description of new products, processes and features. I undertake a series of validation exercises to further bolster this observation. First, I show that top scoring creative patents tend to cite recent academic research rather than previously filed patents. Second, top scoring patents also score higher on ex-post measures of patent quality. These patents receive more citations and higher valuation. Third, I show that creative patents are costlier investments for a firm, and that a creative patent is associated with about 24.9% higher R&D expenditure than a derivative patent. These findings together suggest that creative patents are costly investments that tend to originate from recent academic research and generate higher ex-post value and follow-on innovation than derivative patents.

What factors might explain the co-existence of a decline in “creative” patents and a sharp rise in more derivative “me-too” patents? One factor may be that the age of inventors is rising.

I use patents matched to inventors to show that inventors are about three-times (3.2x) as likely to file a creative patent on entry compared to later on in their career. This number falls to 1.52x for the second patent, 1.25x for the third patent, and so on. In the aggregate, I find that percentage of patents filed by first time inventors have dropped from about 50% in 1980 to 27% in 2016. This drop in share of patents by new inventors reflects the overall demographic shifts in the US. The share of 20-35 year olds in the US workforce dropped from about 47.6% to 28.5% during the same time period.

Another reason for the sharp rise of derivative me-too patents may involve business strategies. At least to me, it seems possible that firms in some industries are using “patent thickets“–the name given to a group of patents on a very similar subject. It’s hard for other firms to enter a market if they need to worry about not just one patent, but many. In addition, if a firm keeps adding new patents to the thicket as older patents expire, this barrier to entry from new firms may not go away. In this scenario, patents have become less of a marker showing genuinely new technological improvements that boost productivity.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest