Comments

- No comments found

About a month ago, I wrote a “Is the US Economy Seeing an Upsurge of New Firms?” based on some patterns I had noticed in the data.

I didn’t realize that I was about to be big-footed–that is, some real experts on this subject were just about to weigh in. At the Fall 2023 Brookings Papers on Economic Activity conference, held yesterday and today, Ryan Decker and John Haltiwanger presented “Surging Business Formation in the Pandemic: Causes and Consequences?” A draft of the paper, along with drafts, slides, and full video for the conference as a whole, is available at the conference website.

Decker and Haltiwanger confirm the basic facts of my earlier post (I write thankfully). But they also put the facts in a broader perspective, by emphasizing that formation of new businesses was one of the ways in which the US economy pivoted during the dislocations of the pandemic recession, as well as in response to certain opportunities opened up by the recession like more widespread acceptance of remote work.

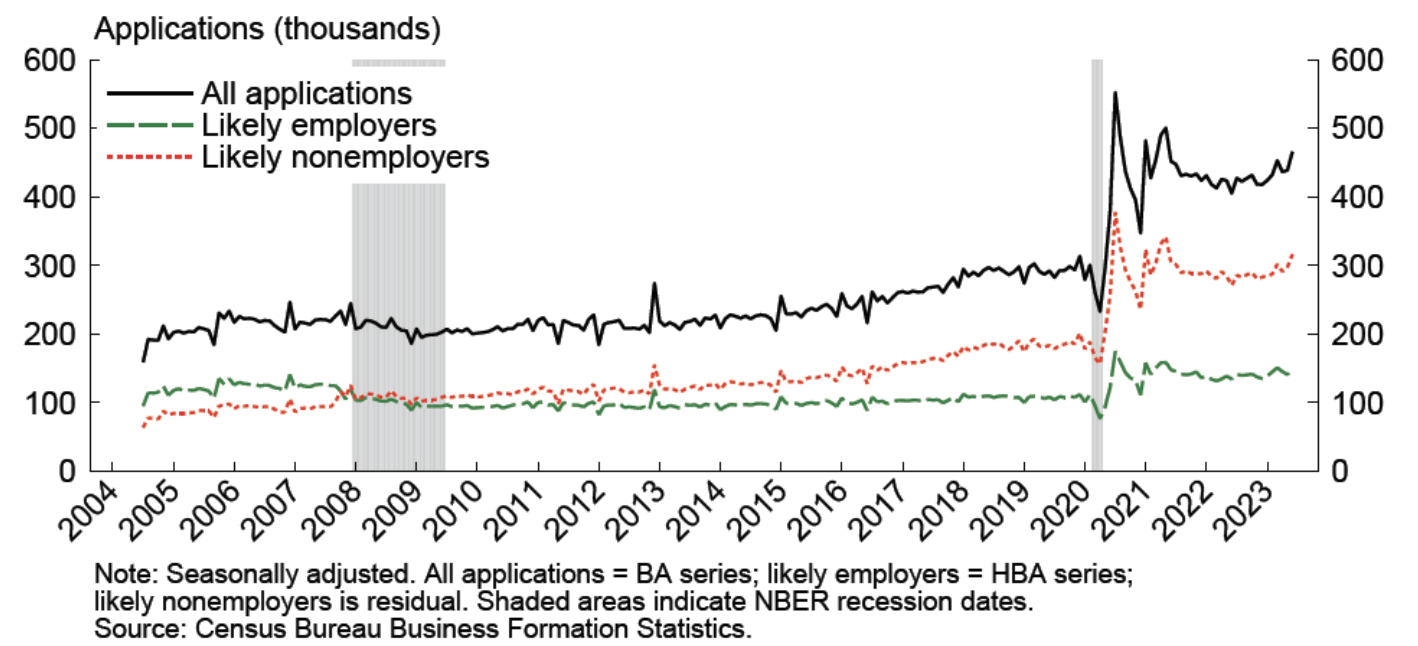

Here are the basic patterns under discussion. When starting a new firm, it’s common to apply to the Internal Revenue Service for an Employer Identification Number, which is needed if the plan is (someday) to hire employees. Such applications spike after the pandemic. Moreover, the government statisticians also try to keep count of which applications seem likely to turn into firms that employ people–not just a business for one person. Here are the patterns:

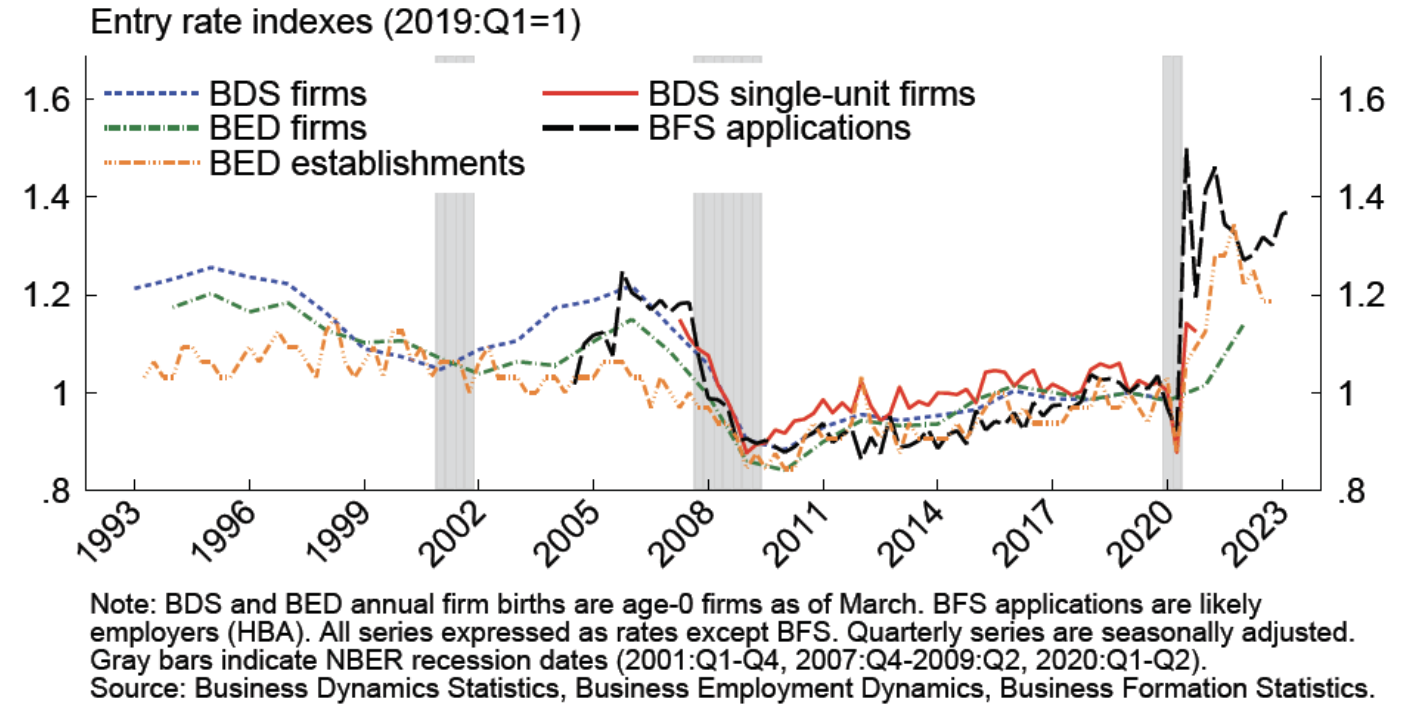

The obvious question is then whether these applications for employer ID numbers are followed by actually opening a new firm. The available quarterly data here is about “establishments,” which refers to a business operating at a certain location. One firm can have multiple establishments. This data is collected through the Quarterly Census of Employment and Wages, and it based on the fact that employers need to pay into state unemployment insurance funds–and thus need to report where they are operating. Here’s the data on formation of new establishments for several categories spelled out in more detail in the paper.

The authors summarize their overall findings this way (again, much more detail in the paper itself):

This set of facts lends itself to a compelling narrative of pandemic business and labor market dynamics. The pandemic sparked rapid, dramatic changes to the composition of consumer demand and to preferences for work and lifestyle, and these patterns have continued to evolve through mid-2023. From the standpoint of potential entrepreneurs, these dramatic changes presented opportunities—both to meet newly formed consumer and business needs and to change the career trajectories of the entrepreneurs themselves. Entrepreneurs made plans and applied to start businesses both early on and through mid-2023; some of these plans have resulted in new firms and establishments that hired workers in large numbers. Entrepreneurial opportunities and the demand for employees at these new firms appear to have played an important role in the “Great Resignation,” as some quitting workers likely flowed toward new businesses (as either entrepreneurs or new hires). Taken together, these patterns imply significant economic restructuring across industry, geography, and the firm size and age distribution. The extent to which these changes will be long lasting has yet to

be seen. …

The rise in applications and employer entry is highly concentrated in a few industries that are conducive to pandemic patterns of work and life (such as online retail and other high-tech industries), consistent with the changing sectoral structure of the economy. We also observe substantial spatial variation in the surge in applications and business entry, consistent with geographic restructuring. The surge in applications and business entry is especially notable in the South, with states such as Georgia standing out. Within large cities we observe a “donut effect” with applications surging more in the suburbs of metropolitan areas than in central business districts. …

We find a tight spatial correlation—at the state and county level—between surging business applications and quits (or excess separations, a close proxy for quits), with a much weaker correlation between applications and layoffs (or job destruction, a close proxy for layoffs). Among other possible explanations, these results are consistent with workers quitting their jobs to start or join new businesses—and somewhat less consistent with job loss being a key driver of business formation. …

We also document a pandemic pause—and modest reversal—of the longer-run shift in activity toward large, mature businesses. The share of activity accounted for by young and small firms has risen; young and small firms exhibit a higher pace of dynamism than large and mature firms, so one might anticipate an ongoing increase in the pace of dynamism. In other words, we find early hints of a revival of business dynamism; but in many respects it is too early to ascertain whether a durable reversal of pre-pandemic trends is occurring.

I sometimes say that the pandemic recession had the effect of dramatically accelerating some changes that were already underway, but at a slower pace: telemedicine become common for a time; online education boomed for a time; online purchases and home delivery continued to grow; and work-from-home increased as well. The greater flexibility to start one’s own business may turn out to be another shift.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest