While global growth is somewhat improving as a whole, it does not indicate a coordinated and sustained rate hike cycle across central banks. The issues facing each country are unique at present, and accordingly, central banks are most likely to consider the domestic environment when taking interest rate calls, even as they are impacted by other central banks' interest rate stance.

Bank of England is Worried about Inflation..

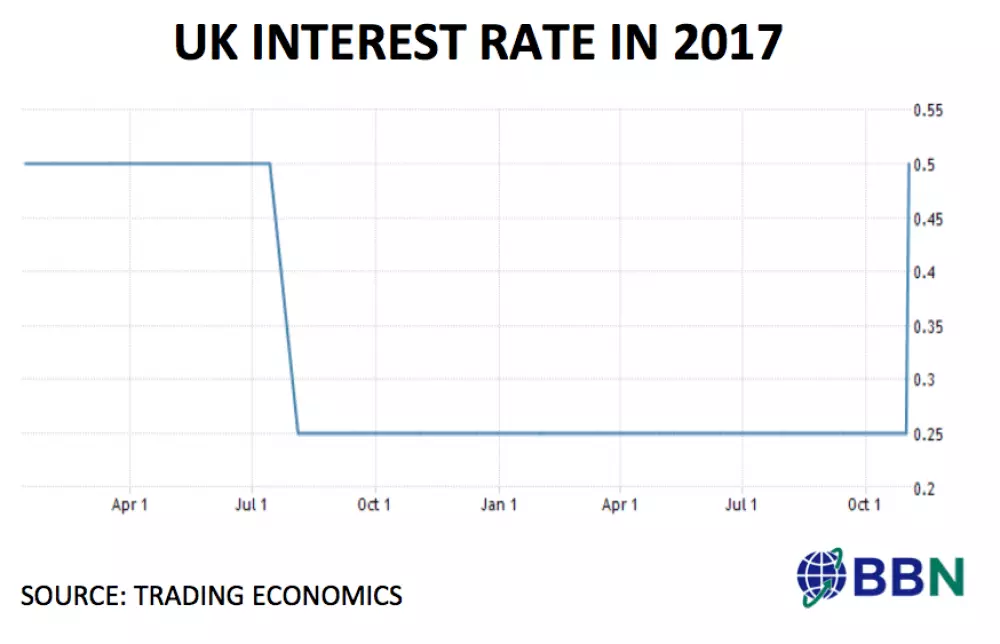

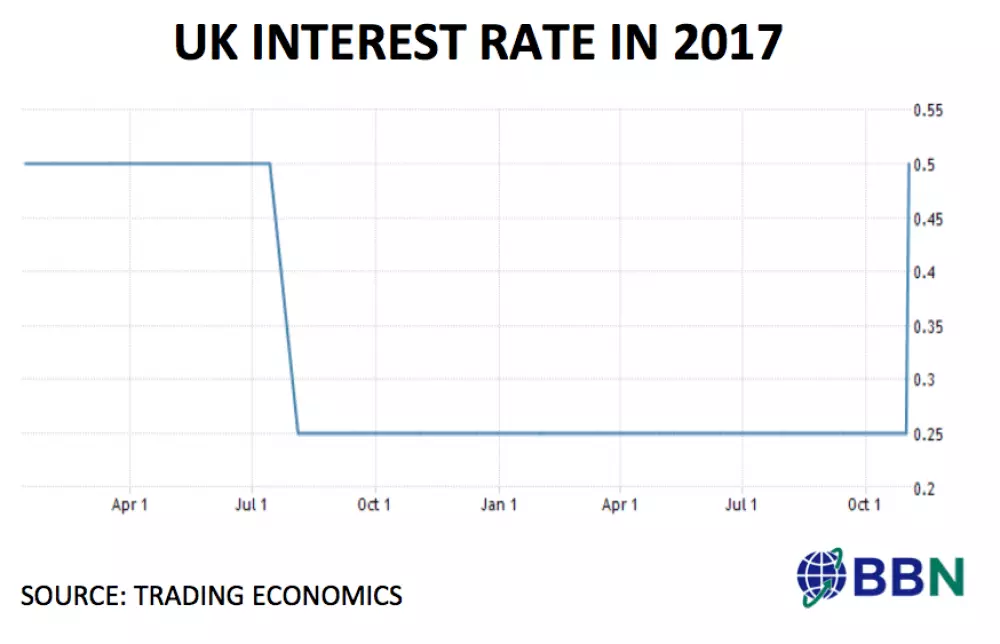

Bank of England governor Mark Carney pointed out in his press statement on the monetary policy that maintaining the 2% inflation target is the bank’s key responsibility. With inflation based on the Consumer Price Index (CPI) at 3% for September 2017, and expected to be even higher in October 2017, the bank voted 7-2 in favour of an interest rate hike to 0.5%.

The bank highlighted rising energy prices and imported inflation as the reasons for the build-up in CPI inflation. The sterling has weakened significantly since the Brexit vote and strong appreciation is unlikely until the Brexit deal is finalised. Given that basic items like food in the UK consumption basket have import penetration rates ranging between 30-40%, the impact of exchange rate depreciation on CPI inflation is thus clearly likely to have been non-trivial.

…But Has Some Comfort on Activity Too

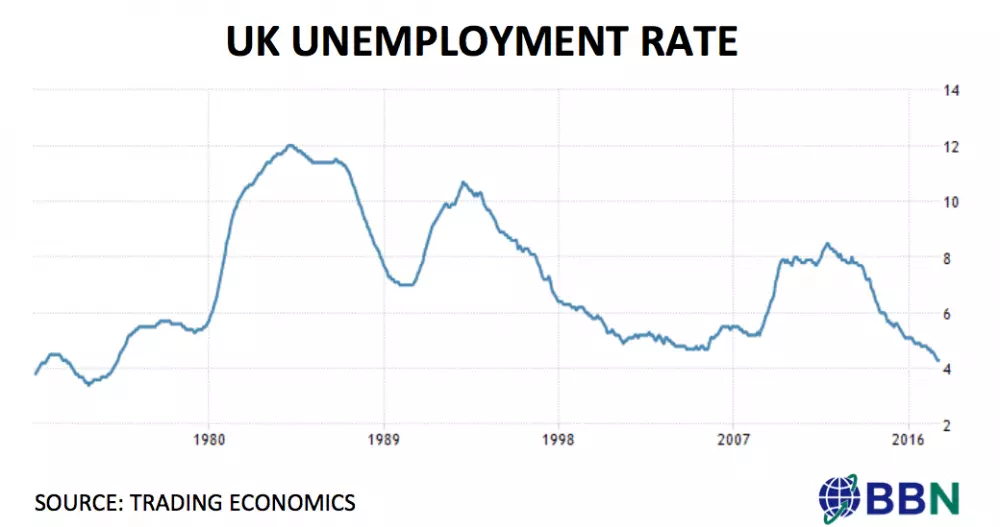

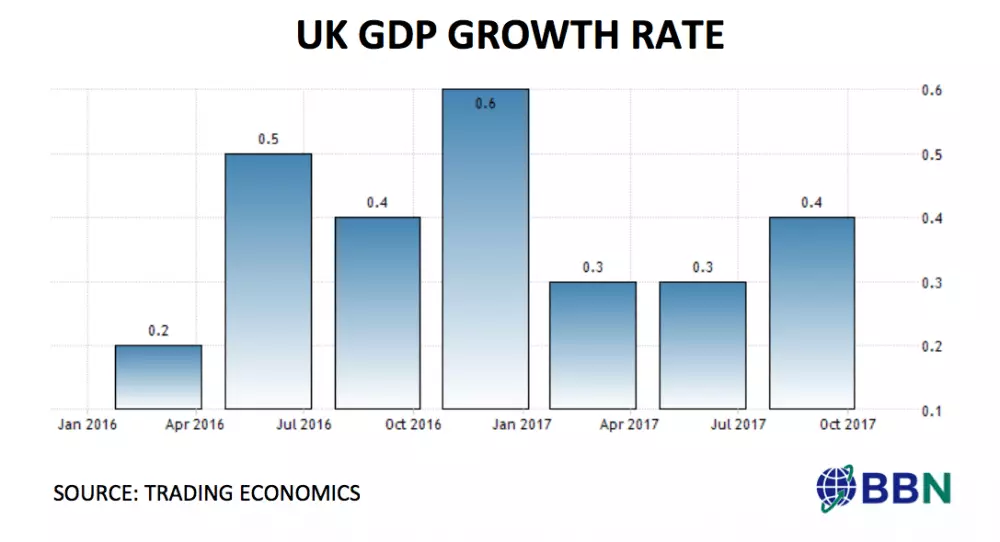

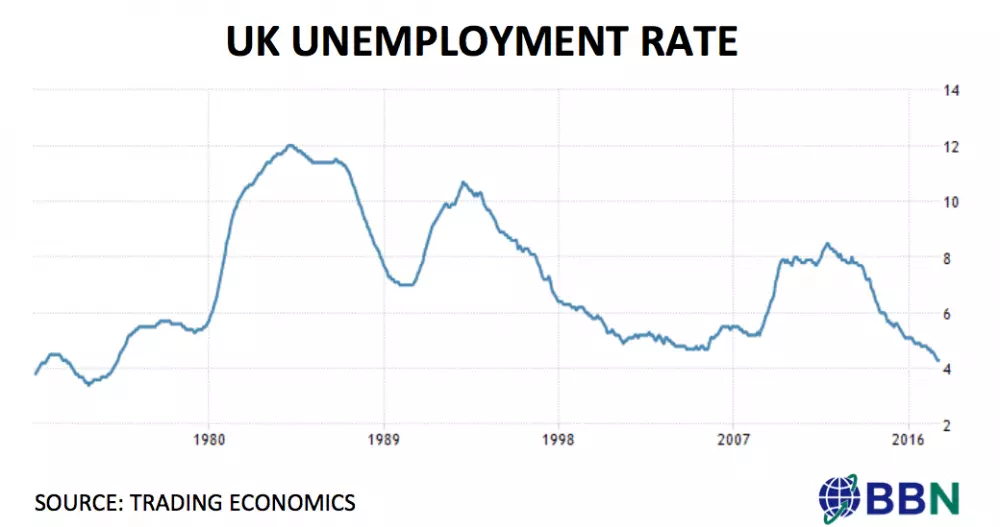

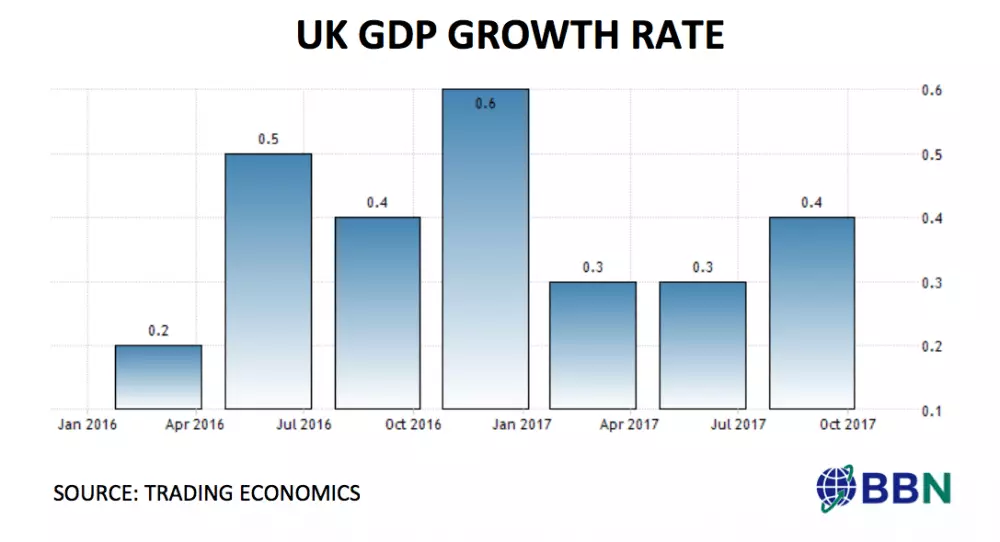

It also has some comfort on activity numbers, however. For instance, it points to unemployment being at a 42 year low, improved global economic conditions, ample liquidity and stable consumer confidence. It needs to be noted however, that GDP growth rates are nothing to write home about – at 1.5% yoy – growth in the third quarter of 20017 was maintained from the previous quarter, but remains at its lowest rate since the first quarter of 2013; this was enough impetus for the bank on balance.

A Single Rate Hike Does Not Make a Cycle

It is probably keeping this in mind as well as the fact that there might be more Brexit related economic pain in store that the bank does not indicate any future rate hikes, in fact, the contrary. Specifically, it says that “…in such exceptional circumstances, the Committee must balance any trade-off between the speed at which it intends to return inflation sustainably to the target and the support that monetary policy provides to jobs and activity.”

