Comments

- No comments found

Artificial intelligence is transforming the world by disrupting every sector.

This article is the first in a series of three with the following:

As mentioned above, this article sets out how AI and Data Science may generate economic value and explains how a clear business objective, data strategy is aligned with business strategy and organisational culture (people matter too!) are all key to successful AI programs.

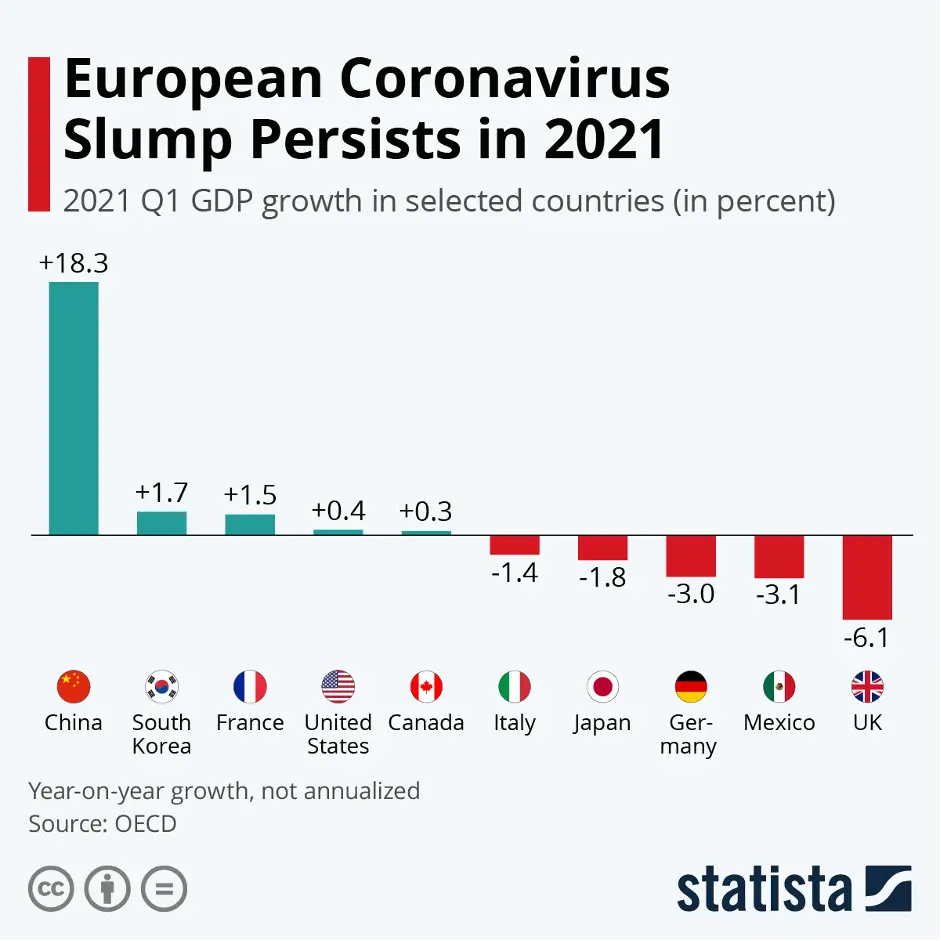

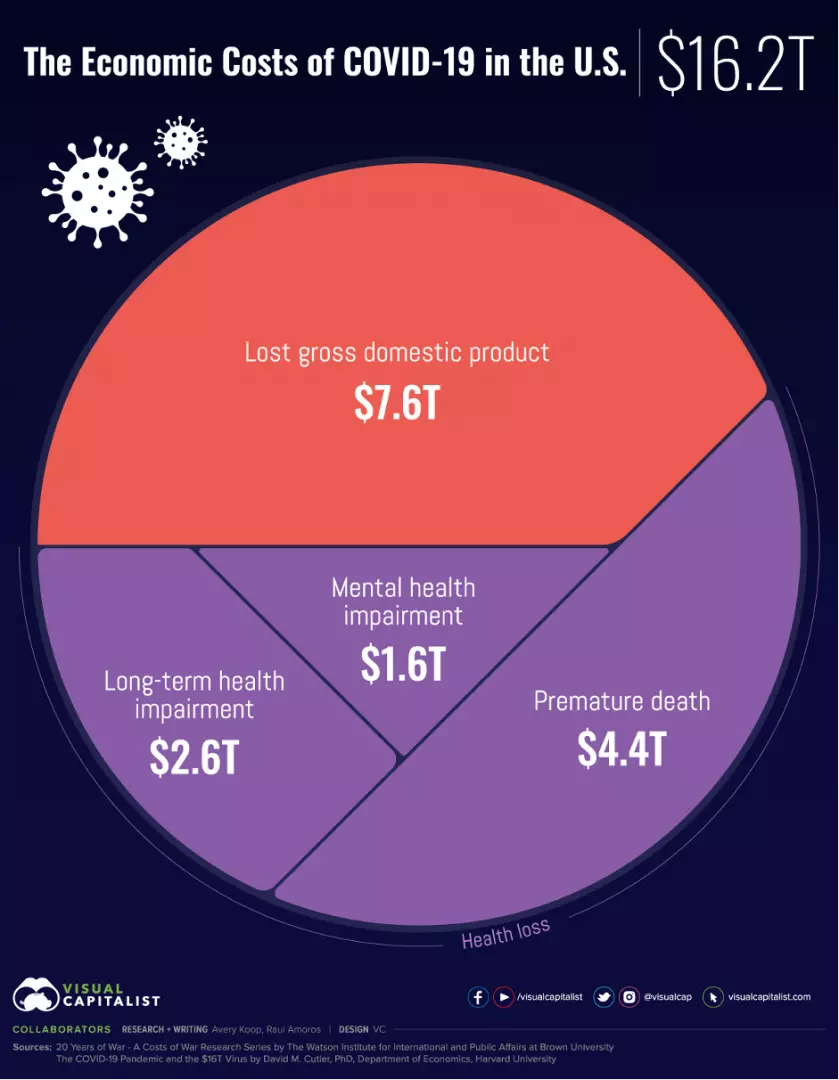

Furthermore, this article is written against a background of ongoing turmoil caused by the Covid crisis to our economies and also to our healthcare globally.

Source for image above: Data OECD, chart Statista

Source for image above Visualcapitalist

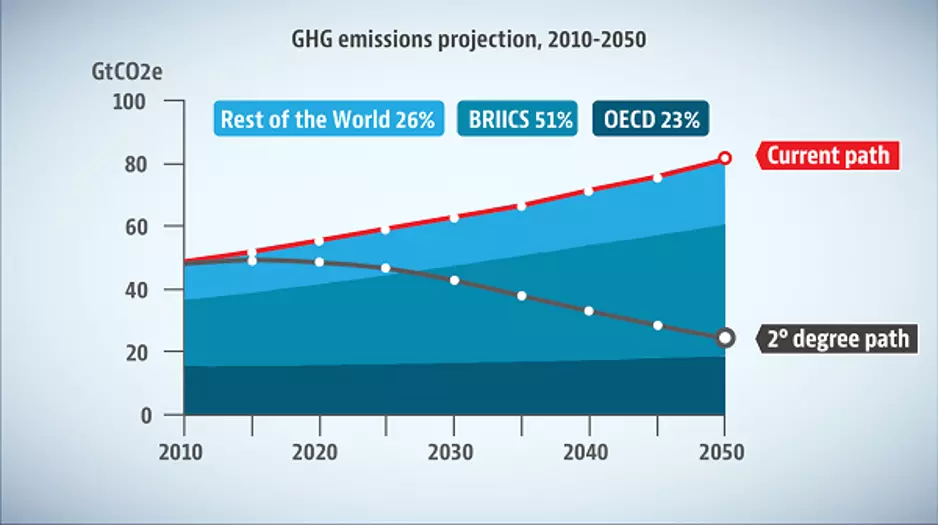

Moreover, there is also an increasing political attention towards the consequences of climate change. There is a pressure on our political and business leaders to pursue policies that would promote economic growth and job creation and yet at the same time environmental campaigners are pressing for concrete action on the mitigation of climate change that in turn would require a break from business as usual (BAU).

Source for chart above OECD

The election results in Germany that will result in the eventual departure of Angela Merkel as Chancellor of Germany will likely also result in the Green Party exerting greater influence in Germany and de facto across the EU in light of Germany’s role as the leading economy of the region. It is highly symbolic that an industrial powerhouse in the form of Germany has opted to elect the Green Party into a key negotiating position. At the same time President Biden is seeking ways to rebuild US infrastructure and stimulate the US economy to ensure a clear pathway to post Covid recovery.

This is an essential moment in time to align economic policy with next generation infrastructure and technology that may enable cleaner economic growth, skilled job creation with better paid jobs and the transition to the fourth industrial revolution (a term originally coined in Germany).

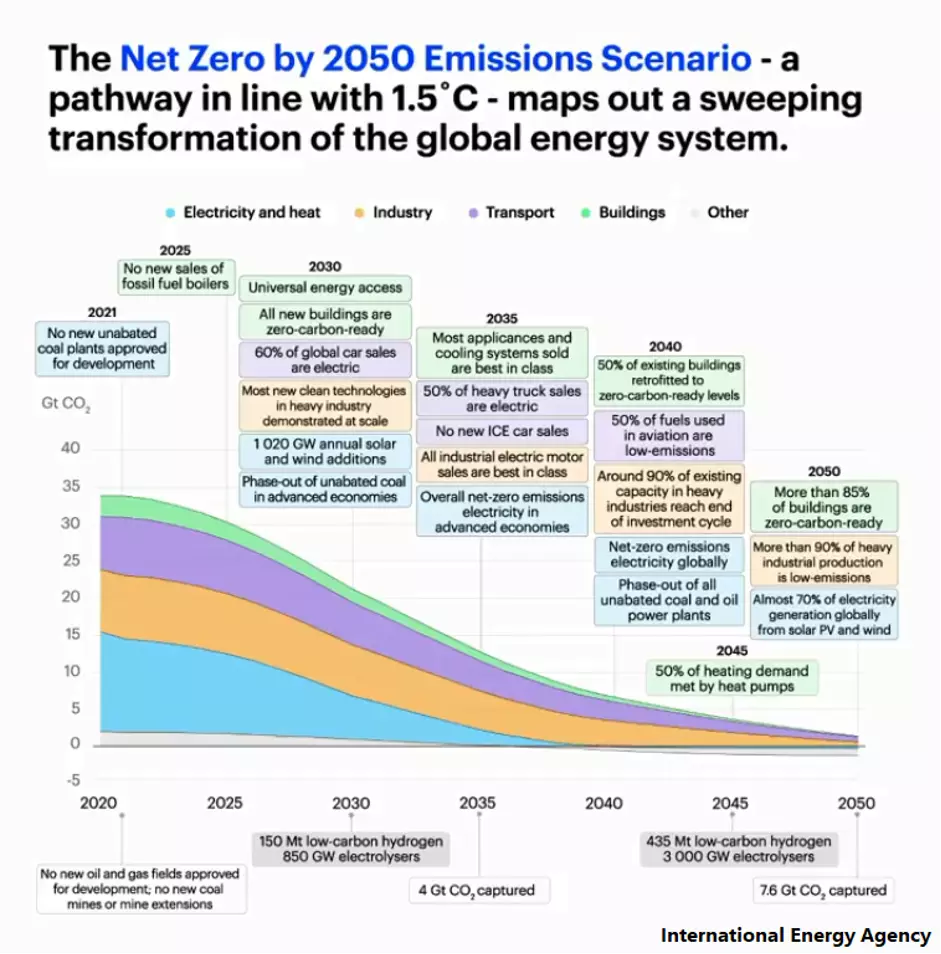

Source for image above IEA

The IEA forecast that “To reach net zero emissions by 2050, annual clean energy investment worldwide will need to more than triple by 2030 to around $4 trillion.”

“This will create millions of new jobs, significantly lift global economic growth, and achieve universal access to electricity and clean cooking worldwide by the end of the decade.”

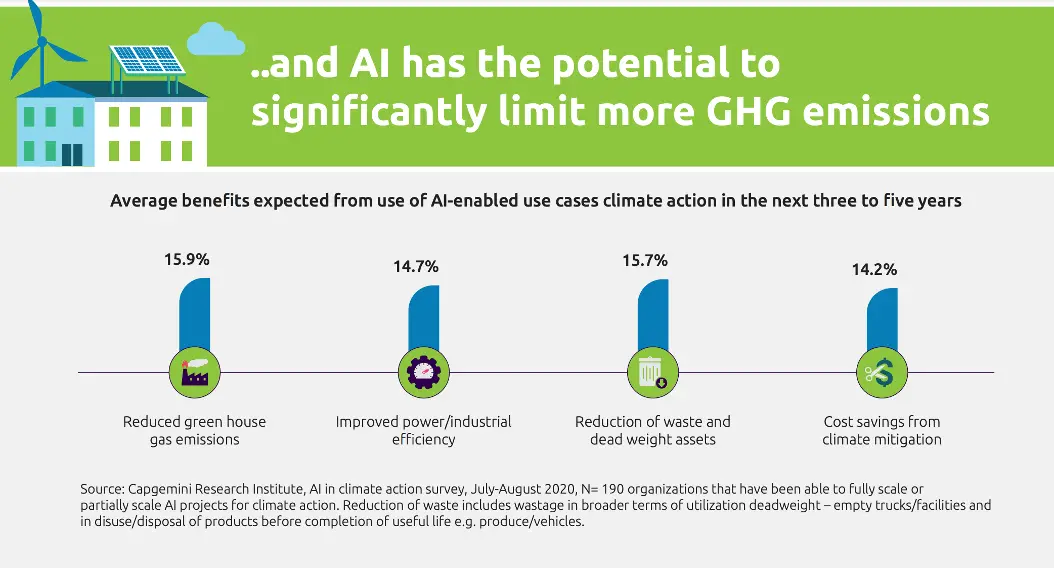

Source for Image above: Cap Gemini

Investment decisions in certain sectors of the economy (for example energy, manufacturing, transportation) taken today will have implications for the next fifteen to twenty years (or in transportation infrastructure for periods well in excess of fifty years) as investment horizons will require such extensive periods to generate a payback on the large capital investments. Equally, the telecoms sector will require large amounts of funding for standalone 5G infrastructure that will be the enabler for the fourth industrial revolution.

This article is the first of a series that aims to set out the benefits of investment into the AI and 5G technology and the ability to leverage these technologies to mitigate climate change whilst also generating shareholder value and economic growth if deployed and scaled in a timely and appropriate manner around the world.

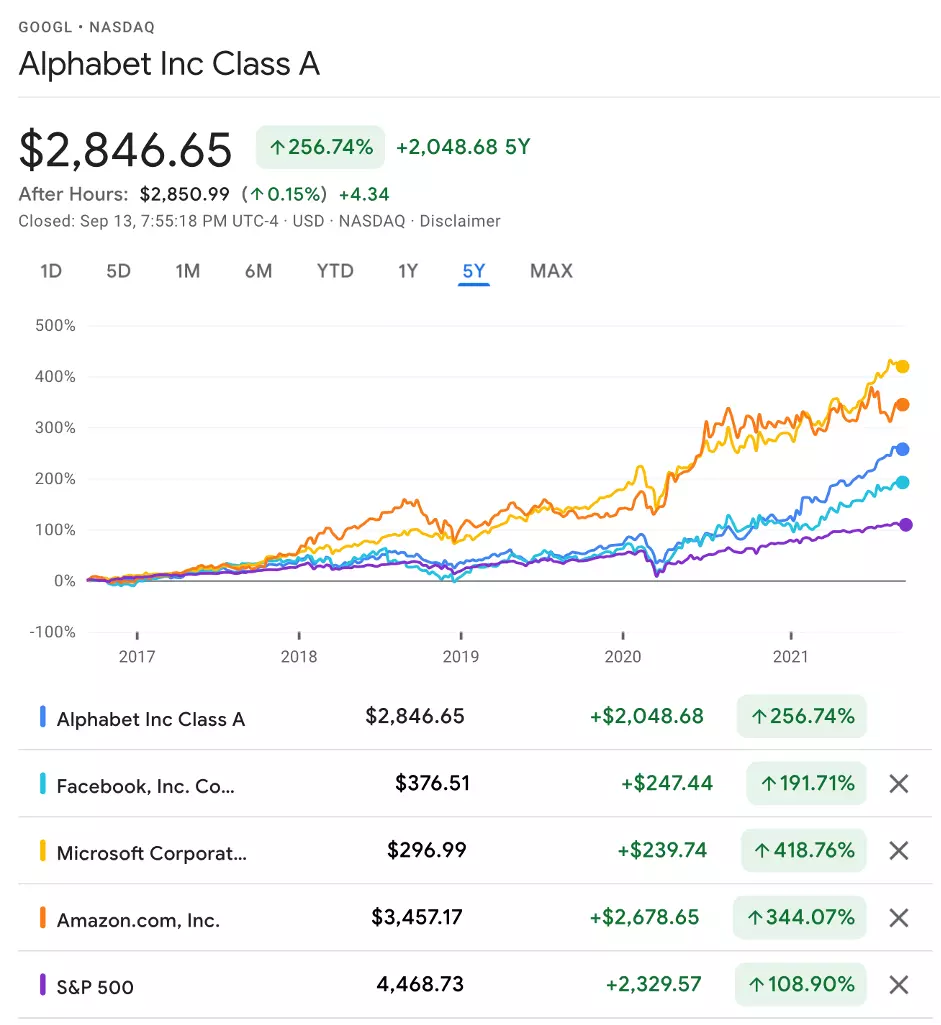

This particular article examines how AI, Corporate and Business Strategy may align including an overview of also meeting ESG objectives. Whilst it is noted by the likes of Gartner and VentureBeat that the majority of firms have been encountering challenges in implementing AI projects, the Tech majors who have been early adopters of AI technology have experienced exceptional growth and outperformance of shareholder value against the rest of the market.

