Comments (2)

Chloe Reid

As a student, I found these tips very helpful.

Oliver Salvatore

Thanks a ton !

Don't be fooled by the movies! Money doesn't rain from the sky once you become an adult.

It's time to put in the work as your parents spend less and less on you. As you go into college, you'll probably get a job or an internship that pays some amount. The comfort of living with a guardian and being dependent creates the false illusion of financial freedom.

As an adult over the age of 18, you are as be financially independent. At the same time, financial obligations start arising. This means that you have to be accountable for yourself. Financial logic is something many people lack or learn a little too late in life. As a student, you want to take care of needs at your level and still have a little extra left over for fun. Saving is the only way to go about it.

Below are five key ways to improve your saving culture and move to the pinnacle of finance.

Most parents who can afford it may choose to give their kids credit cards with some spending caps. Credit cards are always an expensive option, though nobody, not even your parent, likes them. If you have built a good savings record, you might qualify for a credit card with a co-guarantor. Only take a credit card if you know that you have sufficient discipline to ward of crazy spending habits.

With a credit card, there is always a temptation to swipe with the blind assurance of paying later. Interest does rack up, and in the end, that interest would be actual money going towards something else. Carry cash instead, and keep your money in a savings account with a debit card instead.

You can also build creditworthiness through the diligent use of a credit card. Keeping the payments regular and on-time while maintaining a low-interest expense eventually builds up your credit rating.

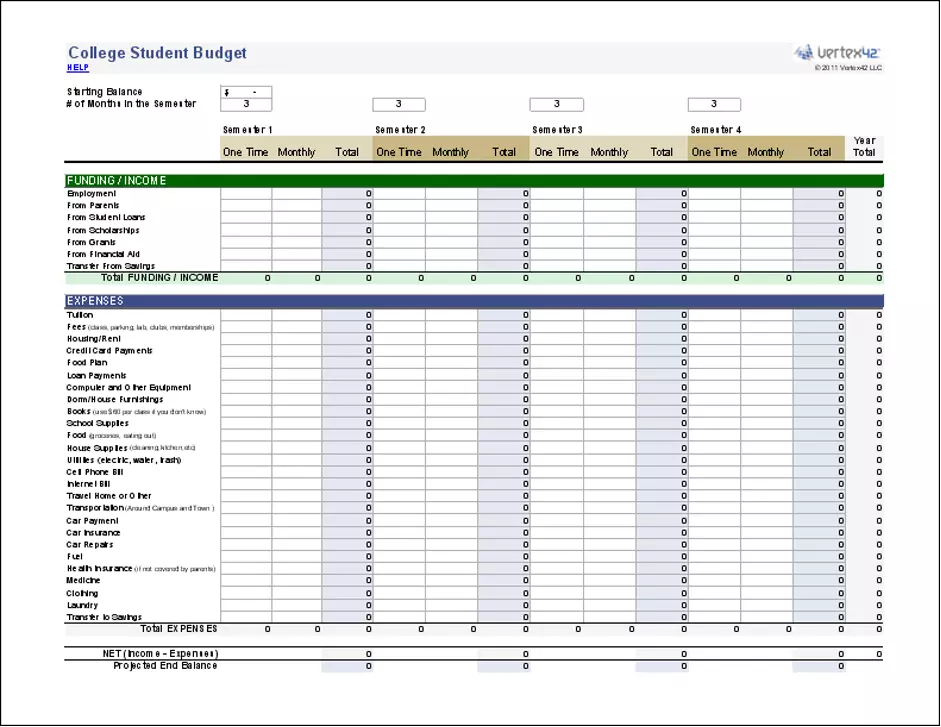

The above template from Vertex42 is the ideal student savings plan, though a little intricate. You can create your template on an excel file and simplify it to the basics of expenses and income. You can also create time to do this manually by hiring professional essay writing services to work on some of your assignments.

Strangely, a good number of adults don't seem to stick to this simple rule themselves; that of tracking every expense. Income isn't so much a problem since it is usually fixed. Expenses, on the other hand, are where all the leakages happen.

Never assume you are too young to start saving, and never assume that guardians will always be able and willing to bail you out. If you can tabulate your income and expenses, the next thing is to ensure that you save at least a portion of your income. How much money you save depends on how much money you make and spend. Simply put, if you want to save more, you must spend less and strive to make more.

But savings also means not being able to spend whenever you want to. With an ATM card, this is quite hard to do. The options would be a fixed account or an online savings account that is redeemable as cash. For a bank, there remain advantages to saving over the long term, for example, building interest.

A business owner knows about expenses on capital items such as computers and company cars and the long-term savings these provide. Likewise, you can use your savings to purchase an item that would benefit you in other ways. This could, for example, be a good computer or a camera, depending on the intended use.

This isn't to mean that you should splurge on material items that you don't need; rather, those that provide value in your academics or career. Buying a good laptop as a student for your design classes can save you up to 5 years of working slower and less efficiently.

Society thrives too much on creating good savers rather than good wealth creators. Having savings in the bank is always a great thing, especially for those curveballs that life throws at us. However, the economic value should also be generated from the money heap.

Thus, after five years of disciplined savings, you can start thinking of funding those creations and ideas. Or you could take a dig at the stock market, anything that you feel is worth investing into.

It is easy to turn into a scrooge all in the name of eternal savings. Motivation is, however, needed to keep the flame burning and enjoyment of your savings into riches, and onwards into wealth. Buy yourself something nice or reward yourself with a holiday occasionally. The benefits to your mental, emotional, and financial life will be immense!

As a student, I found these tips very helpful.

Thanks a ton !

Leave your comments

Post comment as a guest