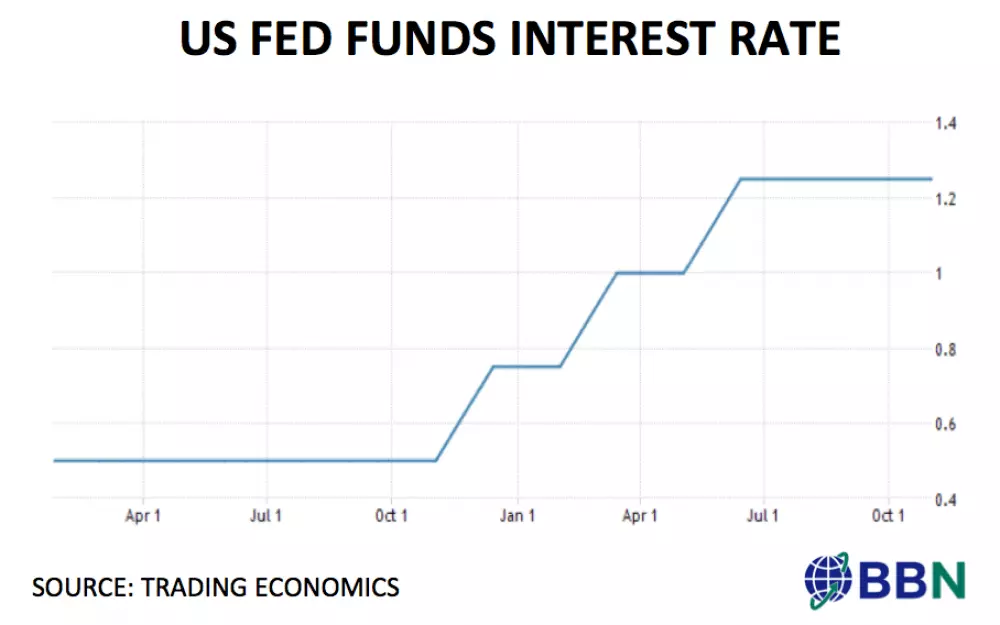

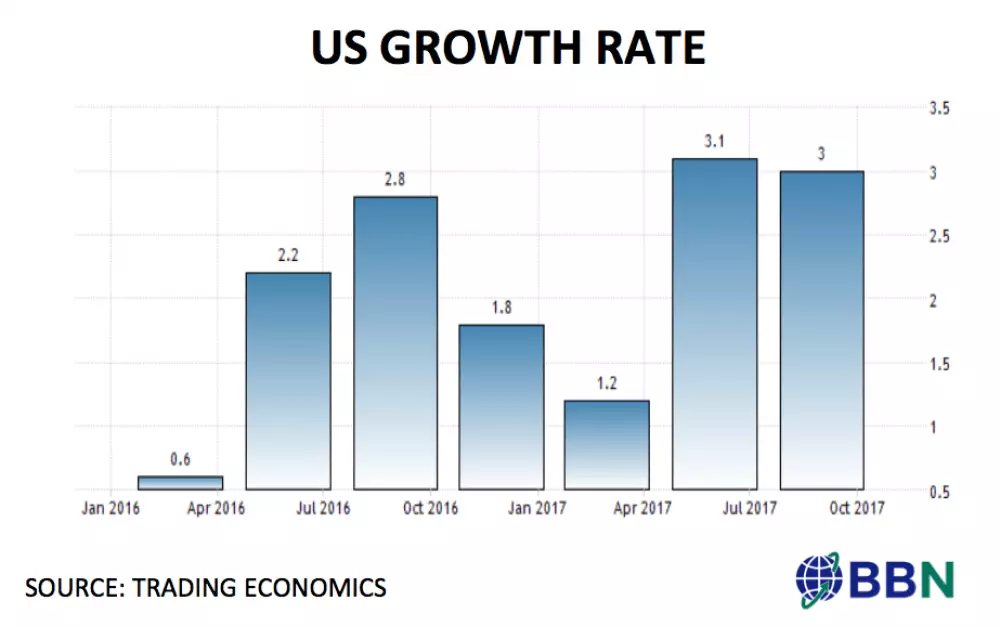

The Fed is More Certain

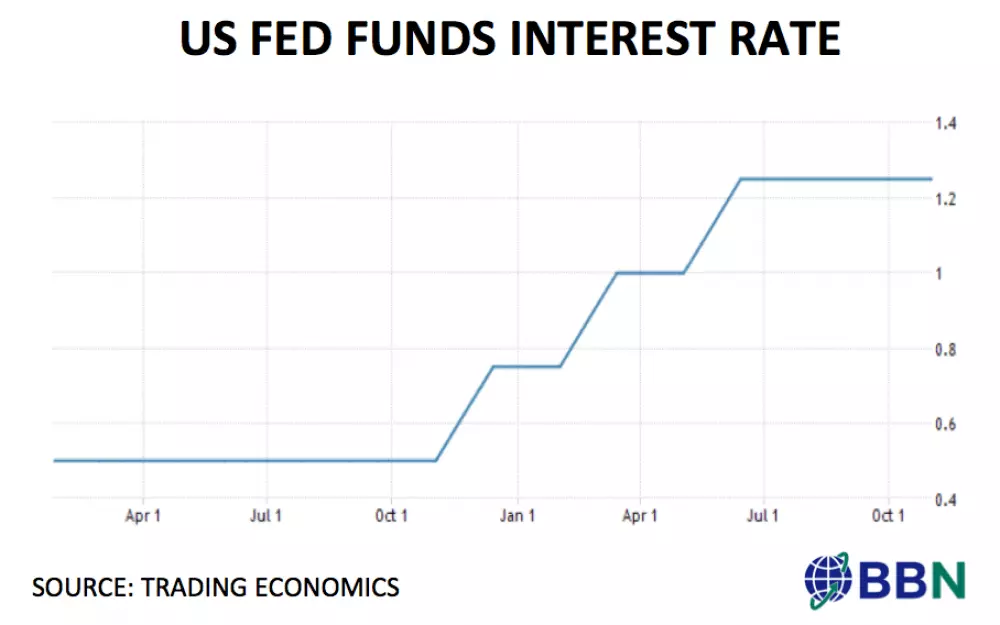

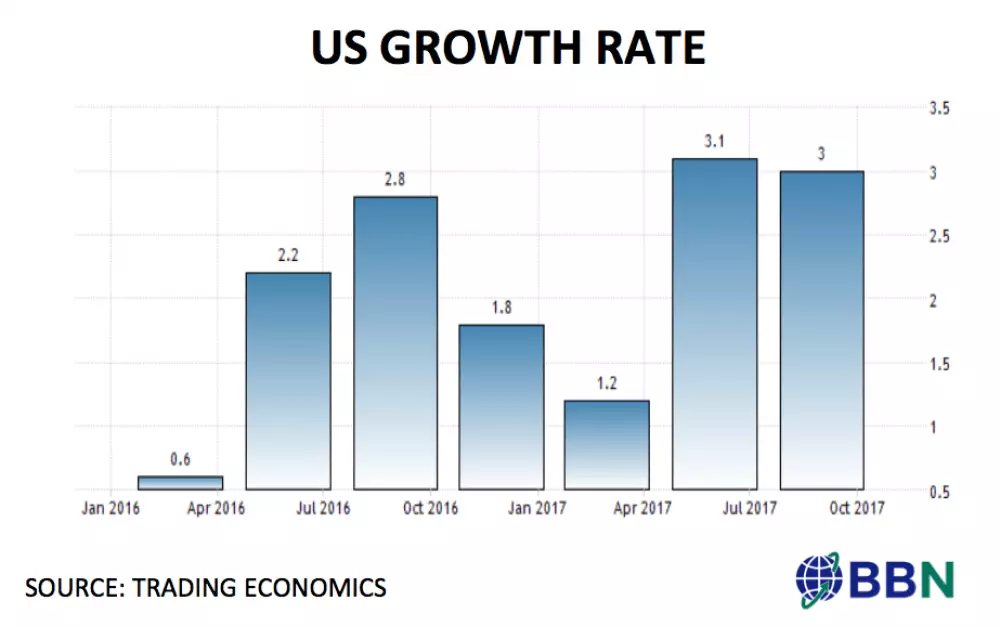

The US Federal Reserve however, is likely to increase rates in the near future from the current range of 1-1.25%. Unlike in the UK, inflation in the US is well under control, which has led to the reserve holding back rates for now. It notes that on a rolling 12 month basis, inflation has been declining and is well below 2%. With the economy however showing largely robust trends, it is possible that signs of overheating as evident in inflation, might start becoming visible.

Even though President Trump announced that the present Fed governor, Janet Yellen, will be succeeded by Jerome Powell starting February 2018; there is likely to be continuity in the monetary policy stance. Powell, with a background in finance, is, however, likely to be unrushed in raising rates in the next year, in so far as he is seen as a policy dove.

….Reflecting Diverging Challenges

Despite the latest hike, BoE policy rates are lower than the Feb Funds rates, which can have implications for global financial flows and thus the exchange rate. However, even stronger interest rates might not impact exchange rates very much, given the fact that uncertainty around the Brexit is here to stay and demand for imported goods is likely to sustain with high import penetration rates in basic items.

Leave your comments

Post comment as a guest