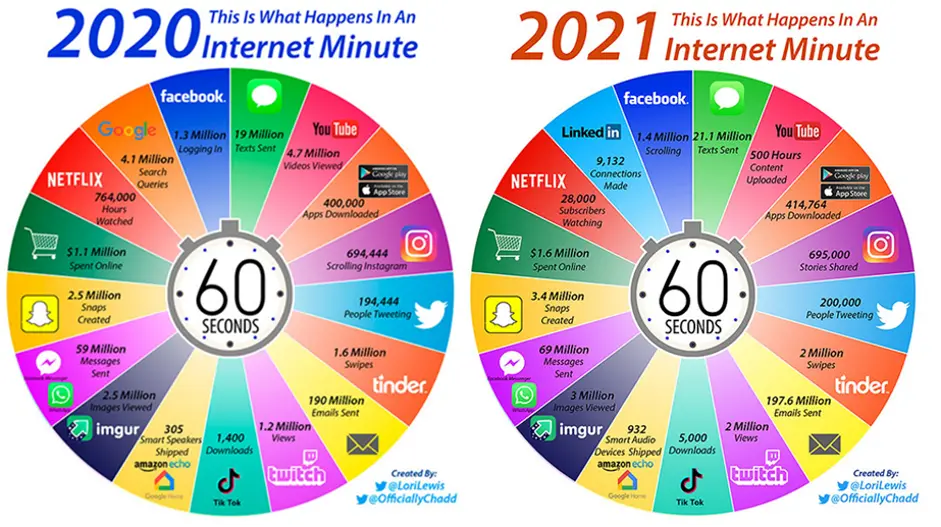

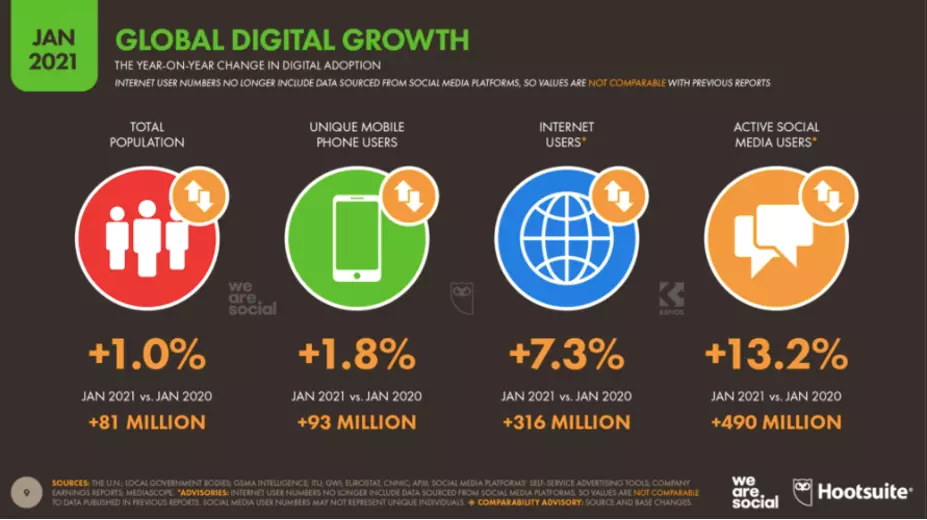

The previous decade has been one of the eras of big data and much of that data has been generated as a result of the rise of the internet and smart mobile with digital media and ecommerce driving much of that data growth.

As the image above shows most segments increased year over year (YoY) and in particular Tik Tok appears to have enjoyed massive growth YoY. In any event the amount of big data created every 60 seconds on the internet is vast.

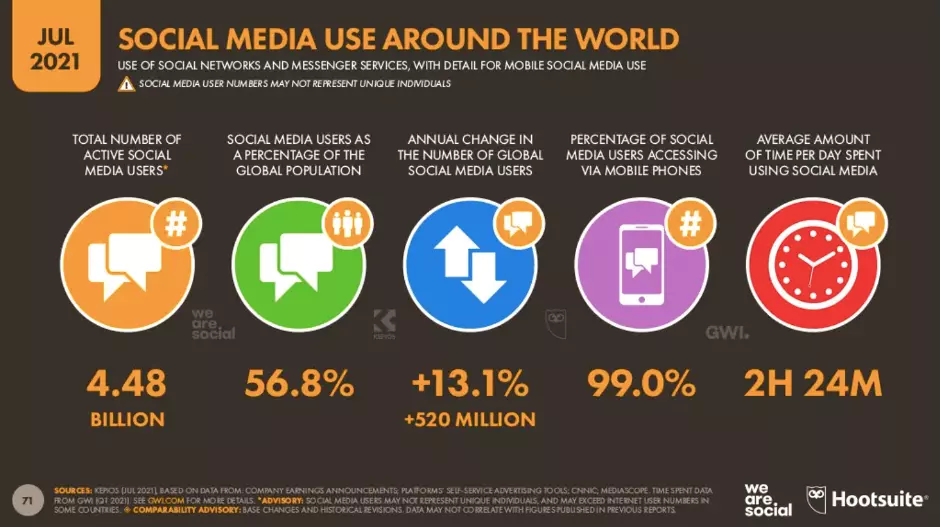

In fact social media usage has only increased during the Covid crisis.

Source for image above: Hootsuite, smartinsights

With more people using digital media relative to the previous year.

Source for image above: Hootsuite, smartinsights

The next evolution of AI and Data Science projects will be to transform other sectors of the economy beyond the digital media and ecommerce sectors and this will have profound implications and potential for economies around the world including Europe and the non-tech sectors of the US, Canada and Japan too.

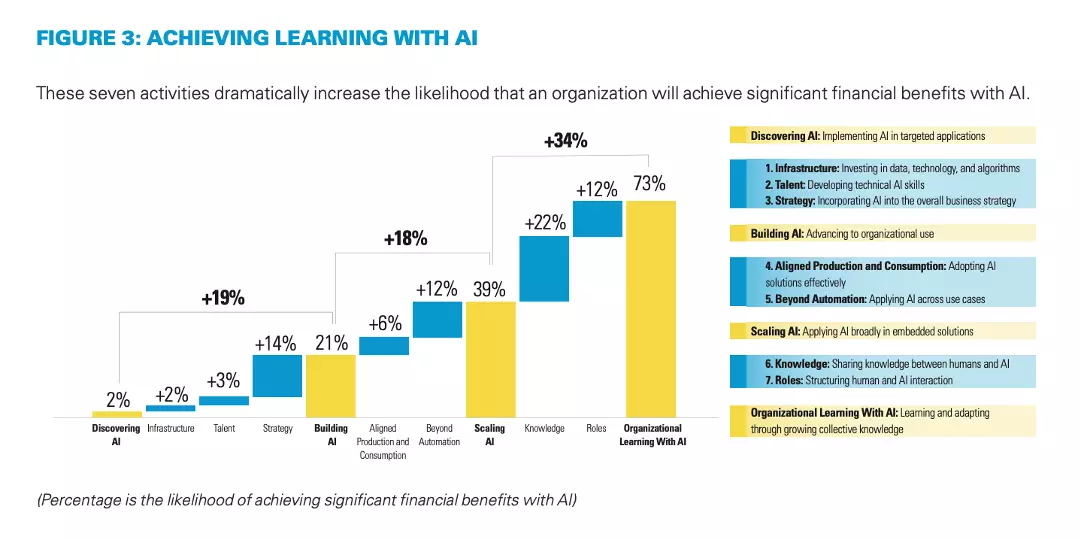

And yet a number of reports have highlighted how a relatively small number of companies have been able to successfully apply AI technology and Data Science capabilities.

Industry analysts believe that there is a high failure rate for AI projects, for example “Gartner predicts that through 2022, 85 percent of AI projects will deliver erroneous outcomes due to bias in data, algorithms or the teams responsible for managing them.”

VentureBeat believes that 87% of Data Science projects never make it into production.

MIT Sloan Management Review and Boston Consulting Group (BCG) noted that only 10% of companies reported substantial financial returns from AI but those that did had intentionally change processes, broadly and deeply, to facilitate organizational learning with AI.

Source for image above MIT Sloan Management BCG

Examples of strong performance from AI firms:

In 2016 Steven Levy observed How Google is Remaking Itself as a “Machine Learning First” Company (wired.com) and sets out how Machine Learning became really important in Google around 2013 / 2014 timeline albeit Google had been teaching Machine Learning internally since 2005.

It has been reported that 35% of Amazon’s sales is generated via its recommendation algorithm and the firm published a paper Amazon.com Recommendations – Item-to-item Collaborative Filtering.

The paper states that the giant online retailer uses recommendation algorithms to personalize the online store for each customer.

Extract from Linden et al. (2003) Amazon.com

“At Amazon.com, we use recommendation algorithms to personalize the online store for each customer. The store radically changes based on customer interests, showing programming titles to a software engineer and baby toys to a new mother”.

As noted from the extract above, Amazon was a pioneer in adopting AI technology to enhance the customer experience and generate better marketing outcomes.

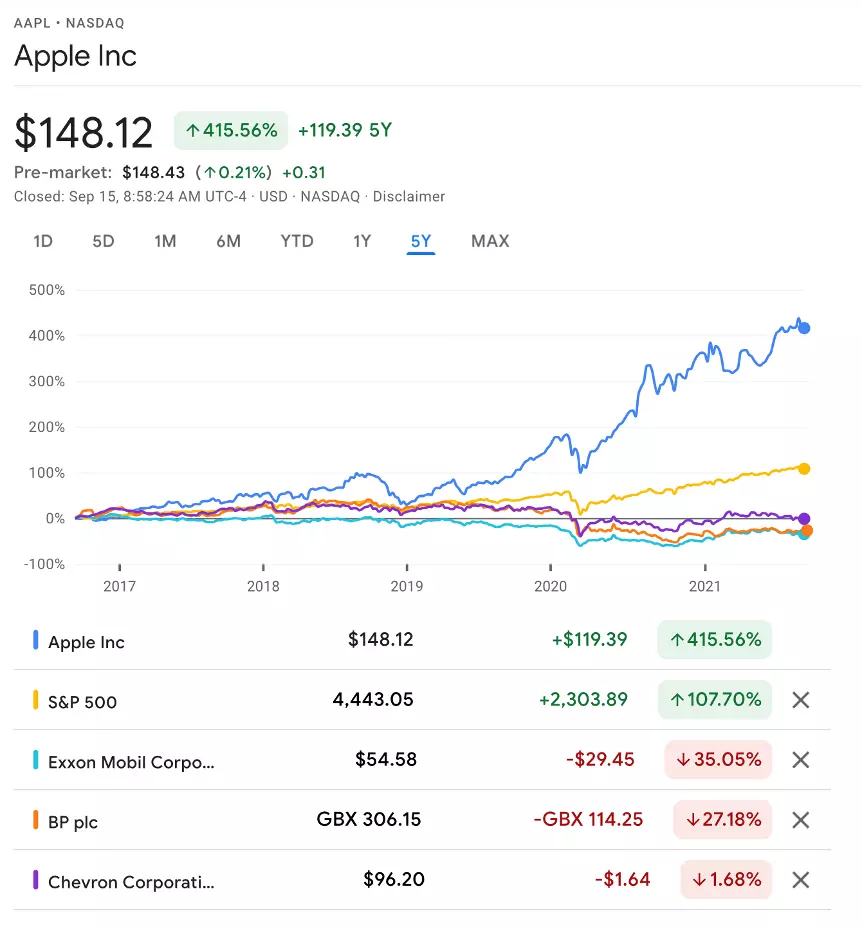

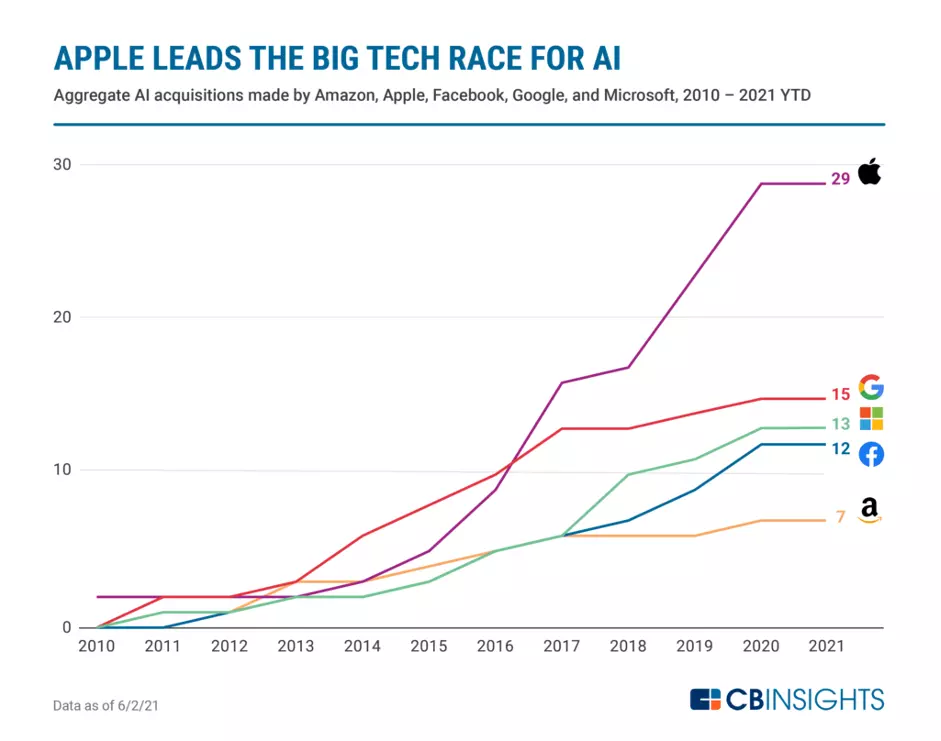

Apple has been an icon of the rise of the tech sector and the tidal wave of smart mobile conquering the world. They have also acquired more AI startups (29 since 2010 according to CBInsights) than the other tech majors.

The chart below from Google Finance compares the superstar icon of the tech sector against the old economy giants of the oil and gas titans since 2016 alongside the S&P 500 index performance.

Image Editorial credit: Dafinchi / Shutterstock.com

A decade ago the oil majors held leading positions in a number of the stock indexes around the world, with Exxon Mobil (NYSE: XOM) holding the title of the most valuable company in the S&P 500 and indeed the world with a market cap of around $328 billion.

However, ExxonMobil was dethroned of this status in August 2011, by Apple Inc (NASDAQ AAPL) with the sales revenues of the iPhone driving Apple's market cap in excess of Exxon’s. Thereafter from November 2018 to early February 2019, Apple, Google and Microsoft traded positions as the most valuable firms in the world. For more see Wayne Duggan 12 stocks that have been the most valuable company.

Today Exxon Mobil has a market cap of $238 billion (down by almost $100billion over a decade ago) vs Apple’s $2.45 Trillion!

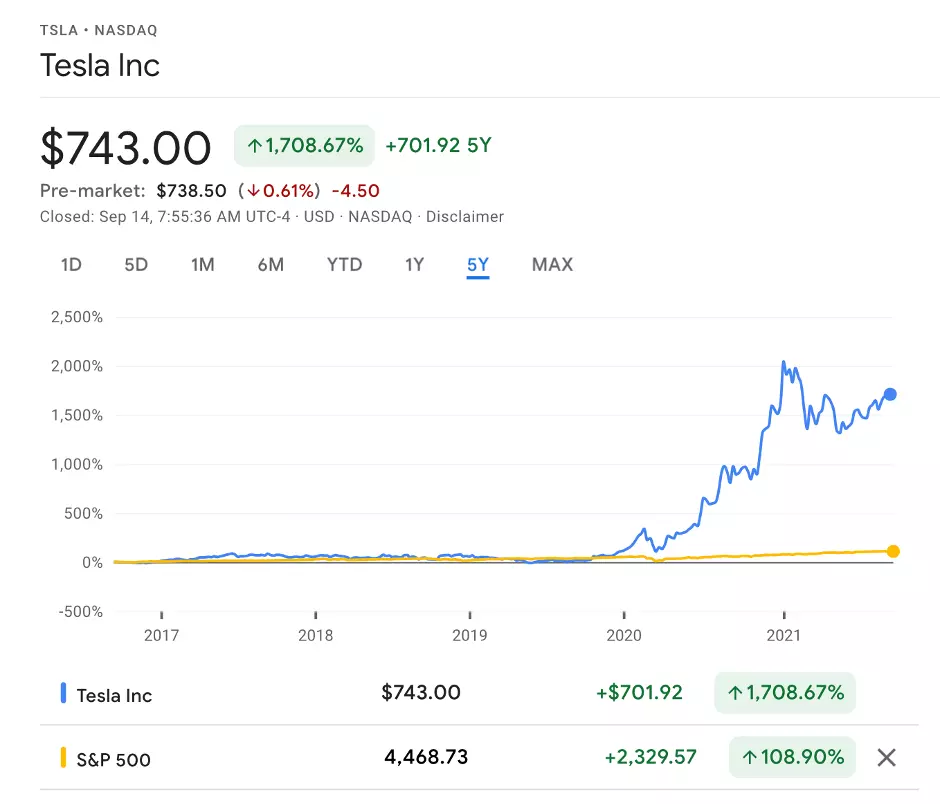

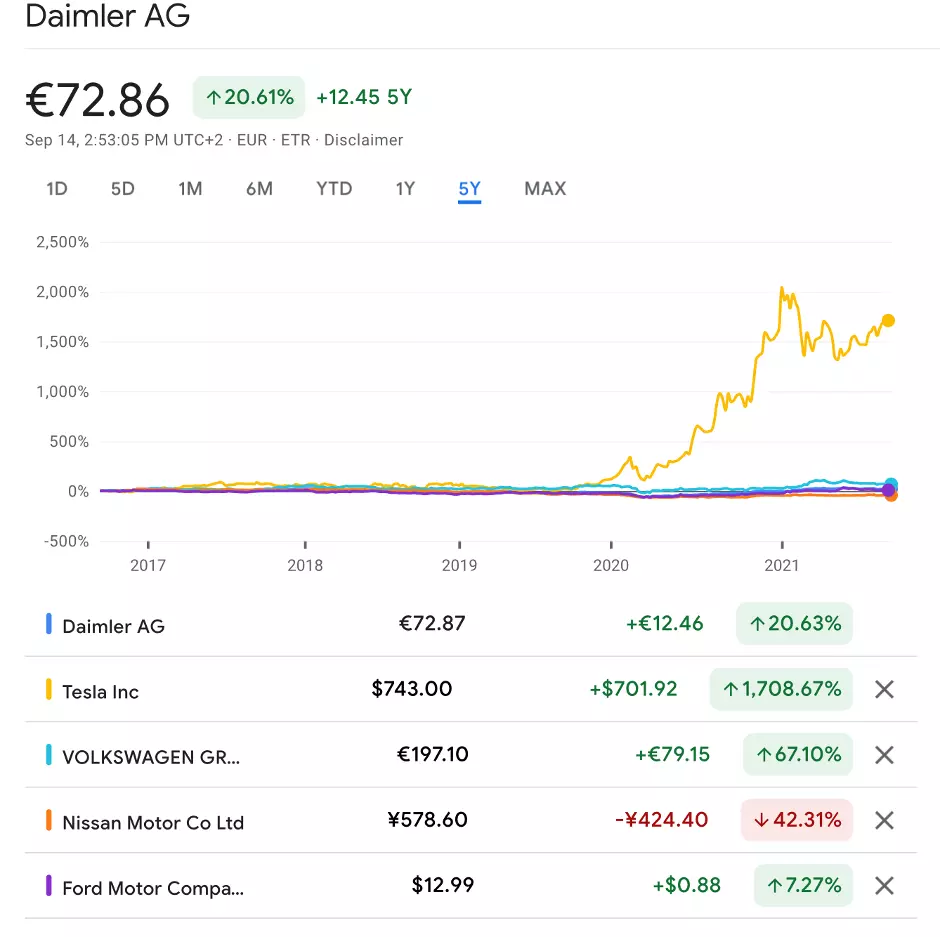

Moving beyond social media, ecommerce, and mobile phones, Tesla provides an exception in the list above in that it is competing in a more traditional space of automotive sector space albeit Elon Musk has stated that Tesla is increasingly an AI company and analysts and investors have regarded Tesla increasingly as a tech company.

Tesla illustrates how a Tech company can disrupt and transform a traditional sector such as the auto sector.

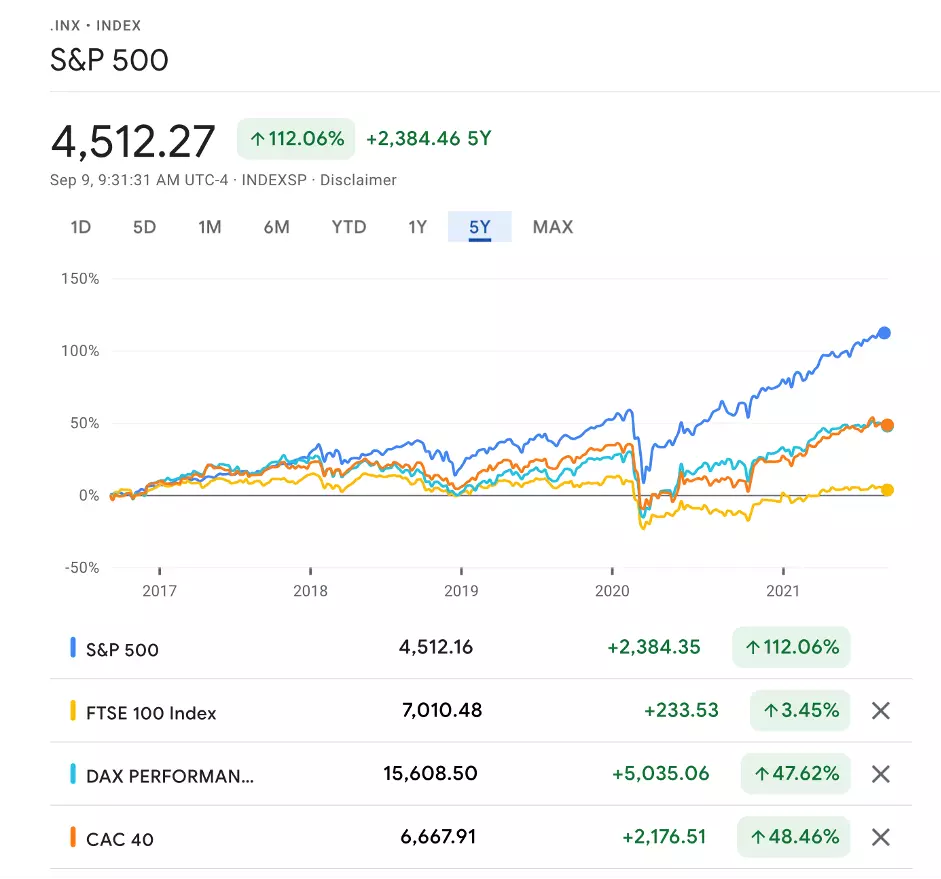

It also is noteworthy that the US S&P 500 has heavily outperformed the leading European stock markets – The FTSE 100, German DAX and French CAC 40.

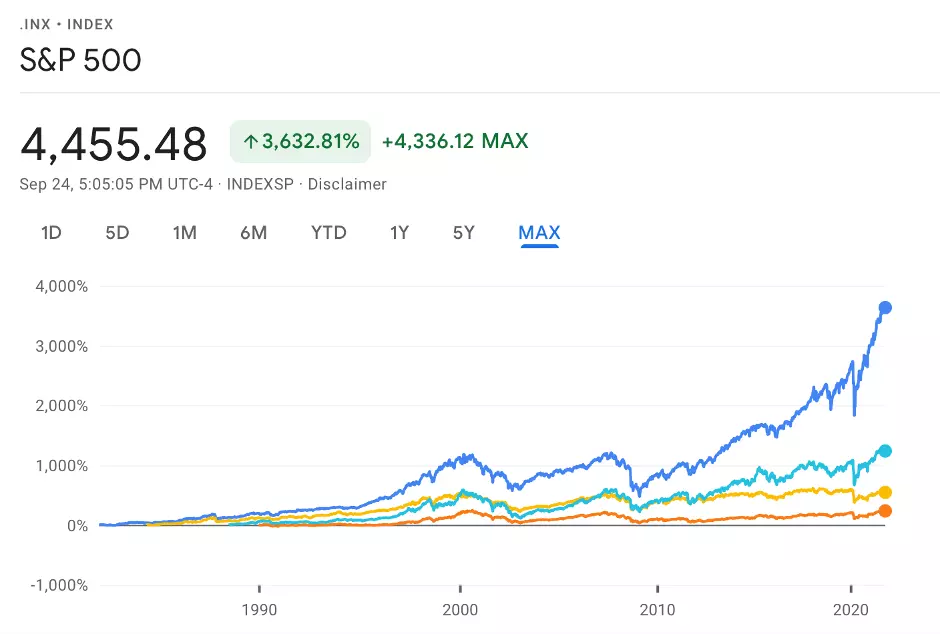

This outperformance is in fact notable since the 1990s as the US increasingly emerged as the tech leader of the world and has accelerated in the past 5 to 10 years as the Deep Learning revolution really took hold in the digital tech space and the tech majors acquired many AI startups alongside developing their internal teams.

The FTSE100 index reflects that the UK has been highly reliant on Financial Services, Pharma and Fossil Fuel (oil, gas and mining majors). The German DAX is reflective of the fact that the economy is heavily reliant on legacy giants in the automotive and engineering sectors and France CAC also lacks a powerful tech presence.

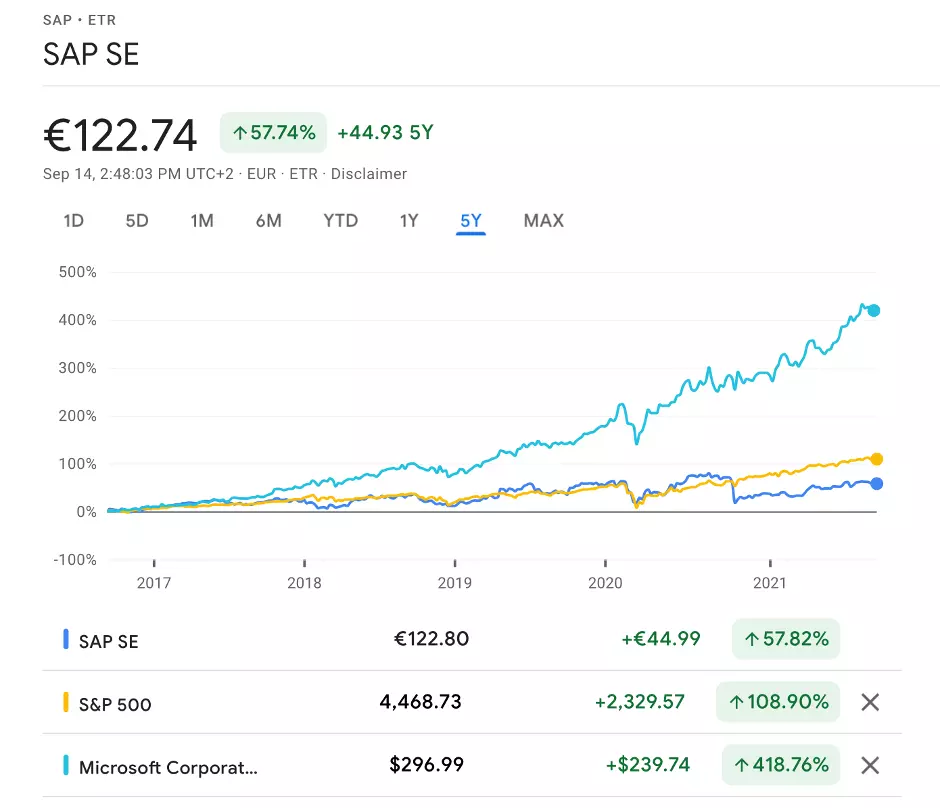

Europe (for the avoidance of doubt including the UK) does not feature a true tech sector or even a true tech giant in the manner in which the US possesses. Whilst a number of tech unicorns have emerged with some translating to IPOs for example Zalando of Germany (whose AI research the author is a fan), the largest tech firm in Europe would be SAP of Germany with an impressive market capitalisation of Euro 150Bn vs the astronomical market capitalisations of US tech majors for example Apple’s market cap of $2.47 Trillion or Microsoft’s $2.23 Trillion (as of 14th Sep 2021)!

Europe’s tech major, SAP vs S&P 500 overall and Microsoft as a proxy comparison.

SAP has delivered attractive returns and performed impressively over the past five years and yet the US based sector has powered ahead at a different level altogether.

European countries (including the UK) need to rethink tech strategy and ambition to fully participate in the tech revolution and maximise the opportunities for shareholder value creation, GDP and job growth. There needs to be a realignment to viewing the AI and Tech sector as engines of growth that may result in job and GDP creation and a shift away from the old traditional and more polluting industries.

The returns of the large US tech firms are amazing given that typically (historically) the assumption of financial analysts has been that once firms become very large their rate of growth and hence share price growth slows down as they mature. And yet Microsoft, Amazon, Alphabet, Apple and Tesla have delivered returns over the past 5 years that are more commonly associated with a fast-growing, young startup!

To further illustrate the point and emphasize the gap between the US on the one hand and Europe of the other we may consider an icon of the German engineering and auto sector in Daimler Benz and comparing the past 5 years performance against other auto giants and the newcomer Tesla (albeit Tesla has acted more as a tech firm) shows an interesting picture over the past 5 years performance:

Note the example given further below of how BMW are applying AI towards their production capabilities as an example of how the auto sector can benefit from AI within their manufacturing process.

The performance over the past five (even ten) years since AI and Data Science really took off alongside the internet and smart mobile sets out clearly that shareholder value is indeed created by the tech giants who have been the early adopters of AI technology, in particular from around 2012 onwards and also with additional intensity from 2016 onwards.

