Comments

- No comments found

The first thing any economist should do while reading a budget proposal is to analyse the basic macro assumptions and the results presented by the administration.

When both macro assumptions and results are poor, the budget should be criticised. This is the case of the Biden Budget Plan: same growth, a lot more debt and less employment.

According to the current US administration, the impact on growth of the Biden budget plan will be negligible, as their own -and optimistic- estimates see no change in the slowdown of the U.S. economic growth trend.

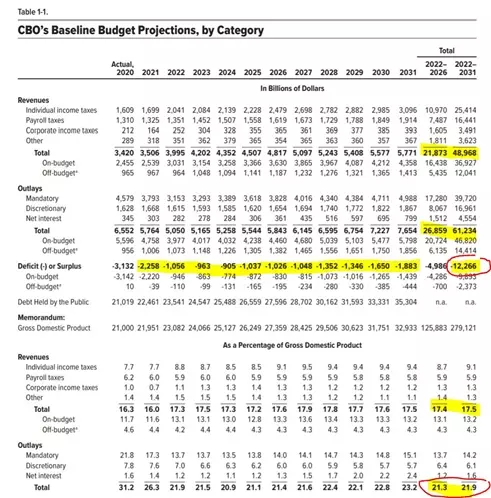

The CBO (Congressional Budget Office, The Budget and Economic Outlook: 2021 to 2031) estimates a 1.7% average real growth in GDP between 2020 and 2030, the same average they forecast for the 2025-2030 period. This is lower than the potential real GDP growth of the U.S. economy but driven by much higher debt… with lower employment.

The CBO also expects an extremely poor job growth, with the unemployment rate at an average of 4.8% in the 2020 to 2030 period, a 4.1% for 2025-2030. This means not achieving the unemployment rate of 2019 even by 2030 after spending $6 trillion.

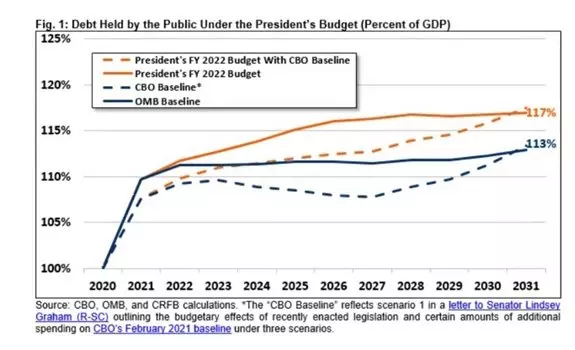

Even more concerning is the massive deterioration of the financial position of the United States. The Committee For A Responsible Federal Budget (CFRB) warns that “Federal debt held by the public would rise from 100 percent of GDP at the end of FY 2020 and a record 110 percent of GDP in 2021 to 114 percent of GDP by 2024 and 117 percent of GDP by the end of 2031. In nominal dollars, debt would grow by $17.1 trillion through the end of FY 2031, from $22.0 trillion today to $39.1 trillion in FY 2031” (President Biden’s Full FY 2022 Budget).

This is a concern because history shows us that these estimates tend to err on the side of optimistic and that debt rises faster.

The $3.8 trillion of offsets in the budget are exceedingly optimistic. The Biden administration assumes that the tax hikes will have no impact whatsoever on investment and forecasts an overly optimistic revenue collection trend. For example, estimates of tax revenue assume a growth above GDP and without any single slump in the entire period, something that has not happened in decades. Even so, the administration estimates will only cover around three-quarters of the cost of new spending, as budget deficits would total $14.5 trillion over the next decade. Annual deficits will likely average $1.4 trillion (4.7 percent of GDP) every year for a decade. There is no single year in which outlays will be covered by revenues even in these bullish estimates of economic growth.

According to the CFRB “rather than putting the debt on a stable and then downward path relative to the economy, the President’s budget would blow past the prior record and increase debt levels to 117 percent of GDP by 2031”.

Spending increases to 24.5 percent of GDP over the coming decade, according to the CFRB. The Biden administration’s baseline projection is 22.7% of GDP, significantly above both the 50-year averages of 20.6 and 17.3 percent of GDP. The problem is that most of it goes to current spending without real economic return and increasing entitlement programs that will likely affect productivity, employment, and investment. Even in the Biden administration forecast, annual spending would be 4% of GDP higher than revenues… And those revenue estimates are excessively bullish.

So how does the Biden administration expect to pay for rising deficits and debt? Neo Keynesian economists say that deficits do not matter and that the Federal Reserve can monetize the excess of spending. This begs two questions: If deficits do not matter why raise taxes massively? and, why not cut taxes instead?

The most dangerous part of the budget is that all this spending delivers no real improvement over the average trend of growth and employment while ballooning the Mandatory Spending side of the budget, making it impossible for future administrations to balance the budget.

Mandatory outlays rise by $1.2 trillion between 2021 and 2030, which shows that no revenue measure now of in the future can eliminate the deficit or cut the debt. No realistic estimate of economic growth or improved tax revenue estimate can offset an increase of $14.5 trillion in debt in ten years. As mandatory spending increases, the likelihood of improving the fiscal challenges of the U.S. economy slide away. One small recession in the next ten years and the debt will rise even faster, way above 120% of GDP.

The CBO and Biden administration projections show tax revenues rising every year in every category, and we all know this is simply impossible looking at the history of the past five decades. Furthermore, even with the CBO or Biden administration estimates, there is one clear conclusion: The United States deficit problem is a spending problem. No realistic revenue measure will balance the budget.

The question is, what inflation are they going to generate to dissolve this debt? This is the biggest risk of this budget. The Biden administration is clearly aiming at a massive increase in consumer prices to soften the debt blow in real terms, and this means lower real wage growth, weaker purchasing power of salaries and, more importantly, destruction of savings and the purchasing power of the U.S. dollar.

Many economists point to the European Union showing that many countries have levels of debt that are higher than 116% of GDP. True. They also show weaker growth, poorer employment rates and subdued productivity growth. There is also a lesson there. France, a country that has constantly raised taxes to allegedly finance a high government spending has not has a balanced budget since the late 70s and the economy has been in stagnation for decades. Unemployment, even in growth periods, is much higher than in the United States.

When you copy the European Union, you also should know you will get European Union-style lack of growth and job creation.

The Biden budget plan, in its own estimates, does not deliver higher growth or better employment levels. Reality will likely show that the results will be even poorer.

Daniel Lacalle is one the most influential economists in the world. He is Chief Economist at Tressis SV, Fund Manager at Adriza International Opportunities, Member of the advisory board of the Rafael del Pino foundation, Commissioner of the Community of Madrid in London, President of Instituto Mises Hispano and Professor at IE Business School, London School of Economics, IEB and UNED. Mr. Lacalle has presented and given keynote speeches at the most prestigious forums globally including the Federal Reserve in Houston, the Heritage Foundation in Washington, London School of Economics, Funds Society Forum in Miami, World Economic Forum, Forecast Summit in Peru, Mining Show in Dubai, Our Crowd in Jerusalem, Nordea Investor Summit in Oslo, and many others. Mr Lacalle has more than 24 years of experience in the energy and finance sectors, including experience in North Africa, Latin America and the Middle East. He is currently a fund manager overseeing equities, bonds and commodities. He was voted Top 3 Generalist and Number 1 Pan-European Buyside Individual in Oil & Gas in Thomson Reuters’ Extel Survey in 2011, the leading survey among companies and financial institutions. He is also author of the best-selling books: “Life In The Financial Markets” (Wiley, 2014), translated to Portuguese and Spanish ; “The Energy World Is Flat” (Wiley, 2014, with Diego Parrilla), translated to Portuguese and Chinese ; “Escape from the Central Bank Trap” (2017, BEP), translated to Spanish. Mr Lacalle also contributes at CNBC, World Economic Forum, Epoch Times, Mises Institute, Hedgeye, Zero Hedge, Focus Economics, Seeking Alpha, El Español, The Commentator, and The Wall Street Journal. He holds a PhD in Economics, CIIA financial analyst title, with a post graduate degree in IESE and a master’s degree in economic investigation (UCV).

Leave your comments

Post comment as a guest