Comments

- No comments found

Globalization is evolving, but it doesn’t actually seem that, as one sometimes reads, that globalization is in reverse.

For an overview of some key facts, Steven A. Altman and Caroline R. Bastian have produced the DHL Global Connectedness Index 2022, subtitled “An in-depth report on globalization.” It’s a just-the-facts report. Here are some takeaways:

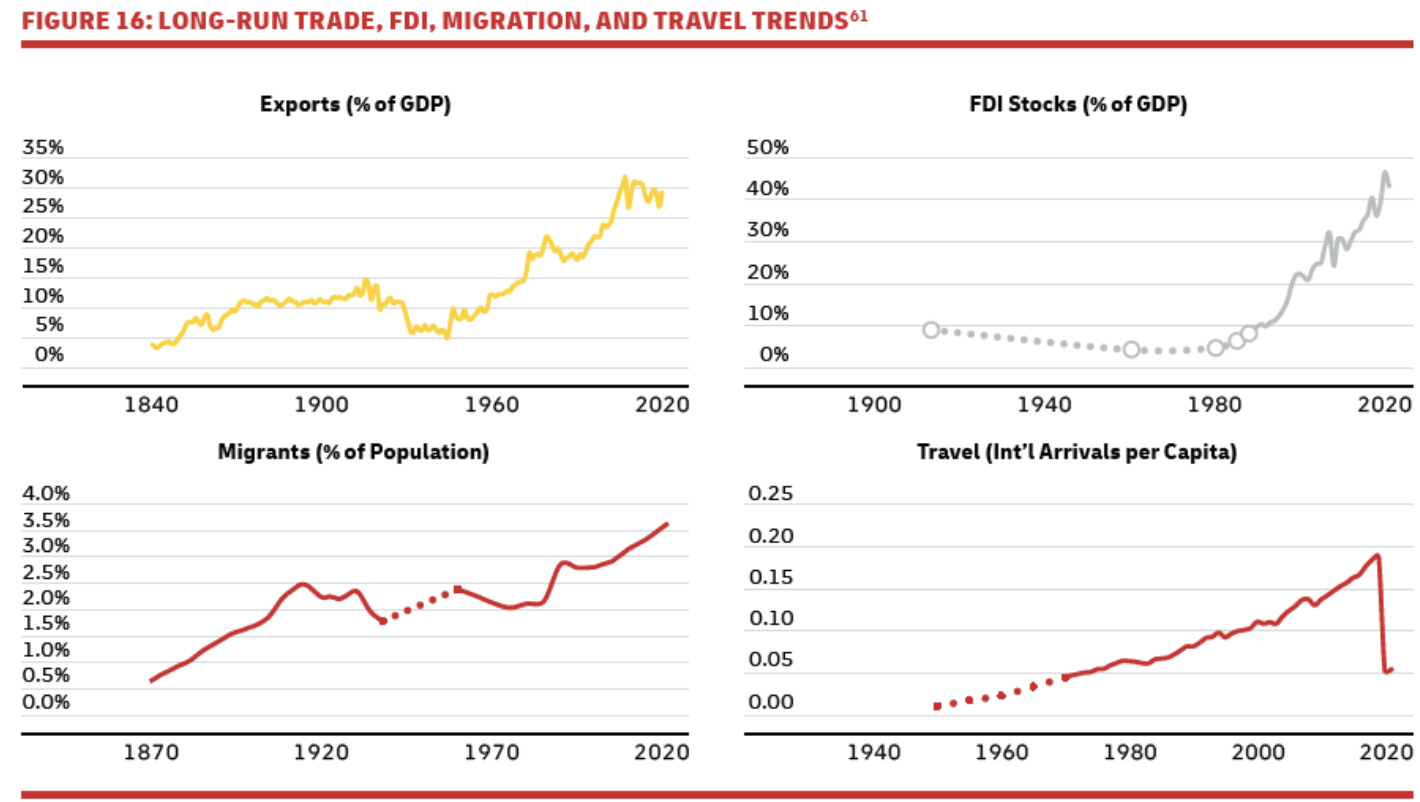

1) The world economy is at or near a record high in exports, foreign direct investment and migration. Travel was way down in 2021, but we’ll see in the next few years if the pandemic made a permanent or temporary change.

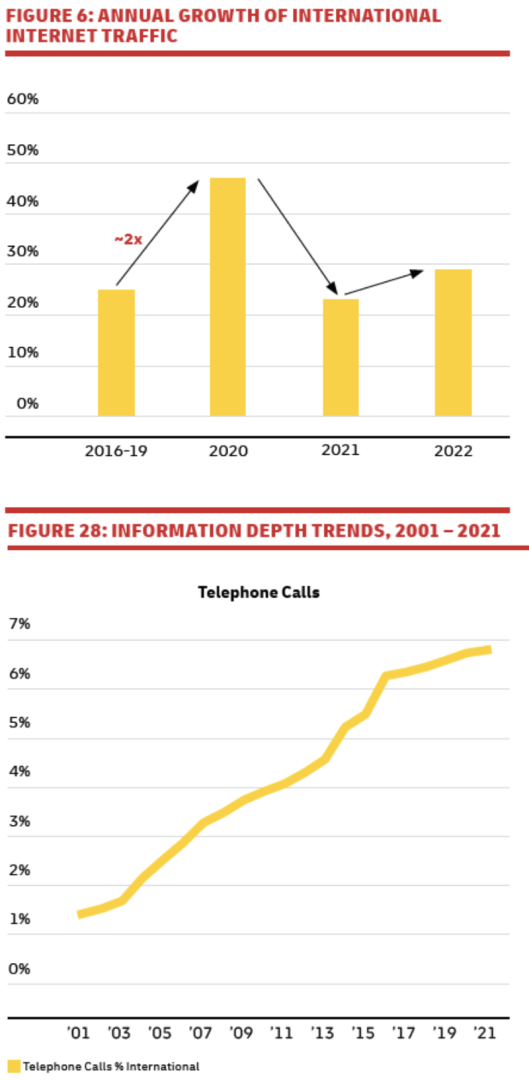

2) The upper-right panel of the above figure shows that exports as a share of GDP have levelled off in recent years–while remaining near the all-time high. However, global flows of data and information are dramatically rising. The first figure shows the annual growth of international internet traffic. After a jump to 47% growth during the pandemic year of 2020, it seems to have gone back to the typical pre-pandemic growth rate of about 25% per year. The second figure shows the steady rise in the share of global phone calls (including calls over the internet) that are international. These patterns suggest that international flows of services (not counting tourism, of course!), rather than goods, have been rising substantially.

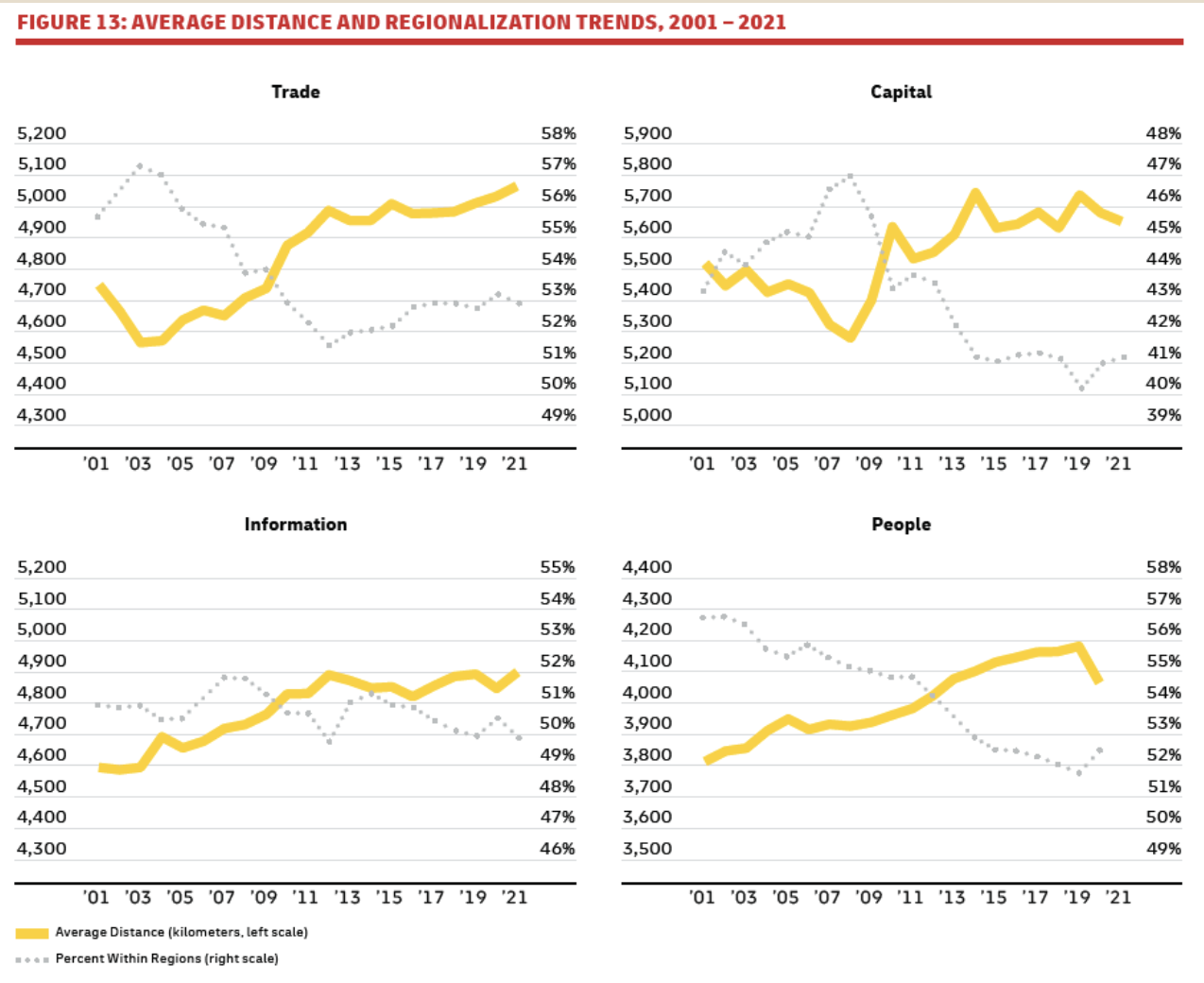

3) In general, the distance of international flows is up over the past 20 years and the share of trade happening within regions is down–although these patterns have leveled out in the last decade or so.

4) China and the United States are clearly experiencing conflicts that have reduced their international economic ties. But the economic relationship remains quite substantial.

On the effects of geopolitical tensions, there is clear evidence of the U.S. and China reducing their focus on flows with each other. Considering a sample of 11 types of trade, capital, information, and people flows, the share of U.S. flows taking place to or from China fell from 9.3% in 2016 to 7.3% in 2022 (or the most recent year with data available). Meanwhile, the share of China’s flows that were to or from the U.S. fell from 17.8% to 14.3%. Those are noteworthy declines relative to 2016 levels, but small changes relative to the U.S.and China’s total flows with the world. And even after these declines, the U.S. and China are still connected by far larger flows than any other pair of countries that do not share a border. Decoupling between the U.S. and China has not—at least yet—led to a wider fracturing of the world economy into rival blocs. There is very limited evidence of close allies of the U.S. and China reducing their focus on flows with the rival bloc.

Indeed, it may be that the US-China conflicts end rearranging the patterns of world trade, with reduced flows between the two countries, but with those international flows being redirected to other countries rather than reduced.

4) There is considerable room for globalization to expand. The authors write:

[T]he world is less globalized than many presume. Most activity that could take place either within or across national borders is still domestic, not international. Roughly 20% of global economic output is exported (in value-added terms), FDI flows equal just 6% of gross fixed capital formation, about 7% of phone call minutes (including calls over the internet) are international, and only 4% of people live outside of the countries where they were born.4 Surveys consistently show that most people overestimate these types of measures, and that such misperceptions exacerbate fears about globalization.

I would add that it’s always easier for politics to blame malignant foreigners for any issues faced by the domestic economy, rather than focusing on what might be done to make US workers and US markets more productive, innovative, and flexible.

For a more in-depth look at some of the underlying causes of and prospects for globalization, a useful starting point is “Is the global economy deglobalizing? And if so, why? And what is next?” by Pinelopi K. Goldberg and Tristan Reed (Brookings Papers on Economic Activity, Spring 2023). The authors confirm that “[d]ata on global trade as well as capital and labor flows indicate a slowdown, but not reversal, of globalization …”

The point out that policy choices have been leaning against globalization for a few years now, including the import tariffs enacted during the Trump administration and continued during the Biden administration, and also the global trade sanctions imposed on Russia after its invasion of Ukraine. The hot new word in international trade is “friend-shoring,” which refers to trading only (or mostly) with friendly nations. Countries around the world are placing greater faith in government subsidies to industry as a way of encouraging growth.

One point in particular in their essay, suggesting the difficulties of deglobalizing in the modern economy, struck me forcibly: the theory of “massive modularity.” Goldberg and Reed describe it this way:

[A] recent paper by Thun et al (2022) introduces a new concept, “massive modularity,” that characterizes many production processes today, and argue that the presence of massive modularity makes it extremely hard to “decouple,” “reshore,” and generally reorganize economic activity across borders. Massive modular systems involve several modules that are interconnected with each other, can experience innovation independent of each other, and can be broken into smaller, more specialized modules, each of which can again experience independent innovation. Different firms, located in different countries, specialize in different modules making production structures extremely complex. As an example, they cite the CEO of Pfizer, who once stated that the company’s Covid-19 vaccine “requires 280 different materials and components that are sourced from 19 countries around the world.” The vast complexity of modern production poses a challenge for policy as measures aimed at reducing risk or promoting domestic industries may have unintended consequences. In general, rebuilding massively modular industries in all their complexity on a national level is a Herculean task. Even if it doesn’t fail, it will certainly take many years to accomplish. Given that the sectors characterized by this high complexity are precisely those sectors that are key to innovation and growth, this effort will likely slow down growth in the US and global economy.

It often seems to me that US-based discussions of globalization are built on a presumption that the US gets to play the leading role in deciding how and whether globalization will happen. This assumption was a pretty good one for the second half of the 20th century. But as other economies around the world–notably China and India–have grown dramatically, their need to drive their own development by exporting into the US market has been reduced. Instead, such countries have a greater ability to depend on selling into their own growing domestic markets–or selling to markets in the rest of the world. The US can decide that it wants to be less exposed to the gains and costs and disruptions of global markets, but many other countries around the world will not choose to follow that US decision.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest