Comments (1)

Allen Brown

What about it's abuse from unscrupulous dealers? They will be well aware of attempts to detect Generative AI trading and will build in algorithms to circumvent this detection.

Generative AI in the stock market is risky due to data bias, black box models, lack of control, market manipulation, and ethical concerns.

The use of artificial intelligence (AI) in the stock market has become increasingly popular in recent years.

One particular type of AI that has garnered attention is generative AI, which is capable of creating realistic simulations and synthetic data. While generative AI has the potential to revolutionize the stock market, there are also significant risks associated with its use. In this article, we will explore the dark side of generative AI in the stock market and the potential consequences for investors and financial institutions.

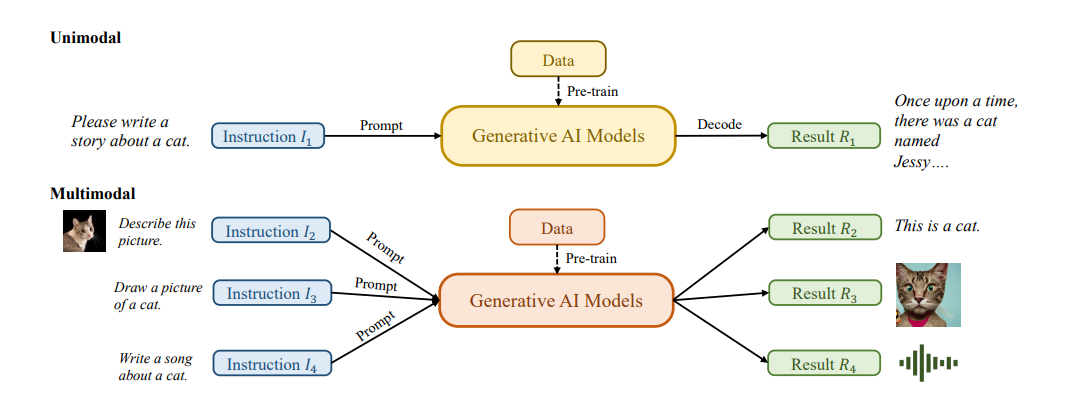

Generative AI is a subset of AI that involves creating new data or content. It uses deep learning algorithms to generate new information that is similar to existing data. This technology has many potential applications in the stock market, such as generating synthetic data to train machine learning models, simulating market scenarios, and creating realistic virtual environments for traders.

Generative AI can be particularly useful in scenarios where historical data is limited or unreliable. For example, it can be used to generate synthetic data to train machine learning models in situations where there is a shortage of real-world data. It can also be used to simulate market scenarios and test trading strategies in a safe and controlled environment.

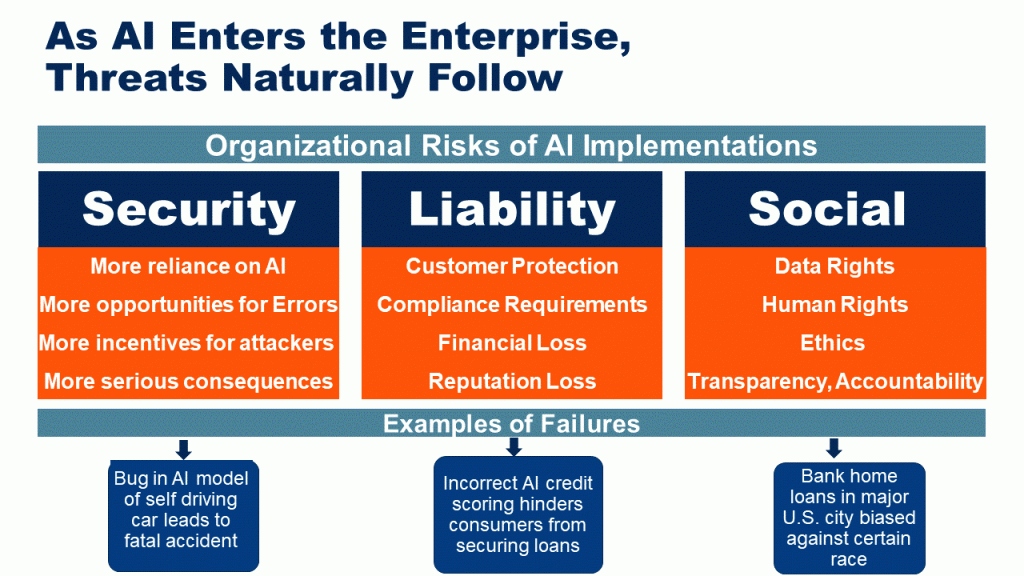

While generative AI has many potential benefits in the stock market, there are also significant risks associated with its use.

Here are some potential consequences:

Generative AI can be used to create realistic simulations of market conditions, which could be used to manipulate the market. For example, traders could use generative AI to create fake news stories or market rumors, which could cause stock prices to rise or fall. This could lead to significant financial losses for investors and financial institutions.

Generative AI can be used to create synthetic data to train machine learning models. While this can be useful in scenarios where real-world data is limited, it can also be risky. If the synthetic data is not representative of the real-world data, it could lead to inaccurate predictions and trading decisions.

Generative AI can be complex and difficult to understand, which could lead to a lack of transparency in the stock market. This could make it difficult for investors and regulators to understand how decisions are being made and to detect fraudulent behavior.

Generative AI can create scenarios that are difficult to anticipate or control. For example, a generative AI model could create a market scenario that leads to a financial crisis or a market bubble. This could have significant consequences for investors and financial institutions.

Generative AI is only as good as the data it is trained on. If the training data contains biases, the AI model will learn those biases and perpetuate them in its output. This is a particular concern in the stock market, where historical data may reflect biased decision-making and market conditions.

Generative AI models can be difficult to interpret, as they are often black box models that do not reveal how they arrived at their output. This lack of transparency can make it difficult to understand how the model is making decisions and to detect errors or biases in its output.

The use of generative AI in the stock market also raises legal and ethical questions. For example, if an AI model makes investment decisions based on non-public information, it could be considered insider trading. There may also be questions about who is responsible for the decisions made by an AI model – the human investors who created it or the AI itself.

While there are significant risks associated with the use of generative AI in the stock market, there are also strategies that can be used to mitigate these risks.

Here are some potential solutions:

To mitigate the risk of data bias, it is important to diversify the training data used to develop generative AI models. This can help ensure that the model learns from a broad range of market conditions and decision-making.

To address concerns about black box models, efforts should be made to develop explainable AI models that can provide insight into how they arrived at their output. This can help investors understand how the model is making decisions and identify potential biases or errors.

To address concerns about lack of control, it is important to maintain human oversight of generative AI models used in the stock market. This can include setting up clear guidelines for when human intervention is necessary and ensuring that human investors are able to intervene if necessary.

To address concerns about market manipulation, it is important to monitor the output of generative AI models for potential signs of manipulation or false signals. This can involve setting up systems to detect anomalies in stock prices or trading volume.

To address legal and ethical concerns, it is important to establish clear guidelines for the use of generative AI in the stock market. This can include regulations around the use of non-public information, as well as guidelines for who is responsible for the decisions made by AI models.

Generative AI has the potential to revolutionize the stock market, allowing investors to make more informed and accurate investment decisions. Its use also comes with risks, including data bias, black box models, lack of control, market manipulation, and legal and ethical concerns. To mitigate these risks, it is important to diversify training data, develop explainable AI models, maintain human oversight, monitor for market manipulation and establish clear legal and ethical guidelines for the use of generative AI in the stock market.

As with any new technology, there are always risks and challenges that must be addressed. However, if used responsibly and with caution, generative AI has the potential to greatly benefit the stock market and investors alike. By leveraging the power of machine learning, we can gain new insights and make better investment decisions, ultimately leading to a more efficient and prosperous market.

It is important to note that the use of generative AI in the stock market is still in its early stages, and much research and development is still needed to fully understand its potential and limitations. As such, it is crucial that regulators, policymakers, and industry experts work together to establish guidelines and best practices for the responsible use of this technology in the financial sector.

In conclusion, generative AI represents a promising new frontier for the stock market, but it must be approached with caution and a clear understanding of its risks and limitations. By taking a responsible and measured approach, we can unlock the full potential of this technology and drive greater innovation and efficiency in the financial sector.

What about it's abuse from unscrupulous dealers? They will be well aware of attempts to detect Generative AI trading and will build in algorithms to circumvent this detection.

Leave your comments

Post comment as a guest