Comments (1)

Ashleigh Boyle

Interesting analysis

Here's an odd fact: Even though the total assets of US investors abroad is smaller than the total assets of foreign investors in the US economy, the total returns earned by US investors abroad has historically been larger than what is earned by foreign investors in the US economy. How does that happen?

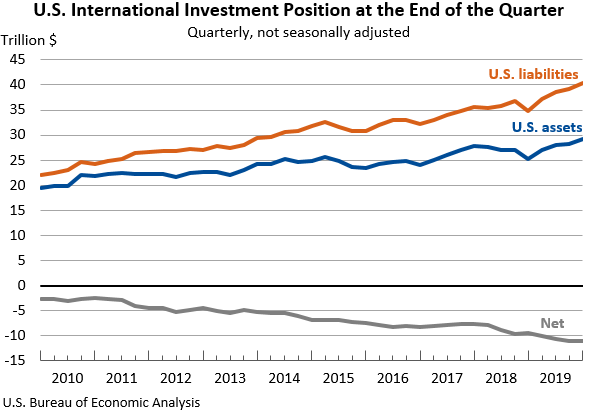

As a starting point, here's the data on "International Investment Position" from the Bureau of Economic Analysis. As you can see, US assets abroad are rising, reaching $29.3 trillion at the end of 2019. But US liabilities--that is, ownership of US assets by foreign investors--is substantially larger at $40.3 trillion at the end of 2019.

Alexander Monge-Naranjo, in "The United States as a Global Financial Intermediary and Insurer" (Economic Synopses: Federal Reserve Bank of St. Louis, 2020, No. 2) delves into the return on these international investments. He calculates that from 1952-2015, the average annual return on assets that US investors was 5.2%, while the average annual return on assets held by foreign investors in the US economy was 2.5%.

Why does this difference exist, and how can it persist? As Monge-Naranjo argues, the typical pattern is that US investors in other economies are relatively more likely to invest in higher-risk asset--like investments in companies. Conversely, foreign investors in the US economy are relatively more likely to put their money into a safer asset, like US Treasury debt. In this sense, the patterns of international investment in and out of the US economy look like an insurance arrangement for the rest of the world--that is, investors in the rest of the world are trading off lower returns when times are good for safer and steadier returns when times are bad.

Or to put it another way, the US economy from this perspective resembles an investment fund which raises funds by issuing lower-cost debt and then makes money by investing in higher-risk companies. This situation is not especially troubling. The US economy is the world's main producer of internationally-recognized safe assets like US Treasury debt; indeed, in bad economic times investors around the world are more likely to stock up on safe assets. In addition, the US financial, legal, and regulatory infrastructure is a huge advantage for US investors, helping to give them the confidence to make higher-risk investments in other countries. Of course, if US Treasury debt stopped looking like a safe asset, and better alternatives bloomed around the rest of the world, the current arrangement would be unsustainable--but in that situation, the US economy would be experiencing a lot of other problems, too.

Bottom line: If you dig down into the "International Transactions" accounts from the Bureau of Economic Analysis, you find that in 2019, the "Primary Income Receipts" for the US economy on foreign investments abroad were $1,123 billion in 2019, while the "Primary Income Payments" flowing from the US economy to foreign investors was $866 billion.

A version of this article first appeared here.

Interesting analysis

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest