Comments

- No comments found

A few years ago the sort of progress we’ve made in computing, AI and automation would have seemed like science-fiction.

AI is not only revolutionizing conversation with ChatGPT, generative Art with DALL-E and Stable Diffusion, but leading to the discovery of new drugs to fight antibiotic resistant superbugs, improving cancer diagnosis, and leading to major efficiency gains across multiple sectors.

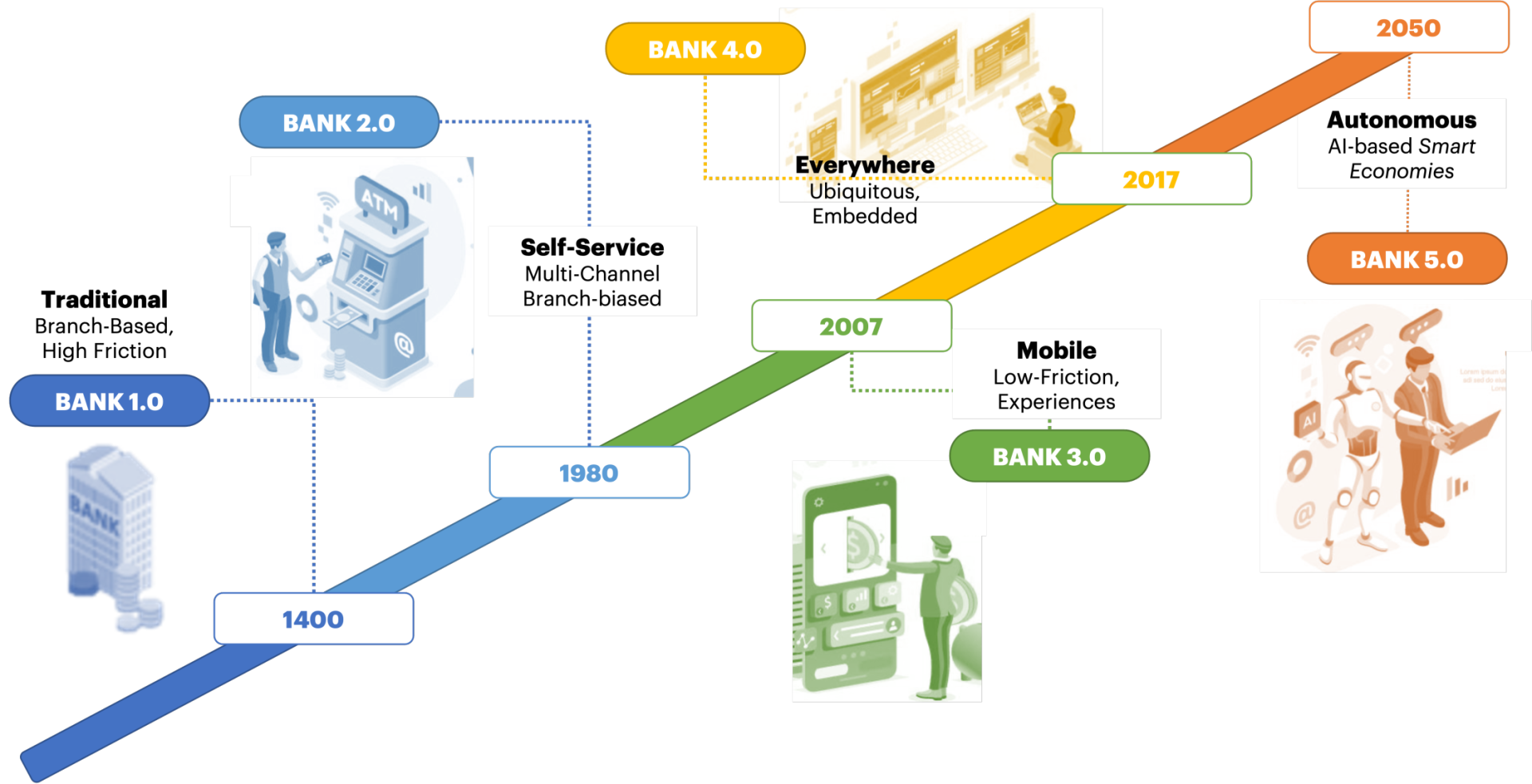

Recently I attended Huawei Intelligent Finance Summit (HiFS) in Shanghai to see the progress the Tech Giant is making in numerous areas, and how the finance sector globally is adapting to accelerating change. In large part, the summit was focused on next generation technology and compute infrastructure to support the evolution of smart financial services in the Bank 4.0 era.

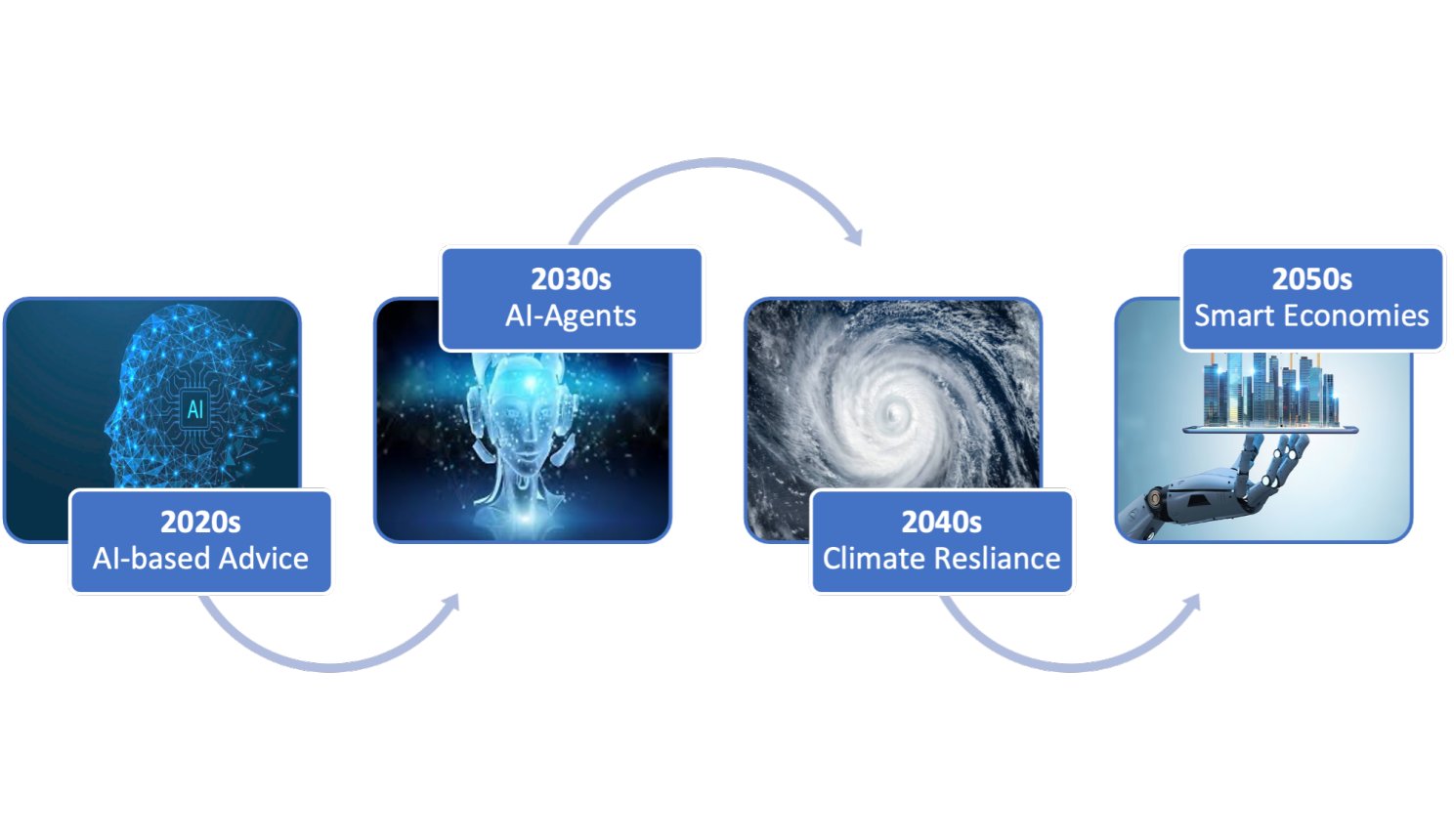

In my keynote at HiFS 2023, I outlined how AI and climate will affect the decades leading to 2050, and how this should focus financial services organizations not only to adapt to technological change, but how the sector needs more of a social conscience as impacts become self-evident.

The 2020s are really about the early integration of AI-based ADVICE into our lives and across society. In this decade we will start to see the augmentation of both businesses and careers with the use of AI. Accountants, Financial Advisors, Doctors, Lawyers, and other specialists will start to use AI to generate better advice. This requires Evolution of Digital Infrastructure to support the increasing need for data to train our models, and the ability to plug in new capabilities at will in the cloud. Those institutions limited to on-premise solutions, will increasingly find both time to market and broad functional capabilities are significantly challenged without more open architecture.

By the early 2030s we’ll have learned to trust AI-based advice and will start to give AI greater AGENCY in our lives. This is the era where smart contracts, robotic process and supply chain automation, autonomous transportation, and algorithms are increasingly commonplace in developed economies. In the 2030s your bank account will be AI-based, with your wallet integrated into your daily life, helping you manage not only your finances, but your health, schedule, and lifestyle. In the 2030s companies will start to automate large portions of production and operations, gaining massive efficiency gains, leading to record returns. But this will be at the cost of many human-led jobs that are displaced by AI. We will need to deal with techno-unemployment increasingly during this decade.