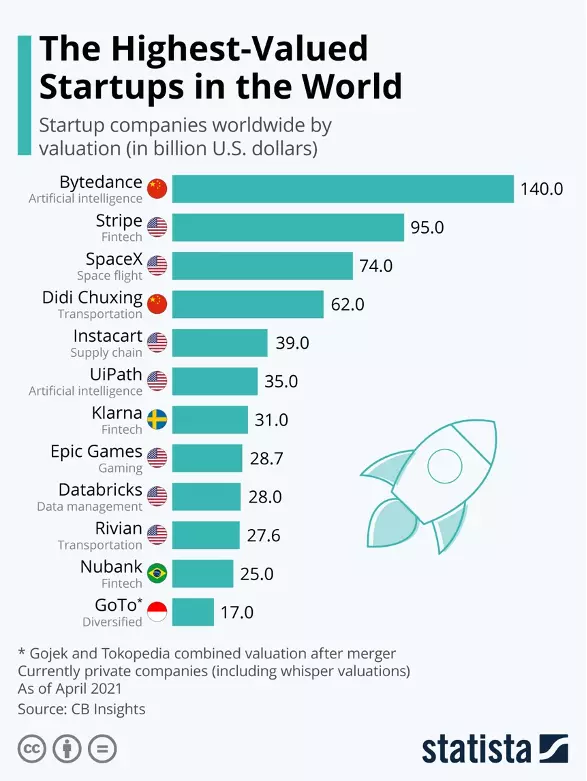

Furthermore, the most valuable startup in the world, Bytedance (owner of social media platform Tik Tok) is classified as being an AI company.

Source for image above Statista

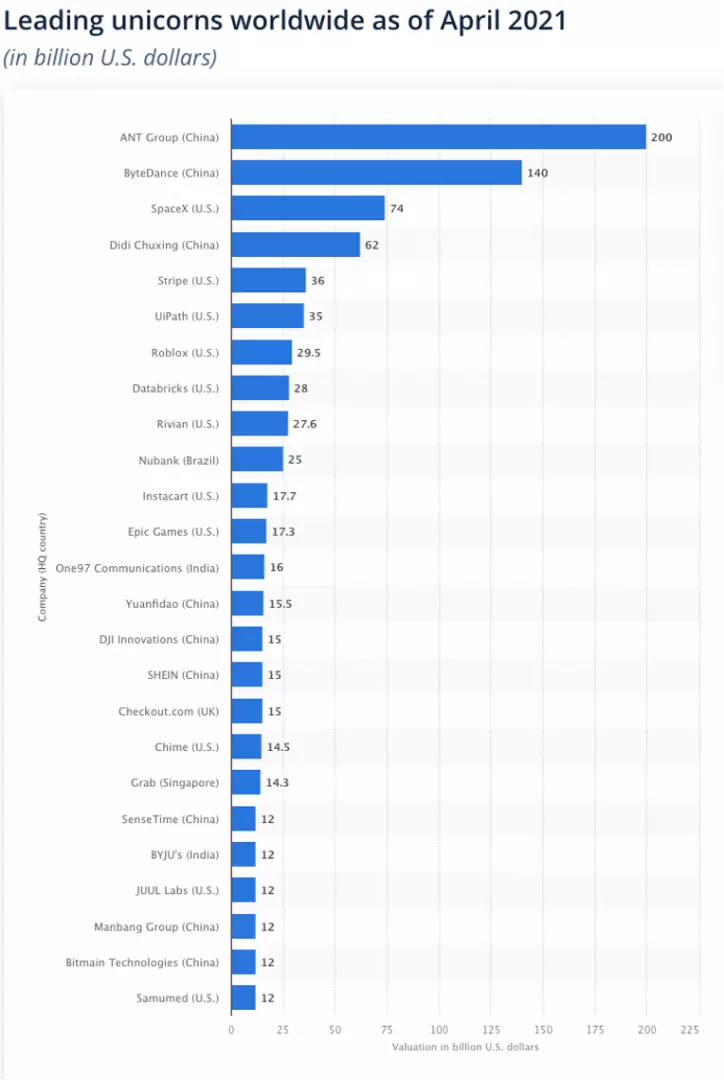

It should also be noted that the third most valuable startup on the list, SpaceX, are using state of the art AI too. Again it is also notable how the US and China dominate the list in the chart above in terms of USD valuation (China $202Bn, US $327.3Bn) relative to Europe and other parts of the world. Stripe applies Machine Learning capabilities towards fraud detection.

Statista have since revised (as of Sep 21) the valuation rankings to place Ant Group as the most valuable unicorn with a valuation of $200Bn. Nikkei Asia noted how AI and vast data support ANT Group’s financial empire observing that “Ant’s Artificial Intelligence system automatically sets credit limits and interest rates, and credit decisions are made using an “all usage history” of services from Alibaba, which owns about a third of Ant.”

The following extract from Statista emphasises the leading positions of the US and China in the new economy: “As of April 2021, ANT Group, a Chinese fintech company which spun off from Alibaba's Alipay, was valued at about 200 billion U.S. dollars, which made it the highest valued unicorn globally. A unicorn is a privately held company with a market valuation of one billion U.S. dollars or more. As of April 2021, there were over 590 unicorns globally, with the majority based in the United States and China.”

If AI can help enable the tech majors to attain such high valuations, then one may ask how can we scale the capabilities of AI to the wider sectors of the economy? The starting point is to understand why AI projects are failing and how to avoid this.

Garter set out three key reasons for the failure of AI projects:

The business objective of the project was noted as the major challenge. AI and in particular the fast-moving state of the art (SOTA) approaches are highly technical and complex areas. Equally much of Data Science is to do with statistics and coding and much of the Data Science terminology that the Data Science team view as everyday bread and butter will fly over the head of the business team as an alien language.

One key part of the problem in terms of a clear objective and performance of the Data Science team relates to organisational culture, corporate and business strategy.

Executives need to align the objectives and capabilities of AI with their Corporate and Business Strategies from the outset rather than as an afterthought.

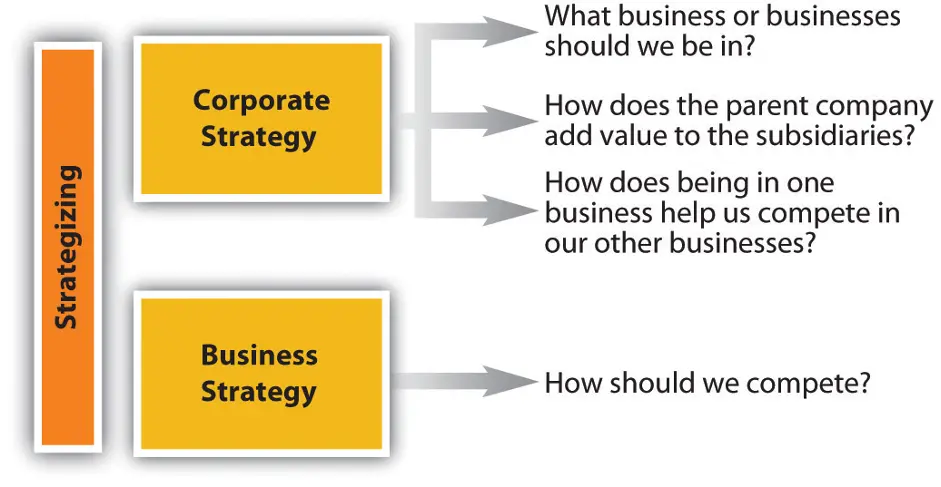

“A Corporate Strategy entails a clearly defined, long-term vision that organizations set, seeking to create value and motivate the workforce to implement the proper actions to achieve customer satisfaction” (CIO Wiki).

The role of corporate strategy is to ensure that the value of the enterprise as a whole is more than the sum of its parts.

Source for image above: International Business Saylordotorg.github.com

“Business Strategy summarizes the distinction between business and corporate strategy. The general distinction is that business strategy addresses how we should compete, while corporate strategy is concerned with in which businesses we should compete. “

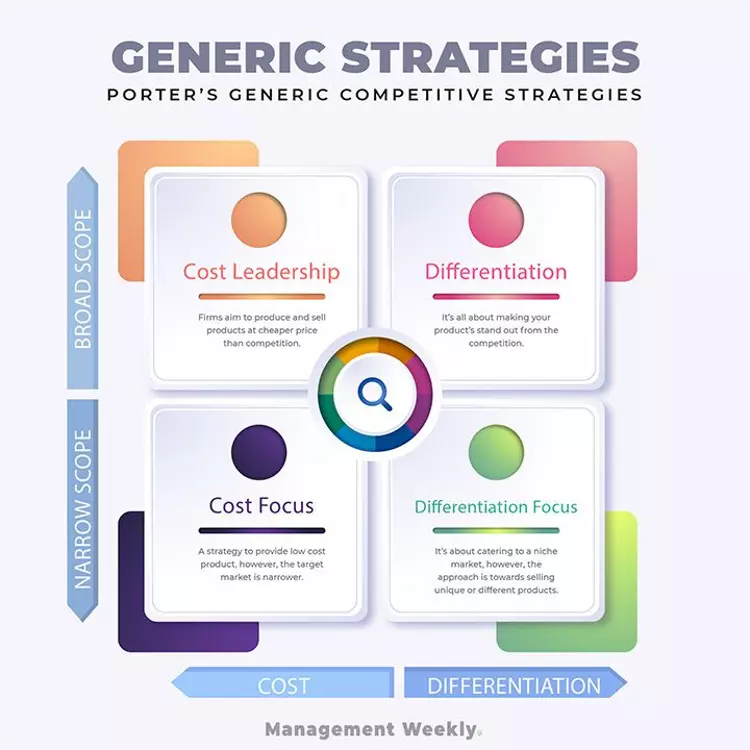

Michael Porter’s generic strategies are often considered by Business Strategists as a key reference point to consider how a firm may compete at a given business unit level.

Source for image above Arinda Mishra, Porter’s Generic Strategies Management Weekly

In terms of objectives for Machine Learning and Data Science projects, we need to ask ourselves what are we trying to achieve?

Is the Business Strategy and held the business objective for Machine Learning about cost reductions for example across our supply chain, automating repetitive back-office functions, predictive analytics for unplanned manufacturing outages?

Or is our business objective and goal for our AI project focussed on increasing revenues with targeted marketing programs?

In essence do we plan to use AI technology to enable cost leadership or differentiation objectives?

In any event we need a clear, tangible goal for the AI program and to ensure return on investment (ROI). And this will include having data that allows us to measure what has been the impact of the project from pre-implementation to post implementation, in effect what was the cost of the problem we were trying to solve beforehand and what is the cost afterwards vs the amount invested in the AI project. An example would be the unplanned outages in the auto manufacturing sector are reported to cost $22,000 per minute!

The cost relates to business operations interruptions and the fact that the machinery (assets) are often very expensive and may be damaged by the unplanned outages, in effect reducing asset life. If an AI program can detect and predict the occurrence of the outage beforehand then the cost to business production would be reduced and the asset life of the costly equipment extended. We are then able to calculate the ROI of the project based upon the frequency and duration of unplanned outages both pre and post implementation of the AI project and compare the delta (hopefully savings due to less unplanned outages) relative to the cost of the AI project (including the data infrastructure required to enable the project).

A real-world example is BMW who have obtained an award in 2020 for their work with adoption of AI across their manufacturing plants to reduce risks and increase efficiencies. For example BMW are using Computer Vision enabled by Deep Learning to check the colour and quality of paint, correct badging and defects on the parts.

BMW Blog extract below:

“BMW has been working on what they call ‘Industry 4.0‘ standards for quite some time now. They introduced robots to help out in their plants around the world, they developed exoskeletons for workers to support them and introduced amazing 3D cameras to scan for imperfections.”

Frankfurt, Germany, Sep 10, 2019: BMW Concept 4 Prototype Car at IAA, fully electric, fully connected, highly autonomous driving eco friendly future SAV car by BMW Editorial credit: Grzegorz Czapski / Shutterstock.com

Extract below from BMW Blog and may serve as a useful template for other firms:

BMW then adopted Seven principles covering the development and application of Artificial Intelligence at the BMW Group:

Human agency and oversight.

The BMW Group implements appropriate human monitoring of decisions made by AI applications and considers possible ways that humans can overrule algorithmic decisions.

This in effect was enabling a framework for embedding AI into the corporate culture albeit such initiatives should receive backing from the C-team if other firms wish to emulate BMW’s AI initiatives.

What about simply buying AI Startups?

One option in Corporate Strategy is Mergers and Acquisitions (M&A). This approach was adopted by the tech majors in the last decade with many AI startups being acquired by the large firms.

The Tech majors have engaged extensive M&A activity in relation to AI startups over the past decade.

Source for image above: CBINSIGHTS

Furthermore, Tesla has been acquiring AI startups for example in 2019 Tesla acquired DeepScale in addition to creating its own internal capabilities.

Hence we may ask should the legacy companies simply try to acquire AI startups to accelerate their digital transformation journey?

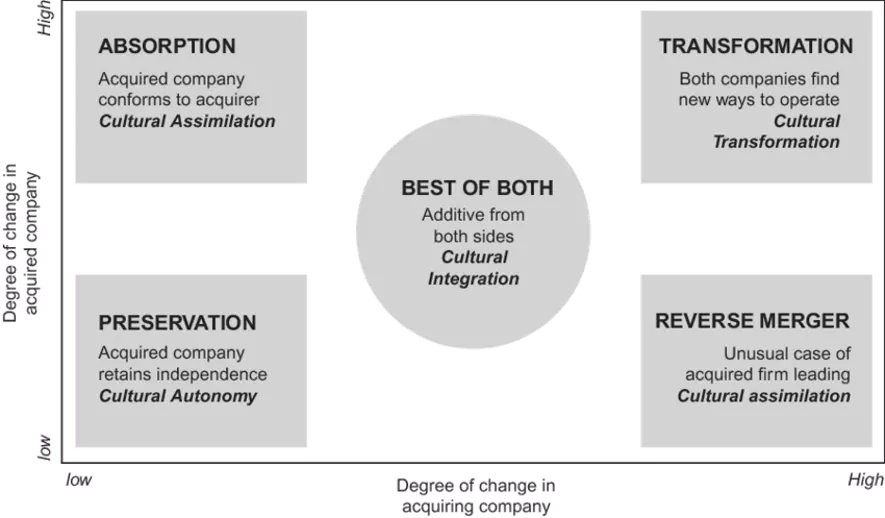

The challenge with strategic fit and a successful M&A of an AI startup into a legacy business will be organisational culture and integration. Adapting from a fast moving and dynamic culture of a startup to a legacy corporate culture with different practices and approaches to technology, people and data is not an easy transition to make and as the image below shows may require a great deal of change in either the firm being acquired or the acquirer to truly extract a best fit post-acquisition.

Dan Denison and Ia Ko (2016) Cultural Due Diligence in Mergers and Acquisitions

Cultural Dynamics of M&A. Source: Adapted from Marks & Mirvis (1992)

On the organisational side the challenge is the mindset of the C-Level of non-tech sector firms towards technology. Tech firms and startups view technology including AI as a source of revenue generation and key part of the customer experience. Legacy firms often view tech as a cost and backend process that is an evil necessity relative to the business rather than a key tool to generate value in the core processes of the company.

C-Level executives starting with the CEO need to take ownership of AI and Data Science initiatives with clear objectives and goals of what is to be achieved and for ROI.

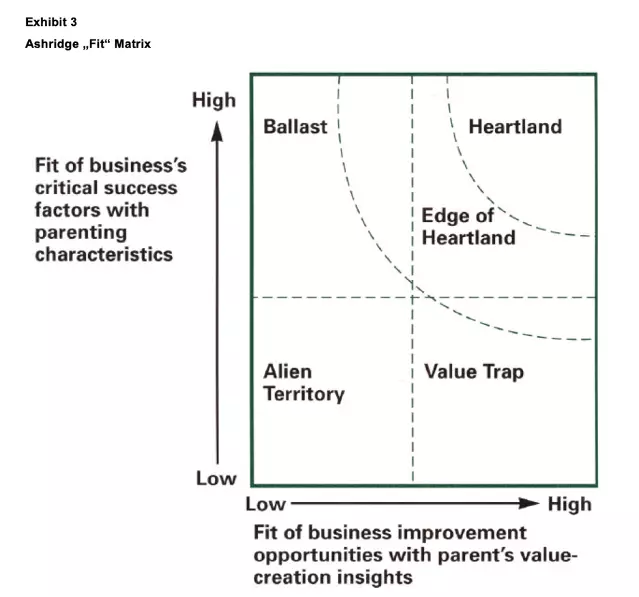

During a guest lecture that I delivered to the MBA students at London Business School, Professor Marcus Alexander (also my Strategy Professor) explained how many of the existing corporations view technology as “Alien Territory” and hence struggle to adopt technology via acquisition of Artificial Intelligence startups. An article that he co-authored and published in the HBR sets out the challenges of corporate strategy and the quest for parenting advantage.

Source for image above Alexander et al. Parenting Advantage: The Key to Corporate-Level Strategy

Torben Rick has suggested that organisational culture is like an iceberg and that 90% of the culture is hidden beneath the surface.

As noted, organisational culture is a complex and deeply ingrained feature. Aligning a tech startup with a non-tech legacy parent will entail a high degree of organisational challenges in terms of cultural fit. However, the same also applies to developing organic AI and tech teams as they too face challenges in terms of integrating with the internal cultures that have been assimilated often over a long period of time within the legacy firm.

The history of Mergers and Acquisitions (M&A) is littered with failures with a bad strategic logic or in particular poor cultural fit once the target was integrated post acquisition and led to a failure to deliver value to shareholders (in fact value was destroyed). For example prior research has shown the following in relation to M&A:

It is argued that the potential for negative outcomes from M&A are greater in relation to legacy (non-tech firms) acquiring AI startups relative to the tech majors whose cultures and understanding are likely to be more aligned.

It is crucially important that the business teams understand that AI does not exist in a vacuum. Machine Learning projects require plenty of high quality data as well as Data Science and engineering teams with appropriate skills. There needs to be an objective goal and measurement of progress including the pre and post implementation results in order to evaluate and measure the difference that the AI and Data Science projects are making to the returns of the firm.

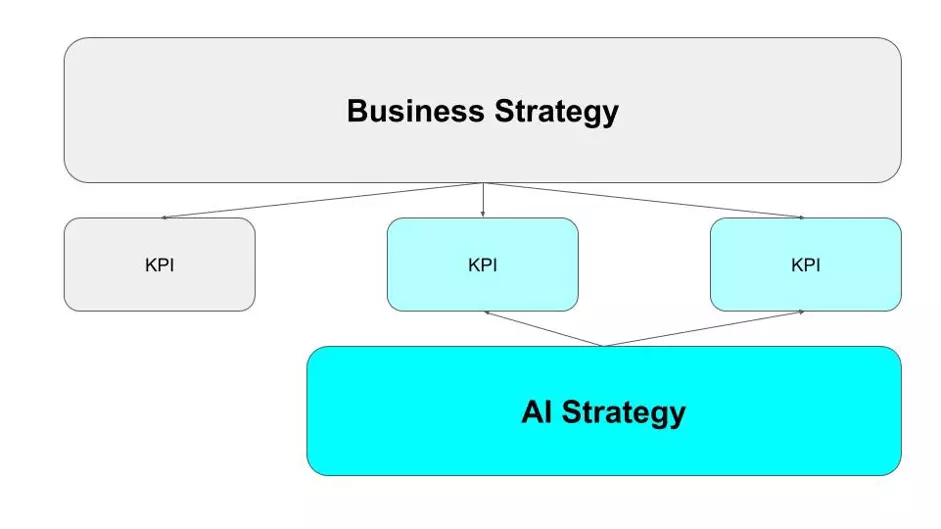

Jan Zawadzki in The Secrets to a Successful AI Strategy states that:

“An AI Strategy exists to support the business strategy. The business strategy defines the road ahead for your company. Which initiatives will provide the highest business value? Which features separate the company from competitors? A business strategy is expressed through measurable goals, e.g. in the form of Key Performance Indicators (KPIs) or Objectives and Key Results (OKRs). These methods track the progress in achieving the business goals.”

