High street banks are facing the biggest challenge in their existence by challenger banks and FinTech. Last year, 583 bank branches were closed in the UK setting a record that will only be broken this year again with an estimated 762 branches being closed in 2018.

Legacy Banking

The most affected are the bank branches in rural and lowest income areas where big banks are trying to slash costs in the face of stiff competition from online and challenger banks.

British banks and building societies are under pressure to lower costs and therefore are closing brick-and-mortar bank branches all across the country at a rate of 300 per year since 1989.

According to data from the University of Nottingham, there will only remain around 8000 bank branches by the end of this year which pales in comparison to the 17831 bank branches in 1989.

Bank branch closures are not only a UK problem, but a global phenomenon.

The reasons for this decline are obvious, more and more people bank online and most do so through an app on their smartphone.

For the older generation this is most unwelcome as many do not even have a computer or smartphone and even if, would not really know how to use it.

This matter is of such a great concern that lawmakers and campaigners are trying to put in place safeguards so that the older generation and most vulnerable customers still have access to in-person banking.

One such solution is banking at the Post office which still has an impressive 11500 branches across the country.

For millennials, online banking is more convenient so bank branch closures is not really a concern. What does concern millennials are bank charges/fees and challenger banks provide exactly that, competitively priced bank charges (some even free) combined with a superior customer experience through a user-friendly app with great customer support.

This trend will not only continue but accelerate as more challenger banks enter the market and start providing even better banking services at even lower cost.

Legacy banking will go the way of the “horse & carriage” with only a few traditional banks surviving for prestige and nostalgic reasons.

PSD2

The Economist has described PSD2 as an “earthquake” in European banking. And indeed it will be.

It will shake up the banking and financial industry in an unprecedented way.

So what is PSD2 ?

In simple terms, if a customer has given explicit consent, it will force banks and financial institutions to share customer account information with other licensed financial-services providers through API (Application Programming Interface).

The thinking behind PSD2 is to open the banking and financial industry to newcomers and at the same time make it more competitive.

A Brave New World in Financial Services Open banking

The opening up of customers' accounts, with their consent, to third parties - is fundamentally changing the retail banking landscape across the globe, and in Europe in particular, with the upcoming implementation of PSD2 (the revised Payment Services Directive2).

There are many definitions of open banking—it clearly means different things to different people depending on what they have seen or read.

With that in mind, we define open banking as the use of APIs (application programming interfaces) to open up consumers’ financial data (with their permission) to third parties, enabling those companies then to create and distribute their own financial products.

Four trends have converged to create the conditions for open banking :

1 - Regulation - new regulations, such as PSD2, are ushering in open banking.

2 - Innovation - new technology, particularly smart devices and the shift to instant payments, are opening up new opportunities in financial services.

3 - Changing consumer expectations - consumers’ increasing desire for frictionless experiences with the always-on, multi-device and 24/7 becoming expected

4 - Competition - competitive pressures including the emergence of new entrants, such the neo-banks, and incumbent banks launching their own API portals

On January 13, 2018, PSD2 will become national law in each of the EU member states and then banks will have to be ready for immediate and proper implementation.

Source: AT Kearny - A Brave New World in Financial Services

Financial services, wealth management and insurance will be the biggest beneficiaries of PSD2 as they will be able to access customer data through API’s and offer their services directly to the bank customer.

For the customer, the benefits will be that he/she will be able to compare prices and if necessary, easily switch from one provides to another.

Near-Zero Marginal Cost

Asset-based business models such as Walmart are at a great disadvantage as compared to tech retail giants such as Amazon or Alibaba.

Whereas Amazon transactions are online and many products are stored in the cloud (Kindle books, movies, music), Walmart has a global physical distribution network that supplies Walmart’s 11695 “brick-and-mortar” stores worldwide.

Physical assets require people and people cost money.

Amazon on the other hand uses superior technology, cloud storage and physical handling of goods using robots with as little as possible involvement of human operators.

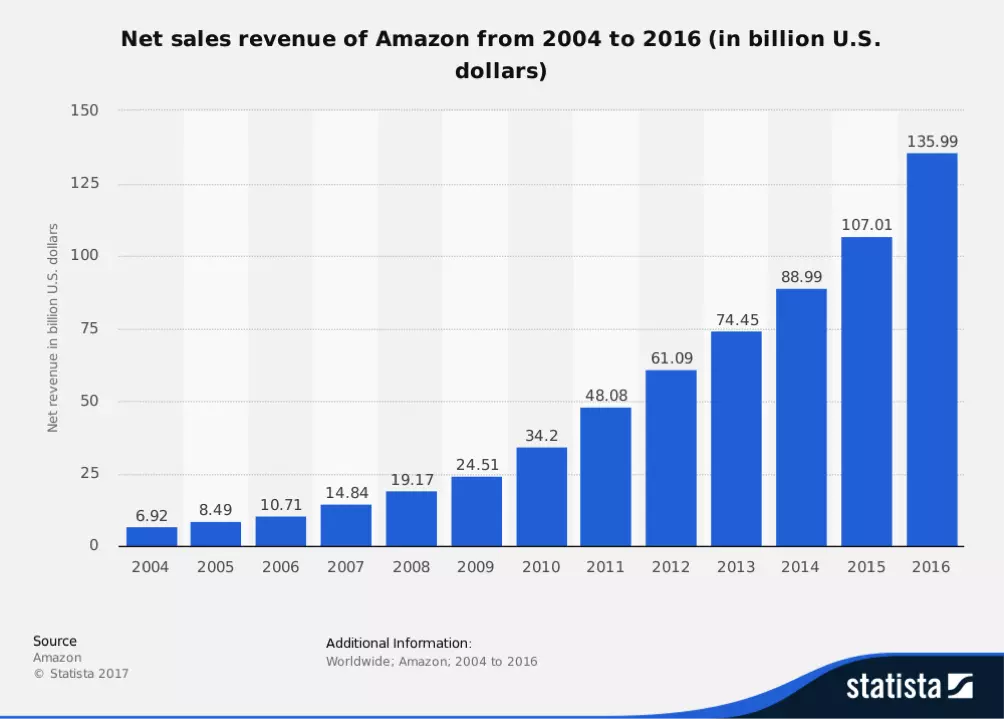

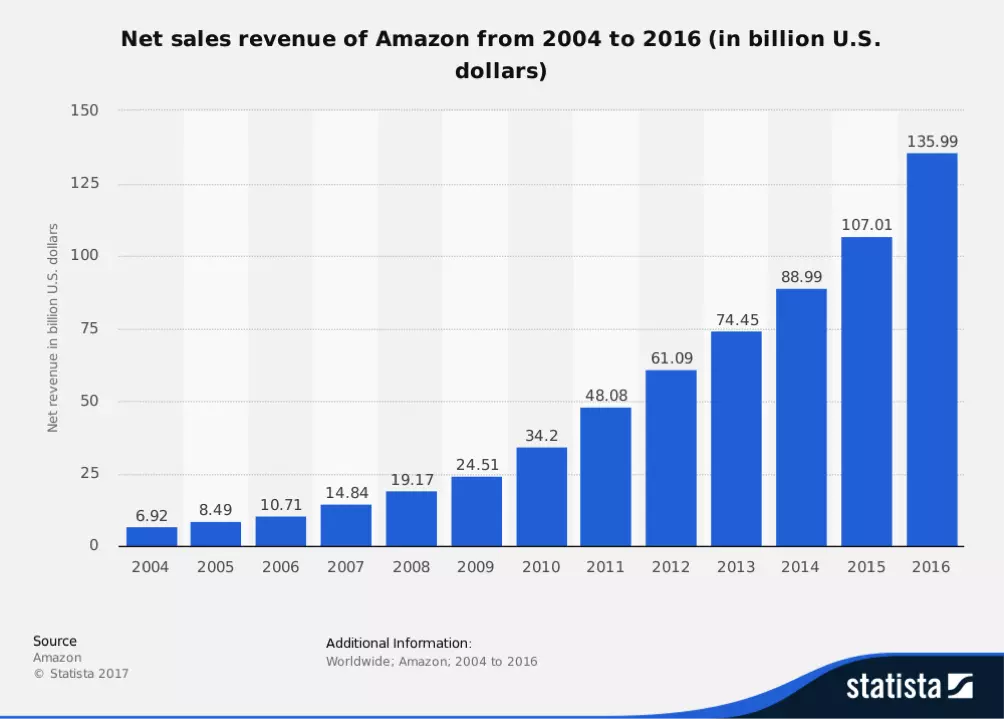

This strategy of using technology across the entire Amazon business model results in driving down costs, increasing revenues and in the end massive profits – profits of $749 million on revenues of $136 billion (year end 2016).

Source : Amazon – Statista

The advantages of platform economics are numerous and the concept of “near-zero marginal cost” is the most important.

Marginal cost is defined as the cost of producing an additional unit of a good or service after fixed costs have been absorbed.

Source : Huffpost

Near-zero marginal cost is achieved when the additional cost of producing another good or service is fractional in proportion to the gained revenue.

In other words, the more revenue, the less cost of producing an additional product or service.

Prime examples in the tech world are Amazon, Airbnb and Uber.

In FinTech, digital wealth platforms, robo-advisories and challenger banks are the champions of platform economics and near-zero marginal cost.

Artificial Intelligence & Machine Learning

John Cryan, the boss of Deutsche Bank, hinted that perhaps half of its 97,000 employees worldwide could lose their jobs.

So far, the German bank has shed just 4,000 of a planned 9,000 jobs pledged in a five-year restructuring announced in 2015.

Many manual tasks done by its employees may be suitable for robots and machine learning.

Source : Economist Espresso

Without knowing, most consumers are already using artificial intelligence and machine learning throughout their daily lives.

Intelligent personal assistants such as Apple’s Siri, Amazon Alexa and Microsoft Cortana are the most known and used on a daily basis, with rapidly growing user engagement.

To grow the user engagement even more and to gain market share, the 3 biggest tech companies produce VCD’s (voice command devices) such as Amazon Echo, Google Home and Apple HomePod.

As consumers get used to using these devices at home, the services on offer will increase exponentially.

The Internet of Things - a network of interconnected physical devices - will add another dimension to the voice controlled operation of household appliances such as TV, music installations, fridges, washing machines, dishwashers and home heating/temperature control units.

So what exactly is artificial intelligence and machine learning?

Artificial intelligence is a collection of advanced technologies that allows machines to sense, comprehend, act and learn.

Source : Accenture

Machine learning is a method of data analysis that automates analytical model building. Using algorithms that iteratively learn from data, machine learning allows computers to find hidden insights without being explicitly programmed where to look.

Source : SAS

Gradual adoption of these new technologies will advance the efficiencies created and will make life easier, that is, the efficient use of time in an ever increasing workload and information overload.

Big Data Analytics

The definition of big data analytics is the process of examining large and varied data sets, both structured and unstructured - i.e. big data - to uncover hidden patterns, unknown correlations, market trends, customer preferences and other useful information that can help organisations make more informed business decisions.

Source : SearchBusiness Analytics

Big data is so important and valuable that it has been defined as the new gold rush in the digital age.

Countless companies - from tech to IT - are vying for big data market share and leadership and at the same time discovering processes to efficiently analyse this data for valuable clues in consumer behaviour.

Being able to extract, analyse and process big data provides unique insights in consumer behaviour and can be further used in predictive analytics.

Before the advent of big data analytics, market research by the likes of Nielsen and Forrester would provide companies with market information and consumer behaviour analytics enabling marketing & sales departments to somehow predict future consumer trends.

Big data analytics has completely changed the process of analysing consumer behaviour and the predicting of trends as it incorporates significantly more “touch points” along the customer sales funnel and analyses not only structured data but also unstructured data which sometimes can reveal surprising patterns of data and customer insights.

Knowing what a customer wants beforehand can be a very profitable proposition for big businesses.

Algorithms

The information extracted through data mining and analysis as well as by using artificial intelligence and machine learning can be processed using algorithms to create effective means of solving problems and creating solutions to the benefit of the user.

In daily use, algorithms provide shortcuts and efficiencies to complicated tasks without the user even knowing of the technology running the background.

Every platform uses algorithms to enhance the user-experience and to provide efficient solutions to complicated calculations.

In FinTech, algorithms provide solutions and significantly increase the user-friendliness of apps and online applications.

Challenger banks, online insurance and digital wealth management - the pioneers of FinTech as we know it today - benefit greatly by using algorithms and thus have the comparative advantage of legacy banks using out-dated and inefficient IT infrastructures.

Targeting the Masses

Big tech companies use all the efficiencies and benefits of platform economics to provide their users with superior user-experience and ultimate customer satisfaction.

When properly implemented, platform economics can result in increased market share and big profits.

The likes of Apple, Amazon, Alibaba, Google and Facebook are nearly reaching the trillion dollar market capitalisation although none have quite broken through yet, however this only a matter of time.

Currently, Apple has a market cap of an astronomical $ 905 billion, followed by Google $ 728 billion, Amazon $ 545 billion, Facebook $ 522 billion and Alibaba $ 481 billion (as of 11 Nov 2017)

It has been rumoured and it’s widely expected that eventually big tech such as Amazon, Google and Facebook may enter into banking and financial services, providing their massive user base with all the tools to transfer payments, get loans and insurances or even deposit money on their online savings accounts.

Amazon has already started to enter the financial services space by offering Amazon Cash, a service currently only available in the US and more recently, Apple Pay Cash has been incorporated in the Apple Pay app to offer cash upload and payment facilities to it’s US customer base.

It’s only a matter of time before big tech financial services are rolled out world-wide.

For platform users, having access to financial services online can save time and money.

Why go to a bank branch to deposit a cheque or withdraw money from an ATM when it all can be done online ?

Big tech companies such as Facebook, Google, Amazon and Apple have the comparative advantage of massive economies of scale and a loyal user base that will not easily switch to another financial services provider because all the financial services facilities will be embedded into a platform with which the user is already familiar with and uses every day.

Alibaba has already entered the financial services market through it’s payments subsidiary Ant Financial (and it’s online payments platform Alipay) which is currently the biggest FinTech in the world valued at a staggering $60 billion which is close to Uber’s $ 70 billion valuation and double that of Airbnb.

Whereas the dragon may be the quintessential Chinese icon – a symbol of power, strength and luck – the country may very well have to start thanking a mighty ant, Ant Financial, for much of its success in the eCommerce and fintech arena. But, what exactly is Ant Financial?

Ant Financial – and its online payments platform Alipay – is Alibaba’s financial services arm. Alibaba is China’s top eCommerce company, which posted a quite impressive set of results in 2016: $15.69 billion in revenues and an EBITDA of $8.12 billion, up 33% and 28% from last year, respectively.

Also, Ant Financial controls 70% of the mobile payments market in China. Alipay has a network of close to 100,000 retailers in 70 countries and regions, including France and Germany.

As of today, Alipay is a pivotal part of Ant Financial’s business, but the company is quickly expanding in other areas, including asset management and lending. And to grow in these different branches of the fintech business, the company is building on the soundest foundation a company could wish for: a user base of 450 million people, many of which use Alipay to pay for a sizeable chunk of the 175 million transactions that Alibaba processes every day.

Source : BBVA

Banking, insurance and wealth management are the key financial industries that are being targeted for FinTech disruption and the stakes are sky-high.

Revolut – a digital bank based in London – has already 850.000 platform users and is aiming for 1 million customers before year’s end 2017 through rapid expansion plans overseas to all of Europe, United States and the Far East.

Robo-advisor giants such as Betterment ($10 billion AUM - assets under management), Schwab Intelligent Portfolios ($10 billion AUM) and Wealthfront ($7.5 billion AUM) have already conquered the wealth management industry.

By providing cheaper wealth management services using ETF’s (Exchange Traded Funds) as opposed to personal financial advisors used by traditional brokerages, robo-advisors not only compete on price but on service as well.

The service in this context is not of using personal financial advisors but in the support of its customer base and their finances.

Using the latest technology through the use of algorithms, robo-advisories provide their customers with tools that are used by professionals in the finance industry.

Portfolio re-balancing, asset allocation, risk management, tax harvesting, pensions, ISA (individual savings account), SRI (socially responsible investing) and sustainable investing are some of the innovative additional robo-advisory services on offer depending on which country one lives.

Until recently, wealth management was reserved for the wealthy that could deposit the minimum amount of £ 10.000 or more.

Robo-advisors - in their quest to capture market share - democratised wealth management by lowering the minimum deposit requirement to a mere £ 1000.

Newcomers such as “zero-robos” even accept a minimum deposit of only £ 1 and offer zero fees with the intent to gain market share.

The playing field has changed for good and wealth management has been democratised by using platform economics.

FinTech companies even have a better comparative advantage over big tech platforms such as Amazon and Alibaba because FinTech platforms benefit from „pure“ platform economics, everything is stored and transacted in the cloud (except for the physical shipment of bank-, debit- or credit cards) whereas retailers are for the most part online (where all purchasing transactions take place) but still incorporate the physical aspect of actually shipping goods and products to their customers.

Legacy banks and brokerages have seen their customer base dwindle and are playing catch-up to the FinTech industry but lagging behind in service and technology.

FinTech - which is financial technology at its best - is targeting the mass market with their innovative financial products, superior user-experience and ultra-fast execution through platforms that have been developed with the end-user in mind.

The power of platforms is only the beginning of a tectonic shift in the financial industry. Artificial intelligence, machine learning and big data analytics will seal the fate of legacy banks & brokerages that fail to implement digital technology in their financial offering to the new generation of mass-market consumers.

Leave your comments

Post comment as a guest