China will likely become the world’s largest economy sometime in the 2030s, primarily due to their investment in infrastructure supporting economy-scale automation and industrial AI.

In the 2040s, the effects of climate change will have become much clearer with food scarcity, warming temperatures, displacement of communities, increased flooding, wildfires and sea rise. Which is why in the 2040s we’ll need Climate Resilient Infrastructure and increasing focus on technology to solve a whole raft of problems. The reality is we have most of the technology we need to affect these solutions, but we are waiting for policy to catch up.

In the 2050s we enter the era of Smart Economies, where machine-to-machine interactions dominate our wealthiest sectors and corporations. Highly automated economies will be much more resource efficient, leading to more prosperous and sustainable futures.

To get to this future intention, we need to change the way we leverage technology and the way our institutions are organized. Over the last two decades digitalization has often been contentious, with traditional financial services players cautioning against rapid technological change, only to see new entrants come in and take significant market share through use of the same.

Huawei is committed to making strategic investments in foundational technologies to deepen its involvement in the financial industry. Huawei has announced four strategic directions for the financial industry: building resilient infrastructure, accelerating application modernization, enhancing data-driven decisions, and enabling scenario innovation. Looking to the future, Huawei will continue exploring business scenarios and developing systematic solutions that align with [these] strategic directions. - CEO of Global Digital Finance at Huawei, Jason Cao

Huawei has long been a major competitor globally in respect to the development of core digital infrastructure. CEO of Global Digital Finance at Huawei, Jason Cao, outlined four key areas of development that are the building blocks for this smart future:

Evolution of Digital Infrastructure: Huawei has invested in a whole raft of core technologies for the digital era such as computing, storage, network, cloud, and databases, and their understand of integrated smart architectures at a corporation and economy level are clearly world-leading.

Cloud-native Application Modernization: Cloud-based distributed technology architecture is critical for scalability and agile adaptation. Increasingly we see banks relying on cloud-native capabilities. The world’s leading fintechs already have made this shift to more of a tech-stack view of architecture away from traditional core systems.

Industrial, inclusive data and AI: To institutional or economy-level AI-based capabilities, we need both integration of AI into industrial production and realtime inclusion of broader data sources and AI components. To build AI-based societies that are inclusive, we must get better at training AI models, and build appropriate guardrails and regulation. When it comes to these broad areas, Huawei is well placed for future-proofing industry

Scenario-based Innovation and Building Next-Gen Ecosystems: Increasingly financial services players will be building flexible capabilities that are responsive to customers’ needs in real-time. This means building embedded finance experiences that are contextual, personalized and move away from the typical products that FIs have relied on the last 100 years.

The building blocks of tomorrow’s smart world requires us to divorce ourselves from the systems, processes, and skills of yesteryear. By 2050 most of what we consider banking today will be effectively encoded in AI. By the later part of the century what we think of as a bank today won’t exist. Our economies will be made up of marketplaces and infrastructure of advanced algorithms themselves regulated by AI.

We could continue to debate this future and to what extent humans will be involved in dispensing advice or directing AI, but the trajectory to highly autonomous smart economies is already very clear. If an economy and its markets wish to compete in this world of the future, we are going to increasingly trust AI to get us there, moving away from human-speed structures to those that can respond in real-time.

We are going to increasingly rely on intelligent infrastructure that can adapt in the moment, instead of taking years of systems development and integration. At HiFS 2023 we saw examples like GLDB bank in Singapore who was able to launch from scratch to market in less than 12 months due to advantages offered by next-generation cloud and product infrastructure. The fastest growing Financial Institutions in the world all are cloud-based and use digital methods to acquire customers at scale. This is already changing market share dramatically.

If you and your organization want to be a part of the smart world of the future, you need to commit yourself to constant adaption, and a clear departure from the products, services, skills and organization structures of the industrial revolution.

Brett King is a futurist, best selling author, award winning speaker and host of a globally recognized radio show. He is also co-founder and CEO of Moven, a New York-based $200m mobile banking startup with over a million users. He is widely regarded as one of the top 5 global influencers in financial services, and his book Augmented was cited by China's President Xi Jinping as recommended reading on artificial intelligence. He advised the Obama administration on the Future of Banking, and has spoken on the future in 50 countries in the last 3 years. Brett focuses on how technology is disrupting business, changing behaviour and influencing society. He has fronted TED conferences, given opening keynotes for Wired, Singularity University’s Exponential Finance, The Economist, SIBOS and many more. He appears as a commentator on CNBC and has appeared regularly on the likes of BBC, ABC, FOX, Bloomberg and more. His radio show, Breaking Banks, began in May 2013. It was the first global show and podcast on FinTech, and has grown to be the most popular with an audience in 140 countries/ 3.6 million listeners.

Leave your comments

Post comment as a guest