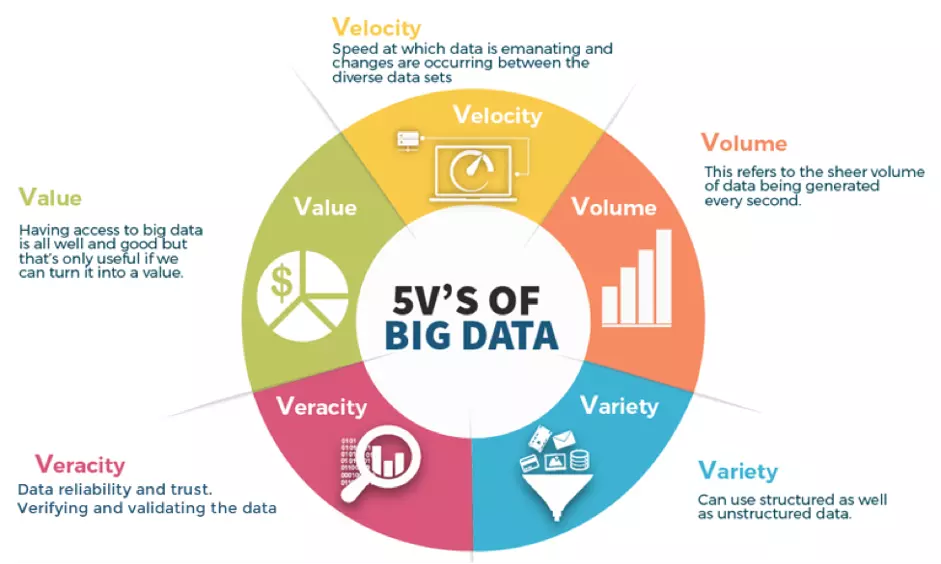

It is also essential for the Data Science teams to remember that a key part of a Big Data analytics strategy is to extract value from the data!

Source for image above: Anick The Data Veracity – Big Data, Techentice

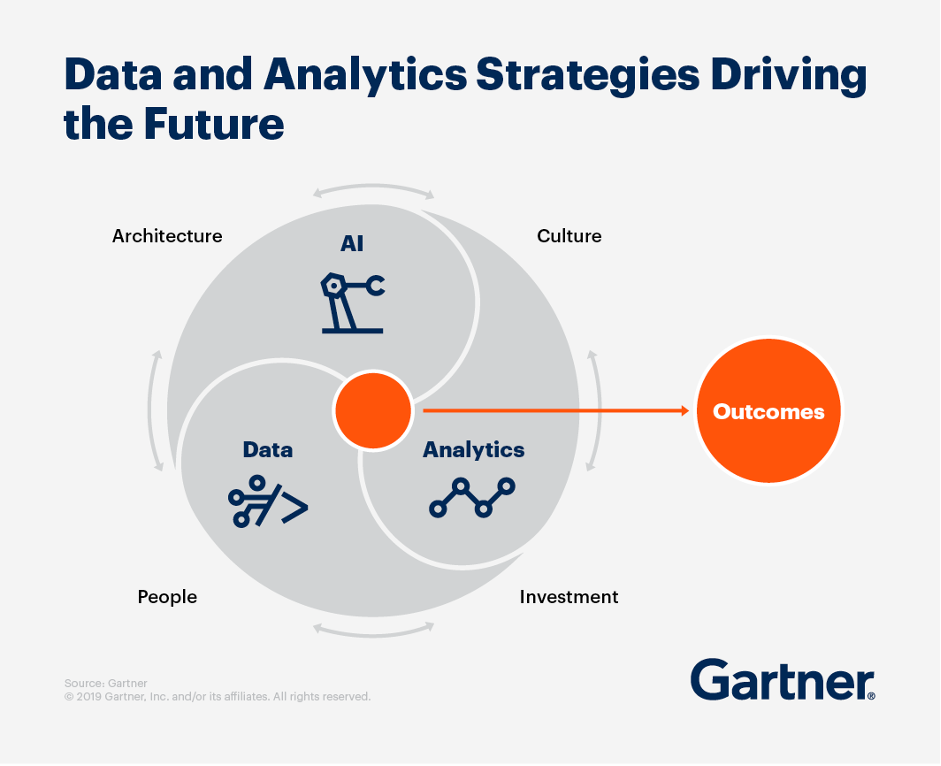

Gartner have set out that a successful AI strategy is about the following:

The infographic from Gartner above illustrates how essential it is to align human resources (ensuring that people are given the correct skills training and a Data Science team receives appropriate investment) along with architecture (including investment into data ingestion and storage capabilities).

In order to successfully scale AI across other sectors of the economy we need to continue with advances in AI R&D and also the hardware side and also crucially a change in organisational culture.

A final observation is that going forwards Corporate, Business and Data Science Strategies may be linked with ESG initiatives including the fight against climate change.

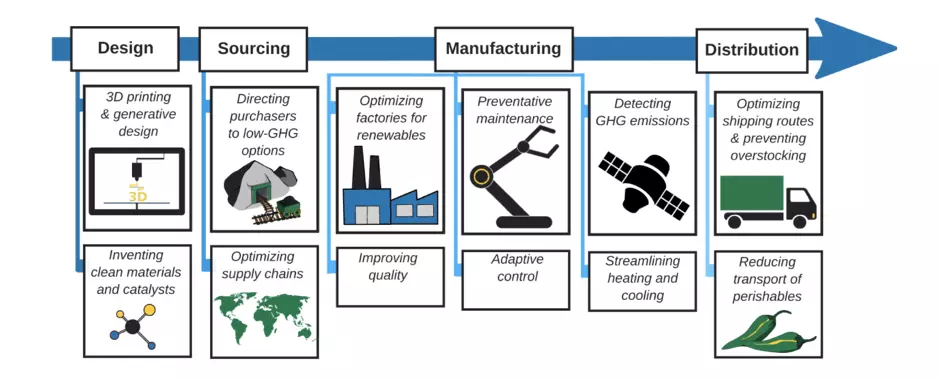

Source for image above Rolnick et al. (inc Yoshua Bengio, Demi Hassabis, Andew Y Ng)

Tackling Climate Change with Machine Learning (2019)

Rolnick et al. (2019) set out how AI may be applied to firms in different sectors of the economy to help derive efficiency gains and reduce carbon footprint in the process.

Indeed, one good example is the retail sector whereby analysts' estimates for annual wastage for unsold inventory range from $300Bn to $1 Trillion per annum! This is a huge waste both in terms of economics and as well as environmental cost. If an advanced alien were to land on our planet today, this process of extracting raw materials in Africa or Latin America and shipping them for manufacturing in the far east then shipping (or flying) them to Europe and North America for sale in premium markets whilst also incurring costs for lorries, warehouses, vans etc for local distribution and then finding that anywhere from 40% to 60% of the items in store will not sell at full price (or in some cases at all) because of lack of demand is simply nonsensical and unsustainable.

Application of AI can reduce the economic and environmental costs by finding efficiencies in the manufacturing and supply chain and also by predicting customer demand for certain products and engaging in targeted promotions to get the relevant products to the customer who actually wants them and also crucially avoiding where possible, the production of products where there is no (or weak) demand.

This article has sought to argue that AI creates genuine shareholder value and economic value. The examples of tech majors and Tesla have been used to show the potential alongside BMW.

Furthermore, the challenge for making AI work in the legacy firms relates to availability of data, investment into data science teams (including quality) as well as having a clear objective for the AI project that links back to the business strategy.

Moreover, Organisational Culture has been flagged as a key area whether the intention is for a legacy firm to acquire an AI startup and successfully integrate it or to develop AI skills internally and organically then culture will be key with C-Team having to take ownership and think like a tech team.

Firms need to value their data and invest in data systems with a view to integrating this into their strategies on value creation for the firm and not just viewing tech (whether AI, modern data systems, and digital in general) as a cost base but rather to view and design from the outset of the project what the revenue potential or cost saving synergies maybe as a result of the project post-implementation. There also needs to be a tangible reference point to measure business as usual (BAU) against the results of the AI project post-implementation in order to calculate the ROI.

Imtiaz Adam is a Hybrid Strategist and Data Scientist. He is focussed on the latest developments in artificial intelligence and machine learning techniques with a particular focus on deep learning. Imtiaz holds an MSc in Computer Science with research in AI (Distinction) University of London, MBA (Distinction), Sloan in Strategy Fellow London Business School, MSc Finance with Quantitative Econometric Modelling (Distinction) at Cass Business School. He is the Founder of Deep Learn Strategies Limited, and served as Director & Global Head of a business he founded at Morgan Stanley in Climate Finance & ESG Strategic Advisory. He has a strong expertise in enterprise sales & marketing, data science, and corporate & business strategist.

Leave your comments

Post comment as a guest